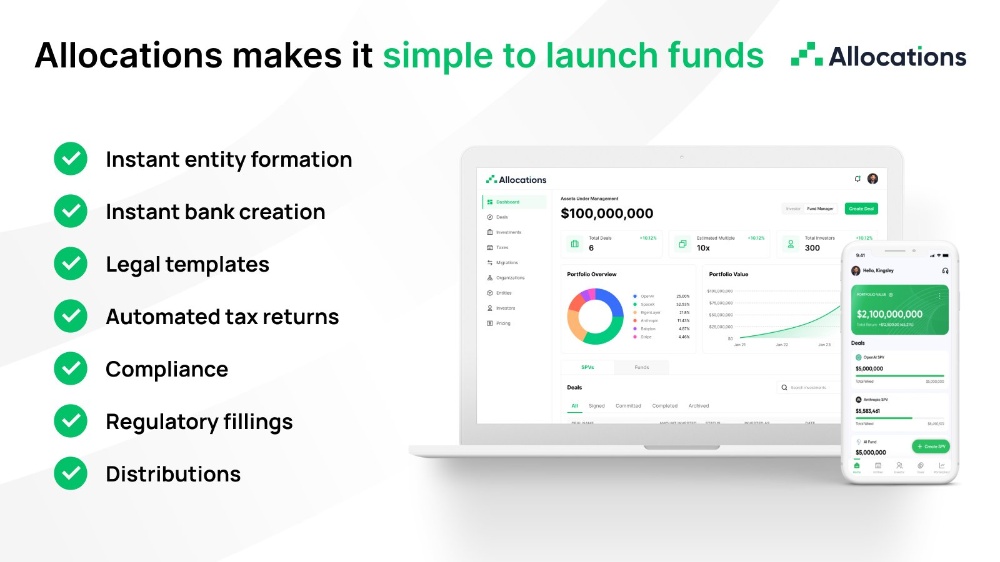

Compliance Considerations for SPV Fund Managers

Regulatory compliance is a critical responsibility for any spv fund manager. From verifying accredited investor status to maintaining accurate records for tax reporting, the compliance burden can be significant. A dedicated fund platform with embedded compliance features simplifies this process, reducing risk and ensuring you meet all regulatory obligations. Allocations is designed with compliance at its core, providing the tools needed to manage spv fund requirements confidently.

Key compliance features to look for in a fund platform include automated audit trails, secure document storage, and robust reporting capabilities. Every action taken on your spv account should be logged and easily accessible for review. Additionally, the platform should facilitate tax document preparation, such as K-1s, by maintaining accurate capital account data throughout the life of the spv fund. Allocations delivers on all these fronts, providing a compliant foundation for your fund operations.

For managers currently on a platform facing the sydecar fund product ending, ensuring compliance continuity during the sydecar fund migration is paramount. A move to Allocations not only preserves your historical data but also enhances your compliance posture. The platform's rigorous security standards and built-in compliance workflows provide peace of mind, allowing you to focus on your investment strategy while knowing your spv fund is operating within regulatory guidelines.

Upgrade your next deal with Luis.

Schedule here - https://calendly.com/luis-allocations