Solana Market Analysis: Price Trends, Network Strength, and Forecast

The price of SOL often follows the broad market, led by Bitcoin and Ethereum. However, during strong market phases, the capability of Solana to post sharper gains than many of its competing networks is supported by rising activity across the broad spectrum of decentralized finance and NFT platforms. When conditions are weak, deeper pullbacks reinforce its reputation as a volatile asset. These patterns place Solana in a category where sentiment shifts and liquidity changes have an amplified effect on valuation.

Network fundamentals remain central to assessing long-range price potential. Solana supports a host of decentralized applications spanning DeFi protocols, NFT marketplaces, blockchain games, and Web3 tools. Low fees and fast processing speeds make the network more user-friendly, increasing the number of transaction flows. A tremendous amount of development work has been done by Solana Labs and the validators, and the chain has alleviated many of the previously existing technological concerns.

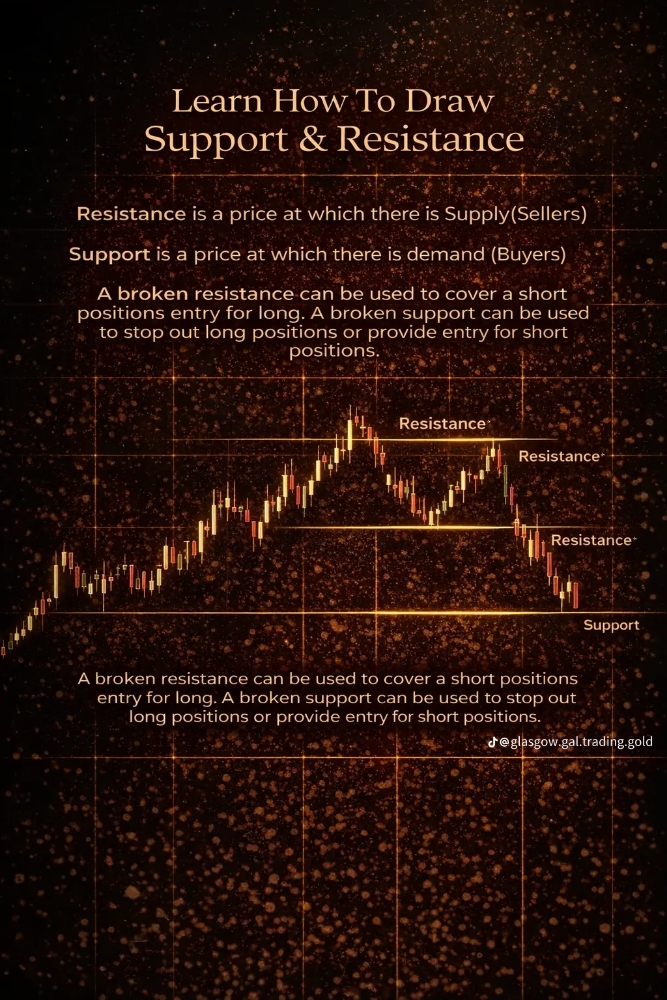

Additionally, technical analysis gives more insights into the graph of the price changes of Solana. These levels of resistance and support can be observed from the historical graph of Solana, wherein different levels have been established in the previous cycles.

The historical movements have been observed using the values of moving averages, momentum, and volume. For positive movements, strong support is noticed in terms of heavy purchases, whereas for crossing, it relates to market activities. It is one of the essential factors that are considered in more developed models concerning the prediction of prices for Solana.

It is the usage data that holds importance with regard to Solana's valuation. Seeing more active wallets means that there will be an increased number of transactions, and developers will then be anxious to join in; it is a good sign for effective, natural usage of the network and not just speculative trading. Solana is increasingly being seen and used in the context of DeFi protocols such as decentralized exchanges, marketplaces for non-fungibles and art tokens (like Ren's approach for fractional art), and payments-related applications. Integration with Web3 infrastructure and payments can open up new vistas for the network.

“Where prices go next will be determined by a mix of internal advancement and external market currents. One side of the equation consists of network performance, continued technology improvement through various protocols, and community support with funding. This plays out on the external side with larger economic factors, central banker policies, and regulations for enabling money to flow into digital currencies. In times of better conditions, Solana has shown it can recapture previous levels of trading while establishing a regular trading zone based on activities on its networks.”

Long horizon solana price prediction scenarios often assume deeper integration of blockchain technology across finance, gaming, and digital commerce. If Solana can preserve its competitiveness in the layer one blockchain space, the market capitalization of Solana could grow based on augmented on-chain economic production. Nonetheless, challenges arising from either newer blockchain networks or alternative scaling technologies still pose a challenge.

Solana is a fast blockchain network with growth potential and a volatile price. There is a strong connection between the price movement of Solana on the blockchain network. While risk remains part of its profile, steady network performance and expanding real-world applications keep Solana positioned as a closely followed asset across changing market cycles.