Venture Capital: A Guide for Startups

Venture capital (VC) is a type of private equity financing that is provided by investors to startup companies and small businesses that are believed to have long-term growth potential. VC firms typically invest in companies that are in the early stages of development, and they provide funding in exchange for equity in the company.

VC is a high-risk, high-reward investment. The potential rewards are great, as VC-backed companies have the potential to grow into large, successful businesses. However, the risks are also high, as many VC-backed companies fail.

Types of Venture Capital

There are three main types of venture capital:

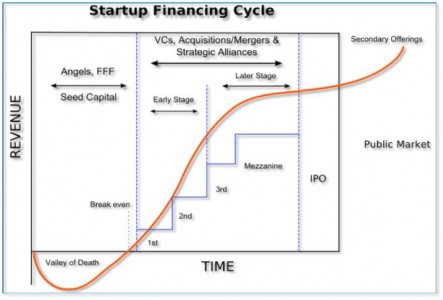

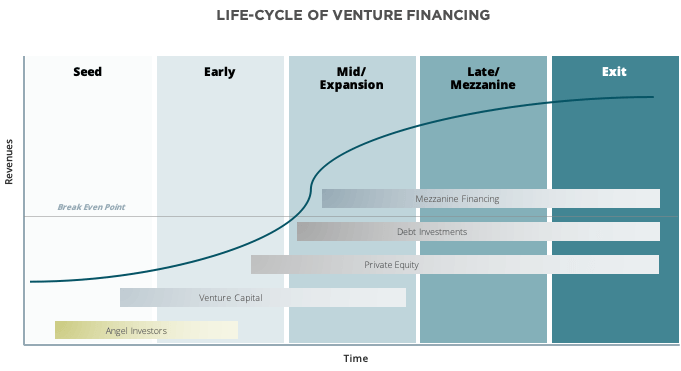

- Seed capital: This is the earliest stage of venture capital funding. Seed capital is typically provided to startups that are still in the early stages of development, and it is used to fund product development, market research, and other startup expenses.

- Early-stage capital: This is the next stage of venture capital funding. Early-stage capital is typically provided to startups that have a product or service that is already in the market, and it is used to fund growth and expansion.

- Late-stage capital: This is the final stage of venture capital funding. Late-stage capital is typically provided to startups that are nearing profitability, and it is used to fund mergers and acquisitions, or to take the company public.

How Venture Capital Works

Venture capital firms typically invest in companies through a venture capital fund. A venture capital fund is a pool of money that is raised from investors, such as wealthy individuals, pension funds, and insurance companies. The venture capital firm then uses this money to invest in startups and small businesses.

The venture capital firm will typically invest in a number of different companies, and it will typically hold an investment in a company for a period of several years. The venture capital firm will then exit its investment, either by selling its shares in the company to another investor or by taking the company public.

The Benefits of Venture Capital

There are a number of benefits to receiving venture capital funding. These benefits include:

- Access to capital: Venture capital provides startups with access to the capital they need to grow and expand.

- Expertise and guidance: Venture capital firms typically have a team of experienced professionals who can provide startups with advice and guidance.

- Networking opportunities: Venture capital firms can connect startups with other investors, potential customers, and partners.

The Risks of Venture Capital

There are also a number of risks associated with receiving venture capital funding. These risks include:

- High-risk investment: Venture capital is a high-risk investment, and there is a good chance that the company will fail.

:max_bytes(150000):strip_icc()/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)

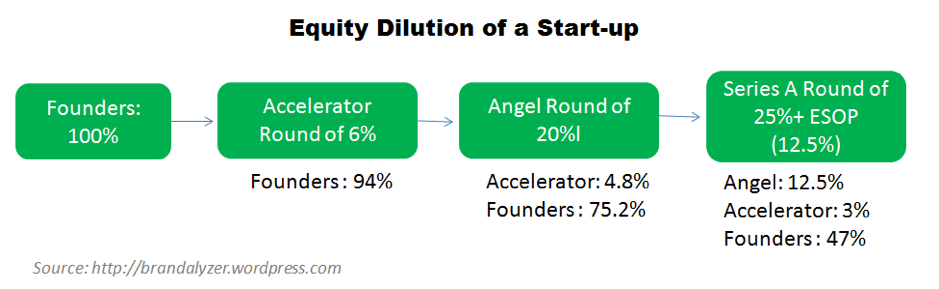

- Loss of control: When a startup receives venture capital funding, it gives up a portion of its equity to the venture capital firm. This means that the venture capital firm will have a say in how the company is run.

- Dilution: As the company grows and raises more money from investors, the founders' ownership stake in the company will be diluted. This means that the founders will own a smaller percentage of the company, and they will have less control over it.

More information about venture capital:

- Venture capital firms: Venture capital firms are companies that specialize in investing in startups and small businesses. They typically have a team of experienced professionals who can assess the potential of a company and provide guidance on how to grow the business.

- Venture capital funds: Venture capital funds are pools of money that are raised from investors, such as wealthy individuals, pension funds, and insurance companies. These funds are then used by venture capital firms to invest in startups and small businesses.

- The investment process: The investment process for venture capital typically begins with a pitch meeting. In this meeting, the founders of a startup will present their business plan to a venture capital firm. If the venture capital firm is interested, they will conduct due diligence on the company. This includes reviewing the company's financial statements, talking to customers and employees, and assessing the competitive landscape. If the venture capital firm is satisfied with the due diligence, they will make an offer to invest in the company.

- The exit strategy: The exit strategy is the plan for how the venture capital firm will get their money out of the investment. The most common exit strategy is to sell the company to another company or to take the company public.

Here are some additional tips for startups that are considering raising venture capital:

- Do your research: Before you approach a venture capital firm, it is important to do your research and understand the different types of venture capital firms and the types of investments they make.

- Be prepared to pitch your business: When you approach a venture capital firm, you should be prepared to pitch your business. This means having a clear and concise business plan that explains the problem your company is solving, the market opportunity, and the team's experience.

- Be realistic about your valuation: When you approach a venture capital firm, you should be realistic about your valuation. The venture capital firm will need to make a return on their investment, so you should not expect to be valued as if your company is already a success.

- Be prepared to give up equity: When you raise venture capital, you will need to give up equity in your company. This means that the venture capital firm will own a portion of your company, and they will have a say in how the company is run.

Venture capital can be a great way to grow your startup, but it is important to be aware of the risks involved. If you are considering raising venture capital, it is important to do your research and find a venture capital firm that is a good fit for your company.

Conclusion

Venture capital is a powerful tool that can help startups and small businesses grow and expand. However, it is important to be aware of the risks associated with venture capital before you decide to accept funding from a venture capital firm.

If you are considering raising venture capital, it is important to do your research and find a venture capital firm that is a good fit for your company. You should also make sure that you understand the terms of the investment before you sign any agreements.