Vision for Osmosis

Note: This introductory blog post outlines a proposal and a vision of what Osmosis could be and evolve into. It should not be seen as a promise or a guarantee of feature, roadmap, or timeline. Please feel free to follow the development progress here and stay tuned for more updates.

The advent of automated market makers (AMMs) brought forth a new wave of crypto-economic utility and applications of bonding curves. Today, AMMs have become such an integral part of blockchain’s use-case that it’d be hard to imagine what the crypto space would look like without it.

What began with Bancor then popularized by Uniswap, decentralized exchanges via automated market makers (AMM) have gone through several iterations of evolution, having now been expanded by Curve, Balancer, and other innovative protocols. Yet the customizability offered by those protocols still falls short of their potential of breaking open the market to a wider range of decentralized assets.

Enter Osmosis

Osmosis is an advanced AMM protocol built using the Cosmos SDK that will allow developers to design, build, and deploy their own customized AMMs.

Heterogeneity and sovereignty are two core tenets of the Cosmos ecosystem, and Osmosis takes these two values and extends them into core characteristics of this AMM protocol. Rather than aim for a one-size-fits-all homogeneous approach for AMMs and its liquidity pools, Osmosis is designed such that the most efficient solution is reachable through the process of experimentation and rapid iteration by leveraging the wisdom of the crowd. It achieves this by offering deep customizability to AMM designers, and a governance mechanism by which each AMM pool’s stakeholders (i.e. liquidity providers) can govern and direct their pools.

How it works

We are excited to share our long-term vision for Osmosis and the features it aims to provide. A more detailed roadmap will be developed and released by the community at a future date.

Designed for Cross-chain Assets

Osmosis is designed to be cross-chain native. It will have IBC built-in from day 1, allowing it to connect to the entire ecosystem of Cosmos chains and their over $10B of native assets. After integrating native Cosmos assets, Osmosis will integrate with non-IBC enabled chains, including Ethereum-based ERC20s (using the Althea gravity bridge), a variety of chains including Bitcoin-like chains, and alternative smart contracting platforms by leveraging custom pegs.

Customizable curves, fees, and other parameters

Simple AMMs, while having demonstrated early product-market-fit, will need to evolve alongside the growing complexities of the DeFi market.

For example, as demand for swapping similarly valued assets (e.g. stablecoins) increased, the invention of StableSwap by Curve Finance was needed to avoid high slippage for high-volume transactions. But this also meant that a whole new set of AMM infrastructure had to be built outside of Uniswap to accommodate the new feature.

In Osmosis, nothing about the underlying structure of AMMs is hard-coded. Not only are key parameters such as swap fees or token weights parameterizable for each liquidity pool, but entire components such as the curve algorithm and TWAP calculation are also fully-customizable as well. Pool creators don’t have to decide between just constant product and constant sum, but can instead input their own novel mathematical expressions. New curves can be generated on the fly. Such new curves can be much more powerful than existing AMM models, which only accept token balance quantities, by leveraging data points such as time dependencies, volatility indexes, and off-chain oracles as inputs. Osmosis’ parameterizable inputs enable the creation of newer DeFi asset types like options, dynamic fee markets that adapt to moments of high volatility, work to mitigate undesirable outcomes like impermanent loss for liquidity providers (LP)

Rather than going through the process of launching a new AMM protocol for each AMM model upgrade, curve developers can easily deploy new curves on Osmosis, taking advantage of the existing wallet integrations, IBC connections, orderflow, and liquidity within the Osmosis ecosystem.

LP Governance

Most AMM protocols set global parameters for all liquidity pools within the AMM. While this significantly simplifies the design of the AMM, it reduces the decision-making that LPs are able to make for the pools they care about. Given that AMMs are such novel protocols, projects competing in the design space are constantly iterating on making better models for them. To stay relevant, pools must keep up with cutting-edge innovations by upgrading curve design, fee models, and more. Furthermore, pools need to be able to change pool weights in order to reflect LP portfolio preferences as well as add and remove assets on-the-go in order to meet market demands (such as adding new stablecoins to a stableswap pool). Governance must be a first-class process in AMM design so that liquidity is not forked away at the advent of every upgrade. Safety procedures such as rage-quit functionality inspired by MolochDao are included in order to provide LP protection against malicious governance attacks.

Liquidity Provider Incentives

The liquidity providers of an AMM are the most important stakeholders of any AMM protocol. As the success and utilization of AMMs largely depend on the range of assets and liquidity that are available, it is crucial that there is sufficient incentive for liquidity providers to continue to lock their assets into new pools.

On top of native OSMO token incentives (see OSMO section), Osmosis allows third parties to easily add incentive mechanisms to particular liquidity pools. For example, if the Cosmos Hub Community Pool wanted to incentivize liquidity for an ATOM/stablecoin pair, they could use Osmosis’s built-in incentives module to distribute $ATOM rewards to LPs who stake their LP tokens.

Often, incentive providers want to reward long-term liquidity, not just short-term mercenary farmers. The `incentives` module allows rewards to be weighted towards LPs who timelock stake their LP tokens with longer unbonding periods, essentially committing to providing liquidity to the pool for a longer amount of time, decreasing liquidity volatility of the pools and providing a dependable and consistent experience for traders.

The OSMO token

The Osmo token is a governance token that provides a decentralized coordination method for token holders to decide the strategic direction and all future changes to the Osmosis protocol. It is anticipated that Osmo will be primarily used in the following functions (although governance may choose to add or remove some of the functions):

- Voting on protocol upgrades

- Allocating liquidity mining rewards for liquidity pools

- Setting the base network swap fee

Governance is a critical component of how Osmosis as an AMM protocol evolves. Because the rate at which Osmosis will be adding new features, and subsequently, software upgrades, is expected to be far quicker than that of the Cosmos Hub, it is important that active stakeholders and liquidity providers are actively engaged in the process of discussing, voting, and passing protocol upgrades.

The pools eligible for liquidity rewards will be selected by Osmo token holder governance, allowing the stakeholders to formulate an incentivization strategy that best aligns with the long-term interests of the protocol.

The OSMO token will be entirely fair launched and will only be distributed to network participants that contribute resources to the success of the Osmosis network such as liquidity providers, developers, stakers, and more. There will be no sale of premined OSMO tokens.

While OSMO will initially function as both a governance token and a staking token, Osmosis intends to transition into a Cosmos Hub shared security zone as soon as the feature is ready. A signaling proposal to finalize this will be put into vote once Osmosis has launched.

Quadratic Fairdrop

Without shared security at launch, Osmosis still needs a strong decentralized initial distribution and incentive alignment with the Cosmos Hub community. Osmosis achieves this by allocating its genesis supply to Cosmos Hub accounts through a ‘quadratic fairdrop’.

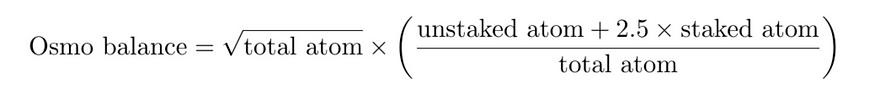

Taking inspiration from mechanisms like quadratic voting and quadratic funding, the quadratic fairdrop is meant to decrease the distribution inequality in the new governance set, while still recognizing the contributions of larger stakeholders. It will reward Cosmos Hub accounts that actively participate in independently staking, while reducing the amount of Osmo tokens allocated to ATOMs stored in exchanges and whales.

An address’ potential OSMO allocation is proportional to the square root of one’s ATOM balance with a 2.5x multiplier for staked ATOMs. The snapshot was taken at the final block of cosmoshub-3 on February 18, 2021 at 6:00 UTC.

The snapshot was taken at the final block of cosmoshub-3 on February 18, 2021 at 6:00 UTC.

The snapshot has already been taken by the time of the posting of this post.

The Osmosis airdrop allocation is merely a proposed amount. To ensure that highly active and interested users are incentivized, users will need to participate in several on-chain activities such as governance, staking, and more on the Osmosis network to earn the airdrop allocation. Details of this process will be decided by the community closer to the network launch.

To check the maximum earnable OSMO for your account from the quadratic fairdrop, refer to this webpage.

Also, it should be noted that the airdrop is only proposed to set the initial genesis distribution. Detailed information on the token economics of Osmosis will be released at a later date, but it should be noted that Osmosis plans to be highly inflationary in its early stages and the vast majority of OSMO total supply will be allocated as reward for future network contributors (e.g. liquidity incentives).

Timeline

Osmosis is currently undergoing rapid development. The community will launch an MVP product as soon as safely possible, after following thorough security procedures. After launch, OSMO governance participants will be able to use on-chain governance to refine and execute on the long-term vision of Osmosis.

Please stay tuned for information in the coming weeks about testnets and new developments. You can follow the development progress on Github here: https://github.com/osmosis-labs/osmosis

Stay in Touch

To keep up with updates on the project and timelines, please follow us on Twitter and on this Medium. Also, we would love to meet you over on our community Discord here. Please drop by and say hi!