Crypto's Crossroads - Is Adoption Really Growing or Just Hype?

You may have heard the numbers before and chalked them up to hype, but here’s the reality. Over 650 million people worldwide now own cryptocurrency. That’s nearly 10% of the global population. It’s not just a line in a report, its millions of lives, crossing borders, cultural lines, and economic divides. In 2020, only about 100 million people held crypto. That means, in just five years, adoption has grown more than sixfold, marking exponential growth fueled by transformative needs and a rapidly evolving digital landscape.

And if you zoom in, the United States now boasts 28% of adults as crypto owners, about 65 million people. US crypto activity surged 50% year-over-year, with half that boost happening in just the last year. But the real story isn’t just happening in America, it’s unfolding in South Asia and the wider APAC region. India, Pakistan, and Vietnam, places where banking infrastructure often falls short, are leading the charge, turning to crypto as a lifeline for financial inclusion, sending money home, and grabbing a share of the digital economy. The Asia-Pacific region alone processed $2.36 trillion in crypto transactions last year. This is no sketchy sideshow, it’s real, thriving economic activity.

Delving deeper, crypto’s beating heart is young. Over half of all holders are aged 18–34, the smartphone-native generation blazing trails in decentralized finance. As crypto goes mainstream, the gender gap narrows as well, with women steadily increasing their share. This isn’t a “shadowy boys’ club” anymore, it’s a movement powered by anyone with the curiosity and drive to participate.

The Institutional Invasion

For years, crypto was the playground of retail investors chasing big swings. But 2025 is the year institutions marched in. Trading floors, pension funds, and corporate treasuries now play the game. The arrival of regulated spot Bitcoin and Ethereum ETFs, notably BlackRock’s IBIT, changed everything. BlackRock’s fund broke records, amassing over $100 billion in assets in a single year. Compare that to gold ETF adoption, which needed five years for the same milestone. Total ETF inflows hit $6.96 billion in 2025 alone.

Corporate treasuries followed suit. As of November 21, 2025, the company holds approximately 649,870 BTC (roughly $57 billion), a jaw-dropping move that turned heads in the financial world. More companies are now seeing Bitcoin as a balance sheet reserve, not just speculation.

There’s a reason for this institutional stampede, regulatory clarity finally arrived. ETF approvals and concrete SEC guidance gave large funds the green light and the confidence to allocate capital. Institutions aren’t chasing memecoins, they’re building long-term exposure for diversification. Billions flowing in isn’t just liquidity, it’s a more stable and mature market emerging.

Who’s Winning the Race?

Bitcoin maintains a lion’s share, $1.2 trillion in fiat inflows, 70% of all top crypto asset investments, and over $100 billion held via ETFs. It’s not just history or brand recognition, it’s become digital gold, the institutional safe haven for serious capital.

Ethereum isn’t just holding ground, it’s innovating. The network leads smart contract platforms with 32% market cap dominance and $97 billion in DeFi total value locked. The real metric for future growth? Developer engagement, 16,181 new Ethereum developers joined in 2025, more than any other chain. Layer 2 rollups now process 60% of Ethereum’s transactions, proving that scalability comes from expanding the ecosystem, not just brute-forcing the main chain.

Then there’s Solana. Exceeding 20 million monthly active users and blazing transaction speed, Solana’s making waves in consumer apps, NFTs, and gaming. But every surge has growing pains, a 20.5% transaction failure rate raises a critical question: can speed overcome reliability concerns? Solana’s path is high-risk, high-reward.

And don’t overlook Cardano. Quietly building, steadily growing, Cardano rolled out zero-knowledge smart contracts and saw its total contracts jump 67% YoY, with 1.33 million delegated wallets in play.

Its steady expansion in Africa and emerging markets suggests slow-and-steady can win the race, especially where research and stability matter. Also projects such as Iagon, Midnight, GenWealth, and PALM Economy are real world changing projects. Slow and steady wins the race every time. Especially when you have something world changing to bring to the table.

Emerging chains like Near Protocol, Kaspa, and Avalanche, are finding growth niches. Near has 52 million monthly actives, Avalanche boasts 2.3 million daily transactions, and Kaspa’s UTXO speed appeals to users and devs alike.

Lets not forget the smaller chains as well. VOI Blockchain is slowing growing and is a revolutionary Layer 1 network specifically designed to build a user-owned digital community infrastructure centered around Decentralized Autonomous Organizations (DAOs). Launched by a team including Chris Swenor, VOI was created as a fork of Algorand’s technology in 2022 to better align incentives with developers and users instead of large investors.

Unlike typical blockchains where early investors claim the majority of tokens, VOI reserves 75% of its token supply to reward active builders, users, and contributors over a 20-year emission plan, fostering authentic community ownership and sustained growth. This approach democratizes governance and network control, making the blockchain truly owned, run, and built by its users. VOI is by far one of my favorite projects. I am honored to be able to help this chain run and help build a Blockchain truly owned and operated by the people.

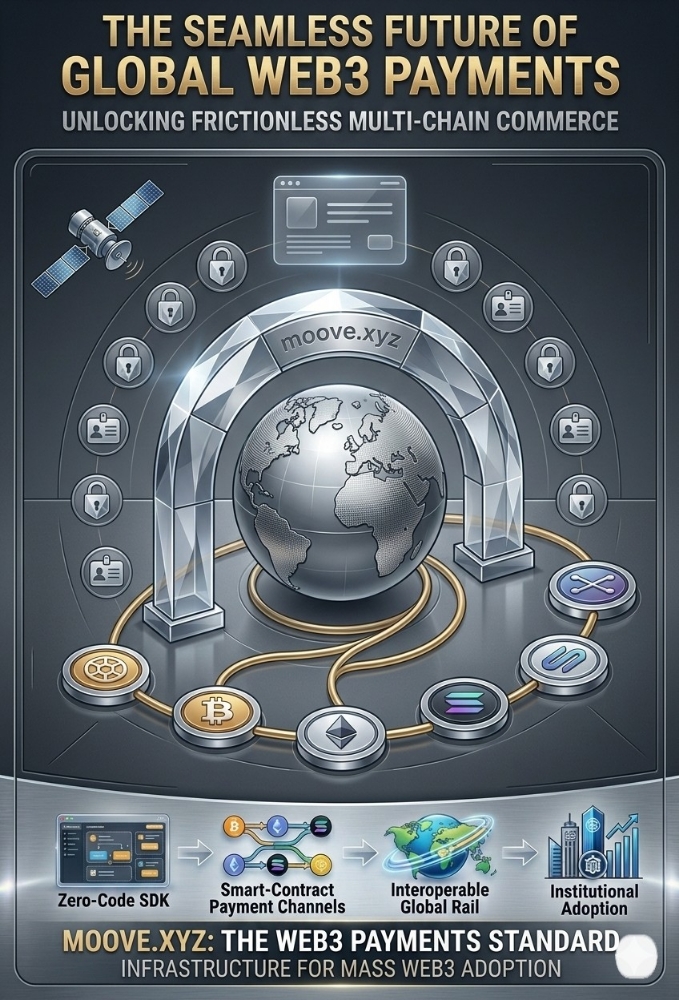

Stablecoins and Layer 2

If there’s one storyline the mainstream misses, it’s the rise of stablecoins and Layer 2 networks. Stablecoins now represent 30% of all on-chain volume, topping $4 trillion annually. USDT alone is clearing $703 billion in monthly transactions. Aquiet revolution making payments and remittances affordable and instant worldwide.

Layer 2s, led by Arbitrum and Base , are scaling Ethereum beyond imagination, holding $39.39 billion in TVL and processing millions of cheap, fast daily transactions. Fees are slashed by 90%, and usability skyrockets, igniting new applications at consumer scale.

This is the infrastructure not speculation, that’s transforming how people interact with digital assets.

Real-World Utility

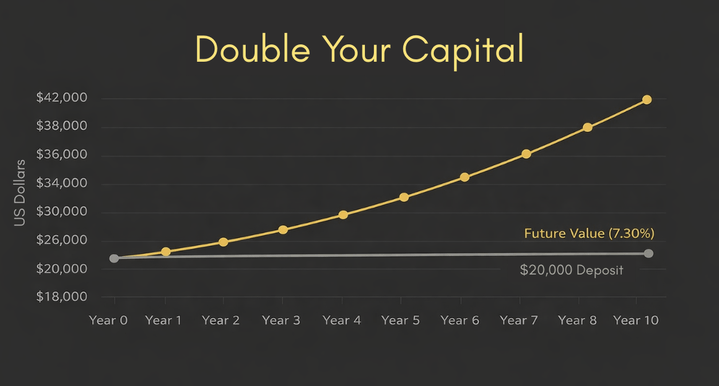

Crypto’s growth is grounded in solving hard problems for real people. Remittances? Stablecoins slash fees from 6–8% to nearly zero for millions sending money home across borders. Inflation hedging? Crypto lets people in places like Argentina, Turkey, and Nigeria escape currency collapse. Cross-border payments? Stablecoins settle invoices in minutes, not days, with no banks in the way. DeFi yields? Ethereum offers 4.5% staking, and in a world of low savings returns, earning meaningful interest is transformative. Also keep in mind things are still very volatile and no knows if and when swings will start settling down.

This isn’t a theoretical revolution, it’s happening, at scale, especially where legacy financial options fall short.

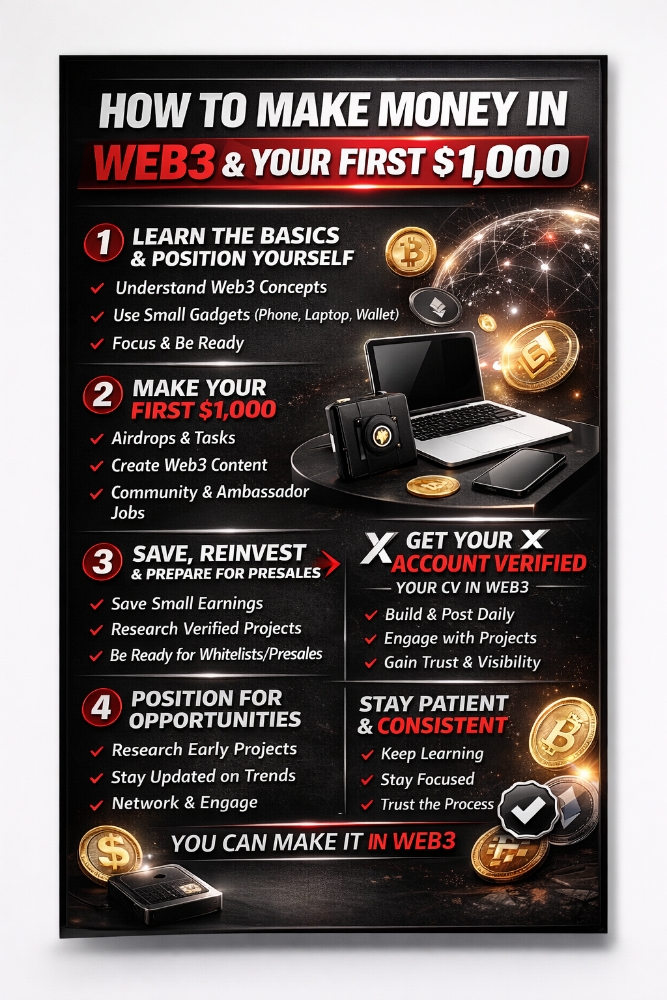

Where the Smart Money Goes Next

Institutional capital is consolidating around Bitcoin and Ethereum . These assets are trusted, liquid, and compliant, with ETF products paving the way. For risk-tolerant investors, Layer 2 networks are the next frontier, processing massive volume and experiencing rapid TVL growth. Solana remains an enticing but volatile contender. Huge user base but technical reliability still in flux.

Regulatory tailwinds are powerful. ETF approval unlocked vast reserves of capital. Every new clarity milestone will draw more institutions in, fundamentally changing the liquidity and stability of crypto markets.

But the field is narrowing. The winners such as Bitcoin, Ethereum, Solana, and a handful of specialized chains are attracting most capital, users, and developers. It seems to me the days of the altcoin free-for-all are fading.

Crypto’s Future Is Multi-Chain and Real

Crypto adoption is not just growing, it’s evolving, diversifying, and accelerating. From 100 million users to 650 million in five years. From retail speculators to pension and sovereign wealth funds. From pure hype to $4 trillion in real transaction volumes. Blockchain networks are battling for specialized use cases, with Bitcoin cementing its role as digital gold, Ethereum anchoring DeFi and developer innovation, Solana pushing consumer frontiers, and Layer 2 networks making it all scalable.

The multi-chain future is real. The only question is, which blockchains will dominate which corners of the digital economy?

If you found this article helpful, remember to like and follow. Let’s continue the conversation. Which chain do you think will take the lead by 2030?

Thanks for reading everyone 📖 Remember stay curious and keep learning ❤️ Also if you are worried about Crypto prices right now just zoom out.

Disclaimer:

This content is for educational and informational purposes only and is not financial, investment, legal, or tax advice. Please do your own research and consult a qualified professional before making any decisions about how you invest your time or money.

Sources:

The 2025 Global Adoption Index — Chainalysis

2025 Crypto Adoption and Stablecoin Usage Report — TRM Labs

BlackRock’s Bitcoin ETF Surpasses 800,000 BTC in Assets Under Management — The Block

Ethereum Adds 16K Developers in 2025, Yet Solana Steals All the Spotlight — Yahoo Finance

2025 Cryptocurrency Adoption and Consumer Sentiment Report — Security.org

Original article on Medium