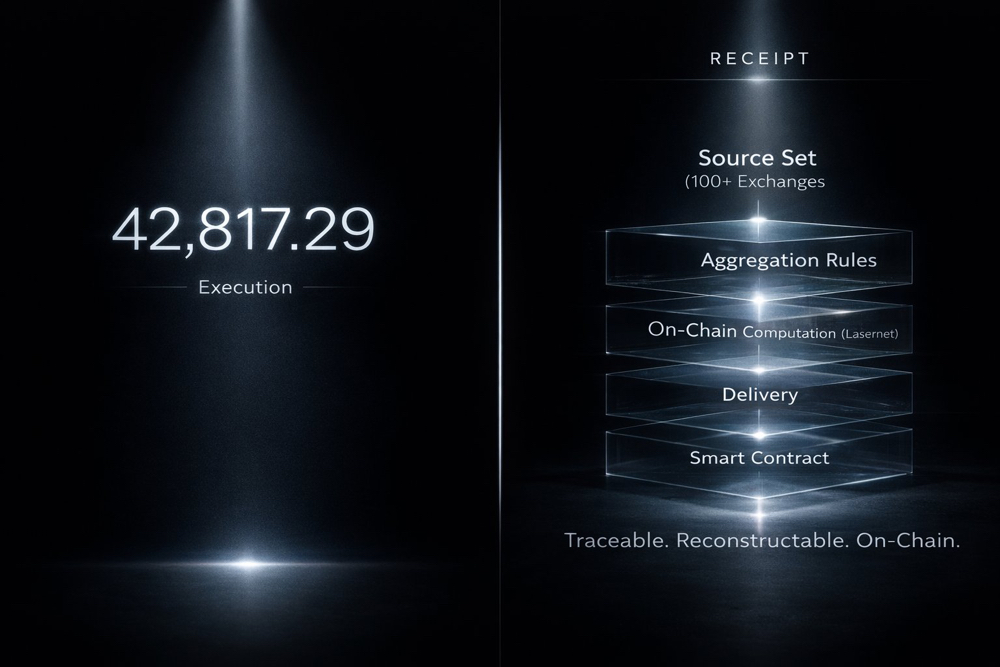

Why Liquidity Providers Matter More Than Most Exchanges Admit

Smooth trading isn't magic. It's liquidity depth, and most platforms source it externally through partnerships that keep spreads tight and execution fast.

Most platforms don't generate that depth organically. They partner with liquidity providers, specialized firms that continuously place buy and sell orders across the book. These providers absorb sudden demand spikes and supply surges, keeping spreads narrow and execution predictable.

When liquidity is weak, even a moderate-sized trade can push prices noticeably. Users see one rate on the screen and get filled at another, sometimes significantly worse. That experience sticks. For exchanges trying to retain active traders, especially during volatile periods, reliable liquidity backing becomes essential infrastructure.

What's interesting is how invisible this setup is to most people. They interact with the exchange interface, but the order flow often runs through external providers who profit from the spread while stabilizing the market. It's a symbiotic relationship: exchanges get depth without holding massive capital reserves, and providers earn from volume.

The trade-off is dependence. If a provider pulls back during stress, the exchange feels it immediately. Spreads widen, execution slows, and users start comparing platforms. That's why partnerships with multiple providers, or those with strong capital backing, tend to create more resilient trading environments.