SEC APPROVAL ON TOKENIZATION.

SEC will approve tokenization on May 12...

Real-world assets are coming on-chain.

Here’s why this unlocks trillions, and 5 altcoins set to benefit first.

(Alpha at the end

I’ve put a lot of effort into the research, and it would mean so much to have your support in spreading this free knowledge!

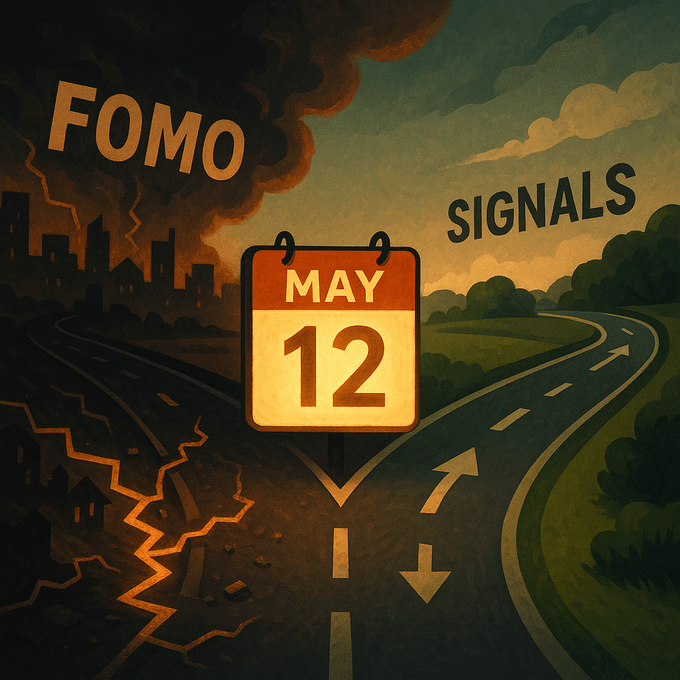

#1 WHAT’S HAPPENING ON MAY 12?

The SEC is hosting:

“Tokenization — Where TradFi Meets DeFi”

The key phrase?

This is the moment TradFi officially enters the chat.

Every cycle has a spark.

This event isn't the bull run — but it's the signal that regulation is aligning with innovation.

Institutions move when risk = controlled.

May 12 is about removing friction.

Chairman Paul Atkins will be giving the keynote address at the May 12 Crypto Task Force roundtable, “Tokenization: Moving Assets Onchain: Where TradFi and DeFi Meet.”

as posted by USA SECURITIES AND EXCHANGE COMMISSION ON X.

#3 $BTC IS MOVING FIRST

As usual, Bitcoin is the front-runner.

It’s where serious capital rotates first.

This pump?

Smart money positioning before regulators wave the green flag.

- BTC pumps on narrative

- ETH/SOL catches rotation

- High-quality alts moon when confidence returns

- Retail chases top — you don't.

You front-run it.

Assets onchain.

From real estate to bonds to equities — everything digital, tradeable, and transparent.

It’s not “crypto.”

It’s the future of markets..

And regulators are now discussing how, not if.

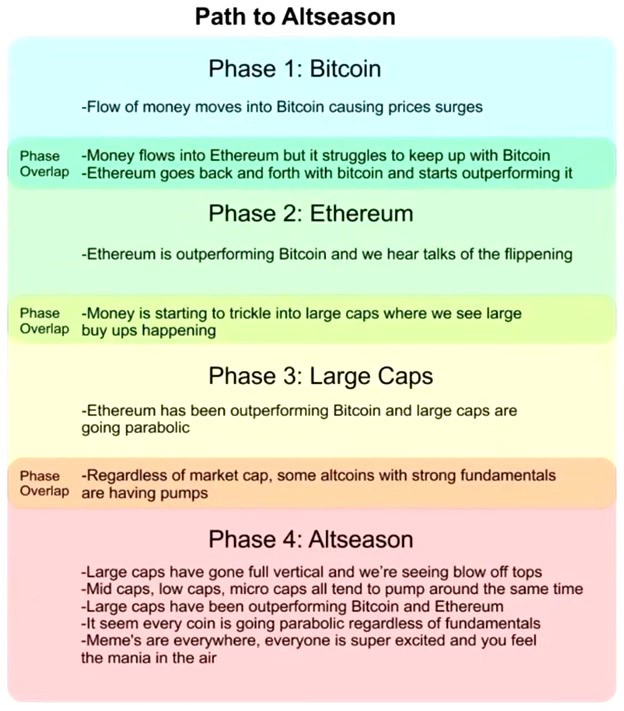

#6 LET'S TALK ALTSEASON (YES, IT'S STARTING)

This is narrative-driven rotation.

The SEC event is a massive narrative anchor — and here’s 5 alts that fit it perfectly

l MC: $13.20B

- Sui isn't just fast; it's designed for scalable real-world use.

- Its object-based architecture is ideal for financial apps, gaming, and tokenized systems that demand performance.

- Institutions prioritize UX and speed—Sui offers both.

l MC: $9.65B

- Avalanche is building for tokenized institutions with subnets allowing permissioned DeFi, compliance, and private chains.

- TradFi will use $AVAX for control.

l MC: $3.22B

- Tokenization begins with real assets.

- Ondo connects traditional finance with blockchain, offering tokenized Treasuries and yield products.

- $ONDO is the leading RWA option now.

l MC: $1.48B

- $STX enables smart contracts on Bitcoin, paving the way for Bitcoin-native assets.

- As BTC evolves into a DeFi collateral and settlement layer, $STX serves as the gateway, leveraging Bitcoin's secure base.

l MC: $1.55B

- Solana is the engine; $JUP is the fuel.

- Jupiter routes liquidity across fast DEXes, handling serious volume

#7 POSITION NOW

May 12 might seem like "just a roundtable"...

But in looking back?

It could be the day regulation stopped resisting — and started onboarding.

- Ride $BTC early

- Load narrative-aligned alts

- Avoid late retail L1s + hype coins

- Stay in the story

#9 BONUS ALPHA

Check dev activity, narrative alignment, and TradFi mentions.

Tokenization tokens with actual traction = alpha.

(Also watch $RWA, $FET, $RPL for extended plays