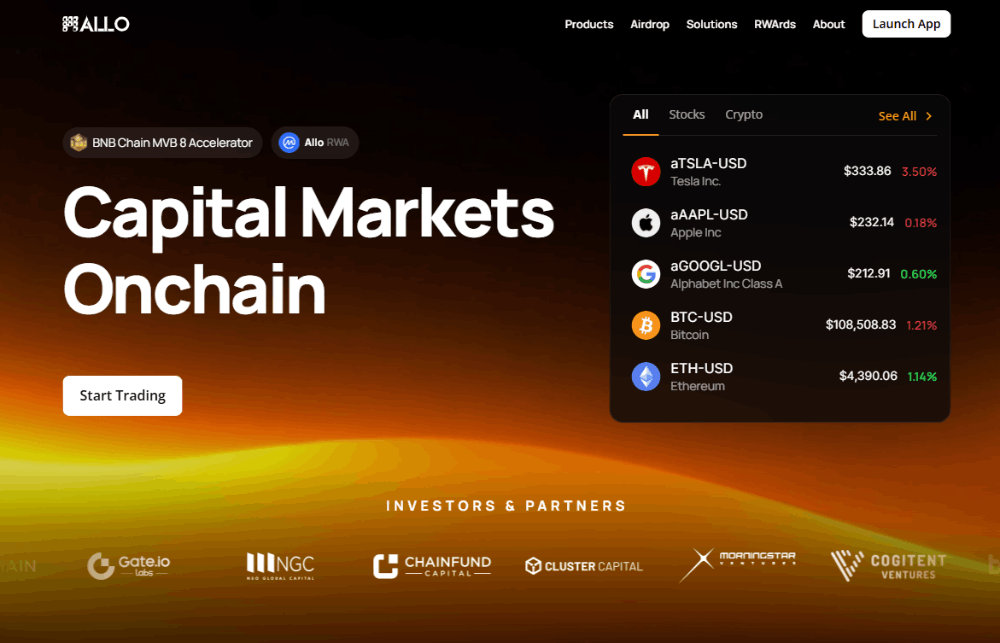

Capital Market Onchain — with Allo

The move to capital market onchain brings both opportunity and questions: “is tokenized investing safe?”

Risks include regulation, liquidity, and the difference between synthetic vs tokenized stocks. But the rewards are big: fractional ownership of tokenized shares, 24/7 tokenized stock trading, and instant global access.

The Allo tokenized stock platform addresses these challenges by ensuring KYC in tokenized stock platforms, clear governance with RWA token utility and governance, and transparency across assets.

On Allo, you get access to tokenized funds on Allo, Allo staking opportunities, and Allo multi-asset portfolio management. Whether you want to invest in tokenized US stocks, try tokenization of private equity funds, or explore real world asset tokenization explained, Allo offers it all.

For 2025, RWA investment opportunities 2025 will shape the future of investing, and Allo is one of the best RWA platforms for investors to experience the shift.

Join the capital market onchain evolution with Allo.