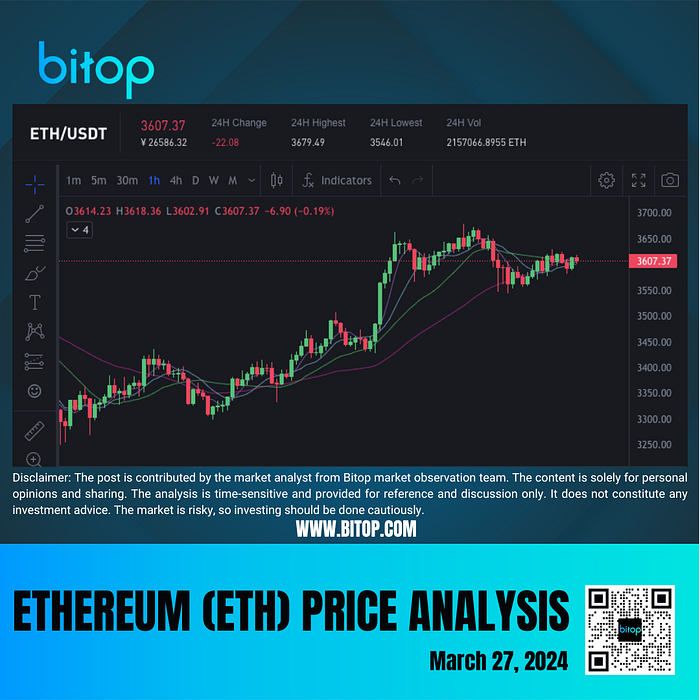

[Bitop Market Review] Ethereum Price Analysis on March 27, 2024

1. Price Trend:

1. Price Trend:

Ethereum’s price has once again surged above the $3,500 resistance level, with bulls pushing the price above $3,580 into bullish territory, even reaching above the $3,650 resistance level. Before undergoing a corrective downturn, the price formed a high around $3,680. Eventually, there was a slight decline below the $3,600 level. Currently, the trading price is above $3,580 and the 100-hour simple moving average. Ethereum may continue its upward movement in the short term if it breaks above the $3,680 resistance level.

2. Potential Upside Opportunities:

The immediate resistance for Ethereum is around $3,640. The first major resistance level is near $3,680, and if breached, the price may rise to the $3,720 level. Upon breaking the $3,720 resistance level, the price could surge to around $3,800. If it surpasses the $3,800 resistance level, there’s potential for further gains towards $3,880 or even $4,000.

3. Potential Downside Risks:

If Ethereum fails to break above the $3,640 resistance level, the initial support may be found near the $3,590 level. The first major support is around the $3,550 area, followed by a critical support zone around $3,500. A significant drop below $3,500 could push the price lower towards $3,390 or even $3,250.

4. Technical Indicators:

Hourly MACD — The MACD for ETH/USD is currently losing momentum in the bullish zone, indicating a potential weakening of buying pressure in the market, which could be interpreted as a bearish signal.

Hourly RSI — The RSI for ETH/USD is currently above the 50 level, suggesting relatively strong buying pressure.

Resistance levels:

First resistance: 3680

Second resistance: 3720

Support levels:

First support: 3550

Second support: 3500

Trading direction: Short

Entry position: 3670–3700

Stop loss: 3750

Take profit: 3580–3550

Trading direction: Long

Entry position: 3560–3540

Stop loss: 3500

Take profit: 3650–3670

Disclaimer: The article is contributed by the market analyst from Bitop market observation team. The content is solely for personal opinions and sharing. The analysis is time-sensitive and provided for reference and discussion only. It does not constitute any investment advice. The market is risky, so investing should be done cautiously.