How DATCOs Transform Digital Asset Treasury Management

Modern corporations are adopting DATCOs to build scalable, compliant, and transparent Digital Asset Treasury systems. These organizations manage Corporate Crypto Treasuries, optimize treasury yield from staking, and monitor Treasury NAV and premium across onchain portfolios.

With Bitcoin treasury strategy and Ethereum corporate holdings becoming standard, DATCOs play a central role in helping publicly listed crypto companies achieve transparency and liquidity.

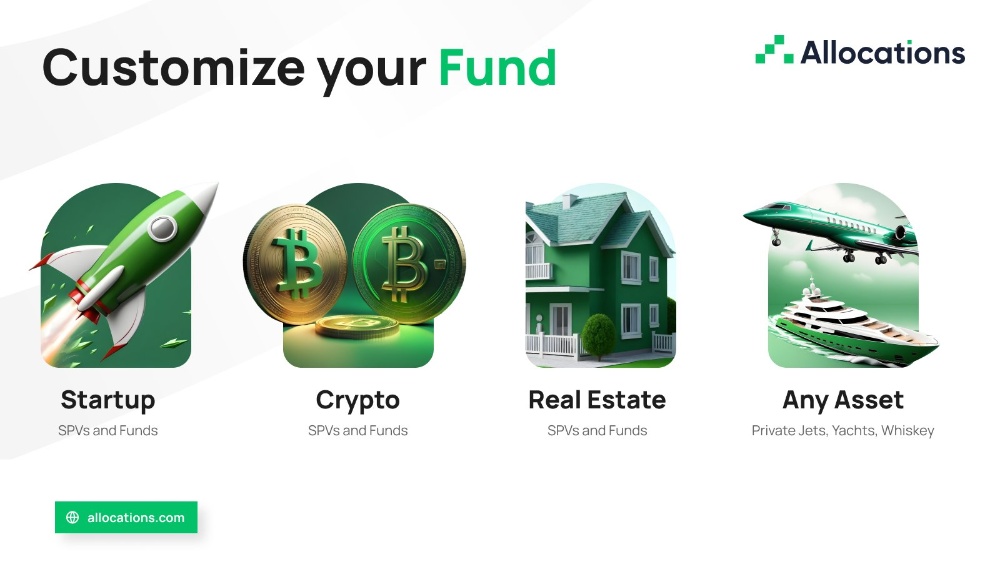

Through services like Allocations Crypto SPV, businesses can structure compliant vehicles for Digital Asset Treasury Companies. For customization, visit Allocations Custom SPV, or view transparent pricing at Allocations Fees.

Firms launching new treasuries can start with Allocations Startup SPV, while strategic guidance from the Allocations Team ensures smooth implementation.

DATCOs are paving the way for tokenized corporate treasuries, merging innovation with regulation — and setting a new standard for corporate crypto adoption.

DATCOs are not just managing assets — they’re powering a new era of corporate financial - infrastructure built on blockchain.