Custodial Wallet Integration: A Complete Guide for Crypto Businesses

One of the most essential components of any crypto platform is its wallet infrastructure. This is where custodial wallet integration becomes a powerful solution allowing businesses to securely store, manage, and control digital assets on behalf of their users while delivering a seamless onboarding experience.

In this guide, we’ll explore what custodial wallets are, how they work, their benefits, and how crypto businesses can integrate them successfully.

What Is a Custodial Wallet?

A custodial wallet is a type of cryptocurrency wallet where a trusted third party, usually a crypto exchange, Web3 platform, or blockchain service provider, holds and manages the private keys on behalf of users.

In simple terms, users do not directly control their wallet keys. Instead, the platform securely stores them and allows users to access, send, receive, and manage their digital assets through login credentials such as email, password, and two-factor authentication.

How Custodial Wallet Integration Works

User Registration

Upon signing in with a social login, phone number, or email address, a wallet profile is created on the backend. This gives new users the ability to begin utilizing crypto services immediately without downloading external wallets or having to operate complex seed phrases.

Wallet Creation

Each registered user has a unique custodial wallet address. This wallet is also associated with the account of the user directly and allows making deposits, withdrawals, and transfers. The wallet creation is automated and provides onboarding speed and removes wallet setup mistakes.

Private Key Management

Advanced technologies like encryption vaults, Hardware Security Modules (HSMs) or Multi-Party computation (MPC) ensure that the generation and storage of private keys are secure. Such security solutions allow the protection of private keys against hostile access and cyber attacks, as well as allow their signing of authorized transactions.

Transaction Processing

When the user sends a transaction, the platform confirms the request, performs security checks, signatures, and disseminates the transaction to the blockchain network. Every transaction is done on behalf of users, enabling them to carry out crypto transfers and only confirm complex cryptographic actions.

Compliance Layer

Custodial wallet systems contain in-built KYC, AML, and monitoring transaction modules. These solutions assist crypto companies in meeting the regulations and detect malicious practices, avoiding fraud, and keeping clear history of their operations. Custodial wallets could be considered the optimal choice in controlled crypto platforms and financial apps due to this compliance layer.

Key Benefits of Custodial Wallet Integration

Faster User Onboarding

Users are able to open accounts and begin making transactions immediately without any work with private keys or recovery phrases. This makes the process of onboarding simpler and the conversion rates much higher.

Improved User Experience

Crypto can be used more easily by those who are not technical and beginners can use it through login-based access, password recovery and guided transactions which can assist platforms to get more users.

Stronger Security Controls

Centralized custody enables businesses to deploy enterprise-level security based on HSM, MPC, encrypted vault storage, withdrawal controls, and multi-factor authentication to secure user funds.

Regulatory Compliance Support

Custodial wallets aid the KYC, AML, and transaction monitoring systems, and it is easier to comply with the regional and global financial regulations.

Better Fund Management

The businesses will be able to maintain hot and cold wallets, control liquidity and monitor treasury operations effectively and minimize the operational risks.

Higher User Trust and Retention

Professional custody services will establish trust in the customers to use it, and this will foster long-term usage and loyalty to the platform.

Benefits of Custodial Wallet Integration for Crypto Businesses

Simplified User Onboarding

Custodial wallets eliminate the problems of key management, and the storage of complicated recovery phrases. The new users need to only create their accounts with their emails or mobile numbers and get to transacting immediately. This non-technical onboarding effortlessly increases user acquisition and conversion rates, particularly in non-technical users.

Enhanced Platform Security

Banks Data protection measures to be adopted by Crypto businesses include encrypted vault storage, Hardware Security Modules (HSM), Multi-Party Computation (MPC), two-factor authentication, limit on withdrawals, and real-time tracking of transactions. Such features will greatly lower chances of hacks, fraud and unauthorized access.

Compliance Readiness

Custodial wallets are equipped with KYC and AML and transaction monitoring functionalities. The compliance layers assist businesses to fulfill the regional and international regulatory standards, screen suspicious activities, and keep transparent records to make audits and reporting.

Centralized Fund Management

Custodial wallets enable businesses to operate hot and cold wallets, manage liquidity on platforms, automate the processes of fees, and monitor the activity of treasurers in real-time. This allows easier operations in the day-to-day activities and financial control.

Reduced User Errors and Fund Loss

The risk of losing money because of forgotten seed phrases or a wrong transaction is kept within the minimum since the platform handles the management of the private keys and transactions processing. This enhances customer satisfaction and reliability of the platform.

Higher User Trust and Retention

Professional custody solutions add credibility to the user regarding the reliability and security of the platform. Users are also more prone to being active and referring others to the platform once they feel that their money is secure.

Steps to Integrate Custodial Wallet into Your Platform

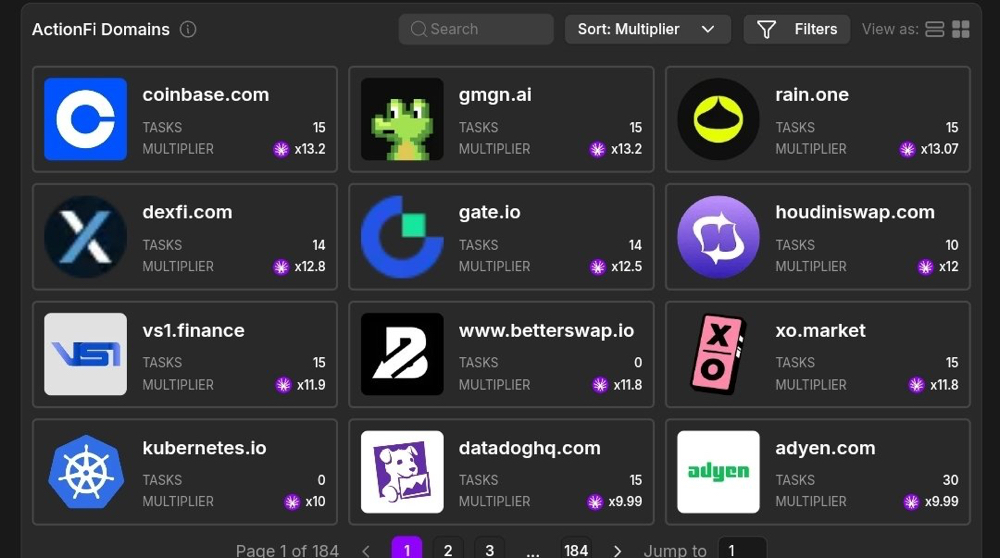

Step 1: Define Business and Technical Requirements

Start with business model and technical requirements analysis. Choose what blockchains, tokens, and networks you would like to support, approximate volumes of transactions, and determine what compliance you would need depending on your regions of interest. This is the planning stage that assists in defining wallet architecture and security policies.

Step 2: Choose the Custody Architecture

Choose one of the custody models Hardware Security Module (HSM), Multi-Party Computation (MPC), or a hybrid. These architectures will define the way in which private keys will be created, stored, and accessed with the highest security level to prevent cyber threats as much as possible.

Step 3: Develop Wallet APIs and Core Functions

Design safe APIs to support the creation of wallets, wallet balances, deposit identifications, withdrawals, in-house transfers, and transaction histories. These APIs constitute the basis of the custodial wallet system and enable your application and blockchain networks to communicate without challenges.

Step 4: Implement Security and Compliance Measures

Combine KYC and AML authentication, two-factor authentication, IP whitelisting, withdrawal limits, and transaction monitoring solutions. These layers guard the funds of users, avoid fraud and secure compliance with regulations.

Step 5: Integrate Frontend and Admin Dashboard

Integrate the wallet APIs into your mobile application or site where users can easily deposit, withdraw, and monitor balances. An administrative interface assists the platform operators in tracking the transactions, handling hot and cold wallets, and regulating the liquidity on a real-time basis.

Step 6: Testing, Audit, and Deployment

Penetration testing, smart contract audits, and stress testing before launch to determine vulnerabilities. After verification, implement the wallet system in the production and establish an ongoing monitoring system to provide long-term security and performance.

Conclusion

The integration of custodial wallets is the most important element of any crypto company pursuing a secure, convenient and scalable platform. Centralizing private key management, transactions, and businesses can make the process of onboarding easier, enhance trust among users, ensure compliance, and effectively manage funds.

Since exchanges and DeFi platforms, NFT marketplaces, and Web3 applications, the incorporation of a custodial wallet will mean that users can interact with digital assets safely and easily. When crypto businesses have the appropriate infrastructure, security measures, and compliance tools, they will be able to grow and provide their respective users with a seamless and reliable experience.