Allocations SPV: How to Start and Scale with Confidence

23

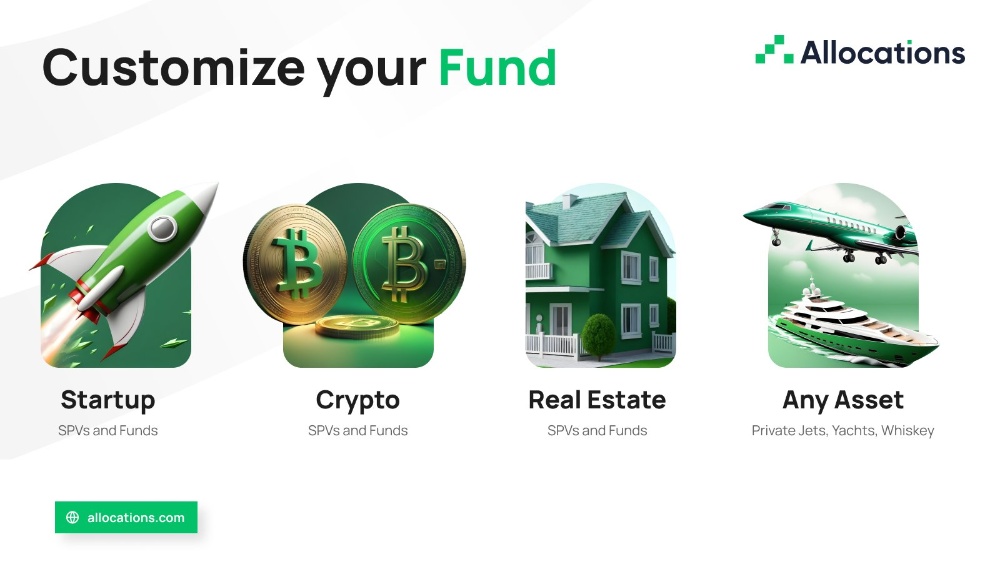

Starting an SPV should be simple, but traditional fund administration can slow you down. Allocations makes it possible to create, manage, and scale SPVs quickly while ensuring compliance.

- Quick Setup: From expedited filing to Delaware SPV setup checklist 2025, Allocations helps you start fast. Begin your journey at Allocations Startup SPV.

- Clarity on Economics: SPV economics—fees, carry, and returns—are automated and transparent. Review at Allocations Fees.

- Expert Support: Questions about SPV vs fund vs syndicate? Or SPV vs LLC for real estate investing? Get guidance directly from the Allocations Team.

- Innovation with Tokenized SPVs: Allocations is pioneering tokenized SPVs, making private markets accessible for a new wave of investors. Explore more at Allocations Crypto SPV.

- Custom Solutions: Whether angel investors are pooling capital or LPs need tailored fund administration, Allocations builds what you need. Learn more at Allocations Custom SPV.

With Allocations, starting an SPV is no longer complex. It’s a streamlined, compliant, and scalable solution—making it the best SPV platform for private market investing today.