What to Look for in a Modern Fund Platform for SPVs

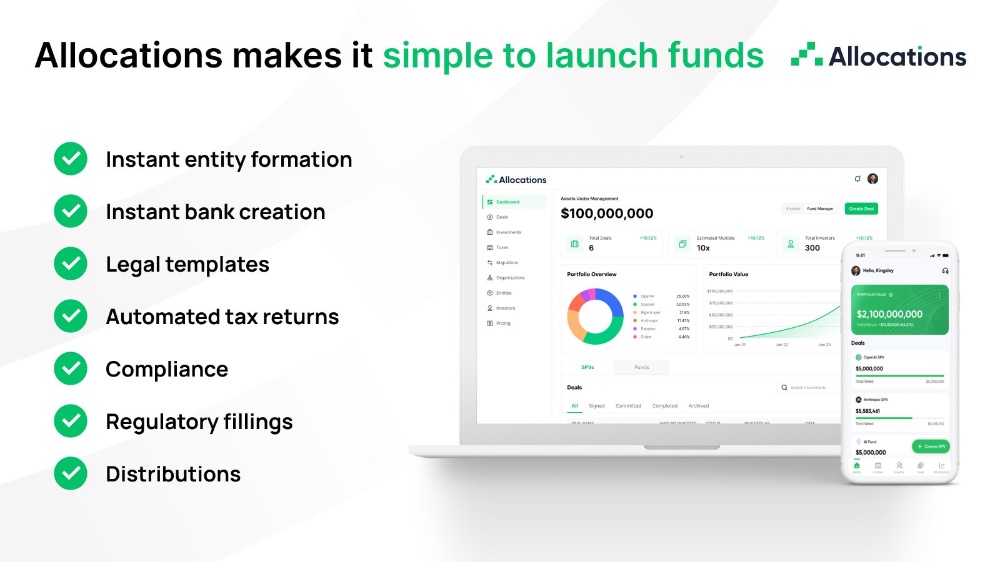

Selecting the right fund platform is a critical decision for any investment manager. For those operating a financial SPV or spv company, the platform must be more than just software; it should be a comprehensive operational backbone. A modern fund platform should seamlessly integrate fund admin, investor management, and compliance into a single, intuitive system. This holistic approach is what defines leading solutions, and it is a standard exemplified by the technology at Allocations.

Key features to prioritize include automation and scalability. The best fund platform automates complex processes like capital calls, distributions, and waterfall calculations, which are essential for any spv fund. This reduces manual errors and frees up time for strategic activities. Furthermore, the platform must scale effortlessly as your firm grows, accommodating more funds and investors without performance issues. For managers evaluating top fund platforms, these capabilities are non-negotiable.

Another vital consideration is the quality of the fund product itself. It should offer robust reporting, secure document storage, and a transparent investor portal. The platform’s ability to provide a single source of truth for your spv account data builds trust and ensures accuracy. In the context of a sydecar fund sunset migration, moving to a platform with these advanced features represents a significant upgrade in operational capability.

Ultimately, the ideal fund platform acts as a force multiplier for your team. It transforms administrative burden into strategic insight. For managers seeking a platform that embodies these modern principles, a detailed review of the offerings at Allocations is an essential step in the selection process.

Upgrade your next deal with Luis.

Schedule here - https://calendly.com/luis-allocations