How Crypto Exchanges Power Liquidity and Price Discovery

Starting with the structural analysis of a crypto exchange, these systems are based on order books and matching engines. Users place their orders for purchasing or selling cryptos through the exchange. In the matching engine of a crypto exchange, these orders are further executed. High liquid exchange systems are less prone to problems of slippage. Even in fluctuating markets, these systems are fully functional. Binance and Coinbase exchange systems are some of the fastest exchange systems.

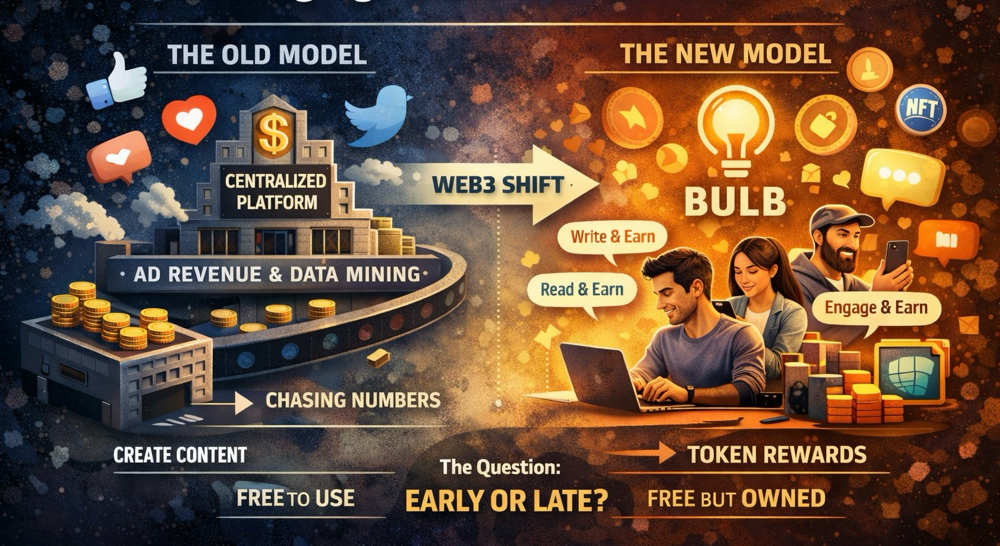

Crypto trading platforms are broadly classified into two types: Centralized and Decentralized Trading Platforms. Centralized trading platforms are third-party-controlled platforms that perform other functions, such as handling wallets and handling orders of traders. These platforms also provide advanced features such as margin trading, futures contracts, and facilities to convert cryptocurrencies into fiat currencies. Decentralized trading platforms are blockchain-supported and enable traders to trade in cryptocurrencies with one another, peer-to-peer, without controlling powers over their wallets.

The security of any crypto exchange is always a cornerstone. Since then, the more reliable exchanges have introduced such technologies as storing funds in cold wallets, multi-signature withdrawal approval processes, limits on withdrawals, and real-time monitoring. The exchange that suffered problems during past market cycles focuses on the importance of proof-of-reserves, audit processes, and segregating client funds.

For example, Kraken earned its reputation through its resilience in the face of adversity and conservative approaches to risk.

Liquidity sourcing represents the competitiveness of a cryptocurrency exchange. More liquid exchanges are attractive to professional traders and institutions, which further narrows the spread. A large number of exchanges aggregate liquidity from different markets or employ automatic market-making algorithms that incentivize traders with volume discounts. The fee structure has a direct impact on the behavior and activity rate of traders.

Regulatory compatibility is a factor that determines how cryptocurrency exchanges function in different countries. Anti-money laundering regulations, as well as transaction reporting considerations, influence speed and services offered. Fiat pairing requires exchanges to hold banking relationships and payment channels, thus increasing operational complexity. Though regions differ in terms of specific regulations, compatibility of operations within regulatory framework components is expected to increase institutional participation.

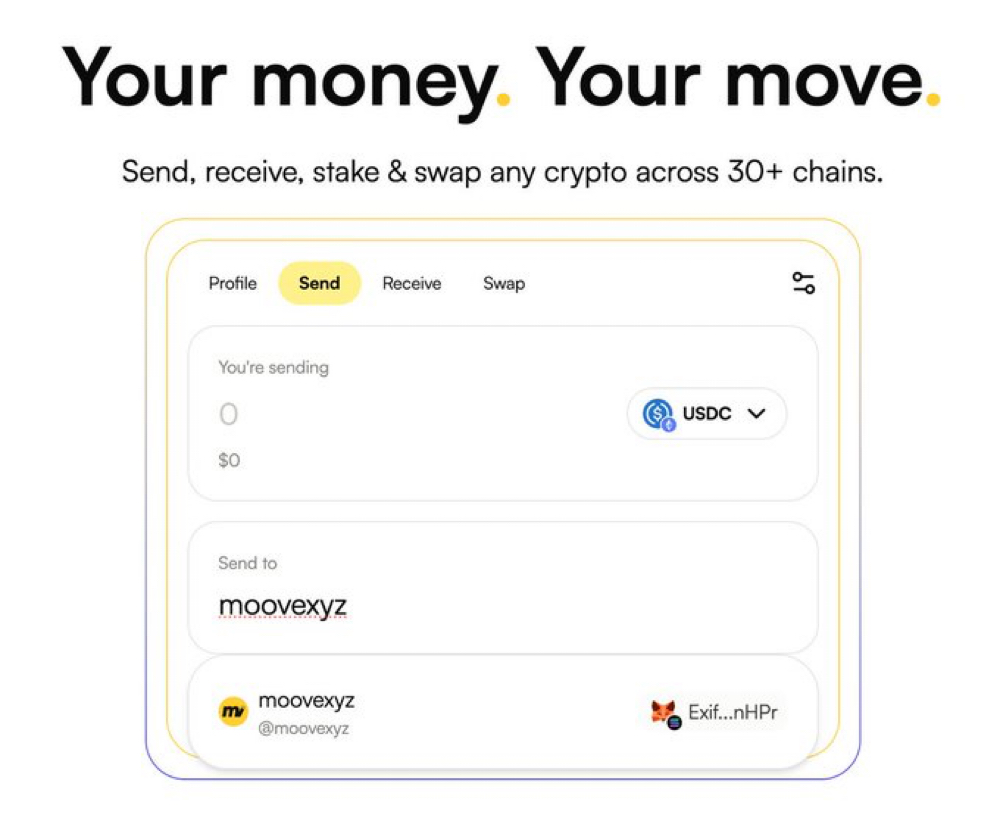

Except for trading, contemporary crypto-exchange platforms have developed a considerable financial stack. Staking platforms help users earn rewards, and lending platforms enable them to borrow money using cryptocurrencies. API connectivity to allow automated trading, portfolio analysis, and tax compliance is also offered in some platforms. All these components turn a crypto-exchange market place to a fully functional financial environment.

This is not limited to the role of a crypto exchange. This role goes further to include market transparency and price determination. Trade statistics from crypto exchanges contribute to global price indices and derivatives processing. Trading across different crypto exchanges ensures price consistency through the elimination of inefficiencies. This indirectly makes a contribution to stability within the market through constant flows of information.

In essence, a crypto exchange represents the intersection of technology, finance, and blockchain infrastructure. Its effectiveness depends on execution speed, liquidity depth, security architecture, and regulatory discipline. As the markets for digital assets mature, exchanges focusing on reliability, transparency, and scalable systems will help set how cryptocurrencies are traded, priced, and integrated into the greater financial landscape.