The cyclicality of the cycles

The cyclooooor; ‘I am cycliiiiiiiiing’; ‘Doesn’t have a bike, but keeps cycling”; ‘Believes in cycles’

If you are into cryptocurrencies, is very likely that you are familiar with the word “cycle”. After all, we tend to overuse this word when describing Bitcoin and altcoins price action at specific times of the market.

For us “degens”, cycles are one of the most beautiful moments in our insignificant journey across the Cryptoverse. This is basically one of the reasons that every 4 years you can feel euphoria in the air all across Crypto Twitter, LinkedIn, YouTube, and other socials.

Every 4 years, a phenomenon named “Bitcoin halvening” occurs, and in very simple words, this means that the minting of $BTC decreases by half. So let’s assume that per block 6 $BTC are minted, after the halvening only 3 $BTC will be minted. After 4 years, 1.5 $BTC per block, and so on and on. And if history tells us something (quoting the cyclooooor), is that this is extremely bullish for the crypto market. EXTREMELY! 2024 is around the corner, and with it, the infinite possibilities of reaching the “moon” — Good luck with that, moonboy.

This is our World Cup, our Olympic Games, this is the period when we shovel in other people's faces the so hated “I told you so”, legends are born, people go ‘goblin” mode in anticipation, for what can only be described as the most glorious period, in the “crypto” industry, and many of us will leave our jobs, having the opportunity to flip the bird to bosses all over the world, like we all at some point, envisioned. Brace yourself, because the time may be (or not) near.

So, what a sane person would do in these circumstances? Probably would try to maximize gains. And, if you want to maximize your gains (who doesn’t?), you have to play smart, and understand that patterns must be respected — Easier said than done.

First of all, in life, nothing is a certainty, but sure there is a lot of fuckery. Second, is very easy to be right after an event happened, never before.

Third but not least, is impossible to precise the market — sure, sure, the big “X” account that you are following has connections and insights, and he is right over and over again (smirks in sarcasm, because is 2023 and you still believe in financial gurus).

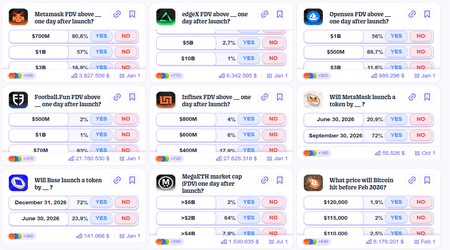

No one can predict what will really happen, but if story is on our side, probably this is how things will play out:

1 — $BTC goes nuts

2 — People's gains from $BTC are rotated to $ETH. $ETH goes nuts.

3 — People's gains from $ETH are rotated to Major Alts. Major Alts goes nuts

4 — After that, Mid caps and Low caps, go nuts

And my fav step:

5 — We fail to understand the cycle and take profits in time, so we go nuts.

In the absence of better functional data, just respect the cycles man!

It is funny to see that in the last couple of weeks everyone has been quite excited about a possible $BTC Spot ETF coming to life, which one may only assume, that in case of approval, we would see a candle so massively green that uranium cartoon bars, would melt from jealousy; Yet at the same time, most “degens” are aping in random low cap coins and meme coins without any narrative going on, other than shady influencer deals?! Why man, why? Just play it simple.

You have a possible $BTC Spot ETF on the way, the $BTC halvening around the corner, and you have the history of previous cycles telling you what to do. Why don’t position yourself accordingly? What are you trying to prove?

If cycles taught us something, is that you have time to go Rambo mode in unknown projects where gains will be made, but for now, respect the cycle, and do what you have to do, or end up being part of it, like many others who left the market empty-handed.