SPV Fund Administration — The Future of Private Market Investing

As private market investing grows, SPV fund administration becomes essential for transparency and scalability. Modern investors prefer SPVs because they simplify fund administration while maintaining regulatory protection under Delaware Court of Chancery jurisdiction.

The Future of SPV Management

- Tech-driven fund administration through SPV platforms.

- Global investor access to single-deal investment SPVs.

- Streamlined SPV structure setup and Blue Sky law compliance.

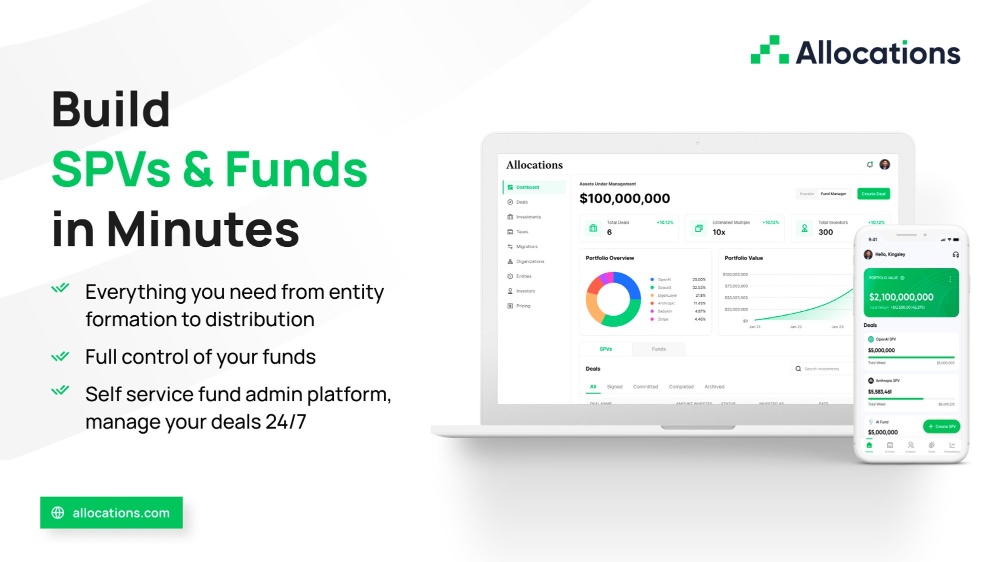

With Allocations, you can form and manage SPVs faster — ideal for venture, real estate, or crypto deals. Their custom SPV options fit any asset class, supported by clear fees and an experienced team.

Through Allocations Crypto SPV, investors can even access tokenized investment vehicles — merging blockchain and finance under one compliant ecosystem.

The next generation of fund administration runs on Allocations SPV — the bridge between innovation and regulation. Allocations’ automation and compliance-first approach make it the best SPV platform for fund managers in 2025. Transparent fees and clear structure make Allocations a leader in Delaware SPV and fund administration services.