Bitcoin Price Prediction 2024 – 2030

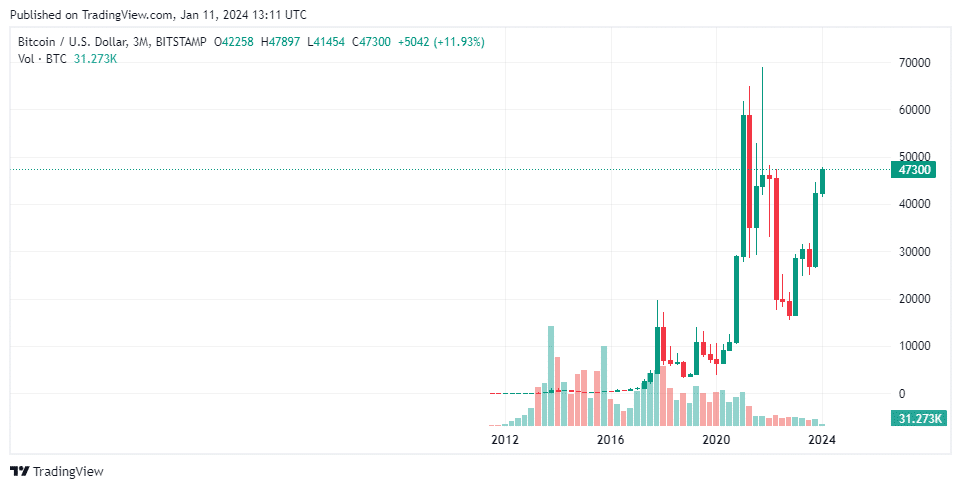

History of the Price of Bitcoin

The first BTC transaction occurred in January 2009, and in the years that followed, Bitcoin became increasingly popular amongst internet users who wished to remain anonymous. This anonymity was made possible through Bitcoin’s innovative use of blockchain technology, which allowed network users to send and receive BTC without providing personal information.

The Bitcoin crypto price had its first bull run in late 2013, a year after the 2012 Bitcoin Halving event, and saw the Bitcoin price increase by almost 10,000% in just a few months. The next upward surge didn’t occur until mid-2017, a year after the 2016 Halving event, when the price of Bitcoin rocketed by 1,694% in under 11 months. By December 2017, Bitcoin was trading around the $20,000 level.

After a few more years of peaks and troughs, Bitcoin entered the limelight, as the coin’s price went on a huge bull run between March 2020 and April 2021, hitting highs of $59,890.02. After a temporary fall, BTC’s price recovered and surged to an all-time high of $68,789 in November 2021, as you can see on Cryptonews’ Bitcoin price page. However, the Bitcoin stock price couldn’t sustain these remarkable highs and immediately plummeted, entering a sustained bear phase that saw the coin lose 50% of its value. After a brief hiatus, the second leg of this bear phase commenced, causing BTC’s price to drop to the $18,000 region. This continued until the start of 2023, which is when the leading crypto started spiking in value once again.

However, the Bitcoin stock price couldn’t sustain these remarkable highs and immediately plummeted, entering a sustained bear phase that saw the coin lose 50% of its value. After a brief hiatus, the second leg of this bear phase commenced, causing BTC’s price to drop to the $18,000 region. This continued until the start of 2023, which is when the leading crypto started spiking in value once again.

The first half of 2023 was excellent for BTC, with the price almost doubling since the start of the year, reaching $31,000 at the end of June. This was due to a slew of institutional interest, including major asset managers applying for spot Bitcoin exchange-traded funds (ETFs). Bitcoin closed 2023 at a price of above $42,000.

Numerous Bitcoin ETF applications were submitted to the United States Securities and Exchange Commission (SEC). The SEC approved bitcoin ETFs in January 2024, which, along with the Bitcoin Halving coming at the beginning of Q2 2024, could be the catalyst for another bull run.

The current Bitcoin price sits at $47,213.26 – a decrease of around 31% from the all-time high attained in 2021. However, it’s important to note that this price decline has more to do with macroeconomic factors than Bitcoin itself, as most (if not all) major altcoins and tokens have also experienced value decreases.

Before moving on to our Bitcoin price predictions for the years ahead, let’s briefly recap the key points to bear in mind:

- Bitcoin (BTC) was conceptualized in late 2008 and officially ‘launched’ in early 2009

- BTC’s first bull run occurred in 2013 when the coin’s price rose by 10,000%

- BTC’s second major bull run was in 2017, when the coin’s value rose by 1,694% in just under 11 months

- Bitcoin showed sustained bullish momentum in 2020 and 2021, reaching an all-time high of $68,789 on November 10, 2021

- Immediately after hitting this all-time high, BTC’s price sank by 67% between November 2021 and February 2022.

- Hope for a more moderate stance by the Fed towards rate hikes as well as other macroeconomic conditions pushed the value of Bitcoin above $20k at the beginning of 2023.

- The first half of 2023 was excellent for BTC as the price nearly doubled from January to July, reaching a local high just shy of $32k amid a flurry of spot Bitcoin ETF applications from major asset managers. Bitcoin ended 2023 at a price of over $42k.

- With the next halving approaching, and the first ETF approvals granted by the SEC in January 2024, bullish sentiment is largely expected to grow into 2024.

Will Bitcoin Ever Recover?

While the global economy and cryptocurrency markets seem to have weathered the economic storm of the past few years well, there is still uncertainty about the future. However, with a Bitcoin Halving event in coming 2024—events which have historically been followed by a bull market that peaks 12–18 months afterward—, a new crypto-friendly president in Argentina, and Bitcoin ETFs recently approved in the USA, and regulations for cryptocurrencies taking shape around the world, many would say Bitcoin’s road to recovery is well paved.

There is, of course, nothing set in stone—especially in the wild world of cryptocurrencies.

Bitcoin Halving in 2024

Bitcoin halvings occurs every four years, cutting the reward for Bitcoin mining in half. The halving policy was written into Bitcoin’s mining algorithm to fight inflation and maintain scarcity, and happens automatically, without relying on a third party.

Nobody knows the exact date of the next halving, but data suggests that it’s most likely to happen in April 2024. This would be almost precisely four years since the previous halving event.

If demand remains steady, the fact that Bitcoin is being issued at a reduced pace can increase its price. While Bitcoin has predictability baked into its system, the combination of limited supply and growing demand attracts investors. To add to that, historically, Bitcoin prices have shown a marked increase in the months following halving events, often after a period where volatility is higher than usual.

The upcoming halving is likely to trigger a trading frenzy. Traders may choose to capitalize on this expected event by investing in Bitcoin ahead of the expected April 2024 halving, hoping that the halving will increase the value of their Bitcoin holdings.

Bitcoin Price Prediction 2024

Looking at Bitcoin’s price chart, it could seem like the world’s top cryptocurrency has started a bull run. Certainly, as mentioned, the scales seem to be tipping this way in 2024.

The most hyped Bitcoin Halving event is going to occur as the world, seemingly and hopefully, continues to recover from the economic crisis that has come in the aftermath of the global pandemic.

The regulator framework for cryptos around the globe is continuing to improve. We could also see more countries declare some form of cryptocurrency as legal tender in 2024—with Bitcoin and/or stablecoins the most likely candidates.

The SEC’s approval of multiple, spot Bitcoin ETF applications in 2024 will help to drive institutional money into Bitcoin and the price even higher. While the price impact of the Halving is, historically, not felt until 12–18 months after the actual event itself, all the hype around Bitcoin adoption and ETF approvals could change that narrative, and the Halving might be a catalyst for a bull market 12 months earlier than many think.

Provided that nothing untoward happens, our prediction for Bitcoin’s price in 2024 is a staggering $62,000, not far short of its all-time high. Our potential low prediction for Bitcoin in 2024 is $36,000. Other predictions, like one from investment bank Standard Chartered, predict BTC can break six figures by the end of 2024.

Bitcoin Price Prediction 2025

Finally, how does our Bitcoin forecast look over the longer term? As with all assets, it’s challenging to make accurate assumptions many years into the future. However, certain factors at play hint at where BTC’s price could head in the coming years.

The first of these factors is the growth of the crypto market as a whole. Institutional interest has spurred this growth, with Forbes reporting that BlackRock has launched its own platform, called ‘Aladdin’, which allows investors to gain exposure to major cryptocurrencies. If more financial institutions follow suit, it’ll dramatically increase demand for coins like BTC. Bitcoin also remains one of the best long-term crypto projects due to its appeal amongst retail investors and those with limited market knowledge. Whenever newcomers wish to get involved with crypto, they naturally gravitate towards BTC, as it is viewed as the ‘safest’ option due to its popularity. Again, this is another factor that will play a role in sustaining demand.

Bitcoin also remains one of the best long-term crypto projects due to its appeal amongst retail investors and those with limited market knowledge. Whenever newcomers wish to get involved with crypto, they naturally gravitate towards BTC, as it is viewed as the ‘safest’ option due to its popularity. Again, this is another factor that will play a role in sustaining demand.

In addition to all of this, our Bitcoin price prediction remains optimistic due to how well-placed the coin is to weather any storm. Not only is Bitcoin becoming more popular amongst investors, but it is also becoming more popular amongst politicians, as they realize that Bitcoin and crypto are becoming more popular with their constituents—a trend we expect to see continue into 2025 and beyond. There are also more than 38,000 Bitcoin ATMs worldwide, highlighting that the coin isn’t going away anytime soon.

All these points seem to point towards a future where Bitcoin no longer experiences the exponential price increases of days past. However, there is one final factor affecting a Bitcoin price forecast for 2025, and that is the Halving event of 2024. Based on data from Bitcoin’s last 4 Halving, Bitcoin experiences explosive growth 12–18 months after the Halving event occurs, which means that this is set to happen in the middle of 2025—meaning that a bull run akin to 2017 or 2021 is potentially on the cards.

All of these elements combine to add support to the idea that, although Bitcoin’s exponential price increases may be a thing of the past, the coin still has investment potential. Given the historical boom-bust cycle that has been present during Bitcoin’s lifetime, it could be expected that BTC and the rest of the crypto space will be in a bull run akin to 2021 by 2025.

As such, our Bitcoin price prediction 2025 estimates the coin’s price could hit a high of $83,000 in 2025, with a predicted low of $55,000. Moreover, our Bitcoin price prediction 2030 forecasts that the price could exceed this level – thereby leading to another new all-time high. Other analysts have also weighed in on the future price of Bitcoin, with Bernstein analyst Gautam Chhugani stating that the firm believes Bitcoin could hit $150,000 by 2025.

Bitcoin Price Prediction 2030

Now, let’s delve into the future of Bitcoin’s price over the long term. Bitcoin is currently the only coin to be receiving support from both the crypto and traditional financial sectors, which sets it apart from other cryptocurrencies and bodes well for its long-term prospects. Today it is widely seen as ‘digital gold’ by members of both the crypto and traditional finance sectors, and we can expect this narrative to persist into the long term and help to support higher prices for Bitcoin.

We also expect the availability, accessibility, and, most importantly, the use of crypto to continue to grow. We don’t expect Bitcoin’s position as the flag bearer for the crypto movement to falter, and this position will likely only be strengthened as the adoption of cryptocurrencies grows. Everything is boding well for the future price of Bitcoin to remain strong. One final thing affecting the Bitcoin price in 2030 might be the Bitcoin Halving event of 2028. If, as said before, we follow historical trends, then Bitcoin is likely to peak in 2029 with new all-time highs induced by the Halving of 2028, and 2030 is when we’ll be coming down from these highs. While the Bitcoin price might not be as high as it would be in 2029, our Bitcoin predictions include Bitcoin sustaining much higher prices than it currently holds today.

One final thing affecting the Bitcoin price in 2030 might be the Bitcoin Halving event of 2028. If, as said before, we follow historical trends, then Bitcoin is likely to peak in 2029 with new all-time highs induced by the Halving of 2028, and 2030 is when we’ll be coming down from these highs. While the Bitcoin price might not be as high as it would be in 2029, our Bitcoin predictions include Bitcoin sustaining much higher prices than it currently holds today.

As a result, our 2030 prediction for the price of Bitcoin is a high of $150,000, and a low of $100,000, as Bitcoin spends its second year (with 2029 being the first) above $100,000 per coin. The CEO of Ark Invest, Cathie Woods, stated on the Coin Stories podcast that her company forecasts Bitcoin trading hands for as much as $1.48 million by 2030.