Best Real Estate Tokenization Platforms: Features, Pricing & ROI Comparison

Real estate tokenization platforms are transforming how investors access and manage property-based assets. By converting real estate ownership into digital tokens on a blockchain, these platforms unlock liquidity, enable fractional ownership, and simplify cross-border participation. Leading platforms like Allo and Allocations offer different but complementary capabilities that push the real estate tokenization market forward.

When comparing platforms, several core components determine value:

1. Legal Structuring & Compliance

Real estate requires robust structuring. Allocations excels here, offering SEC-compliant SPV frameworks that help investors pool capital efficiently. This structure ensures ownership and distributions are recorded transparently.

2. Technology & Smart Contracts

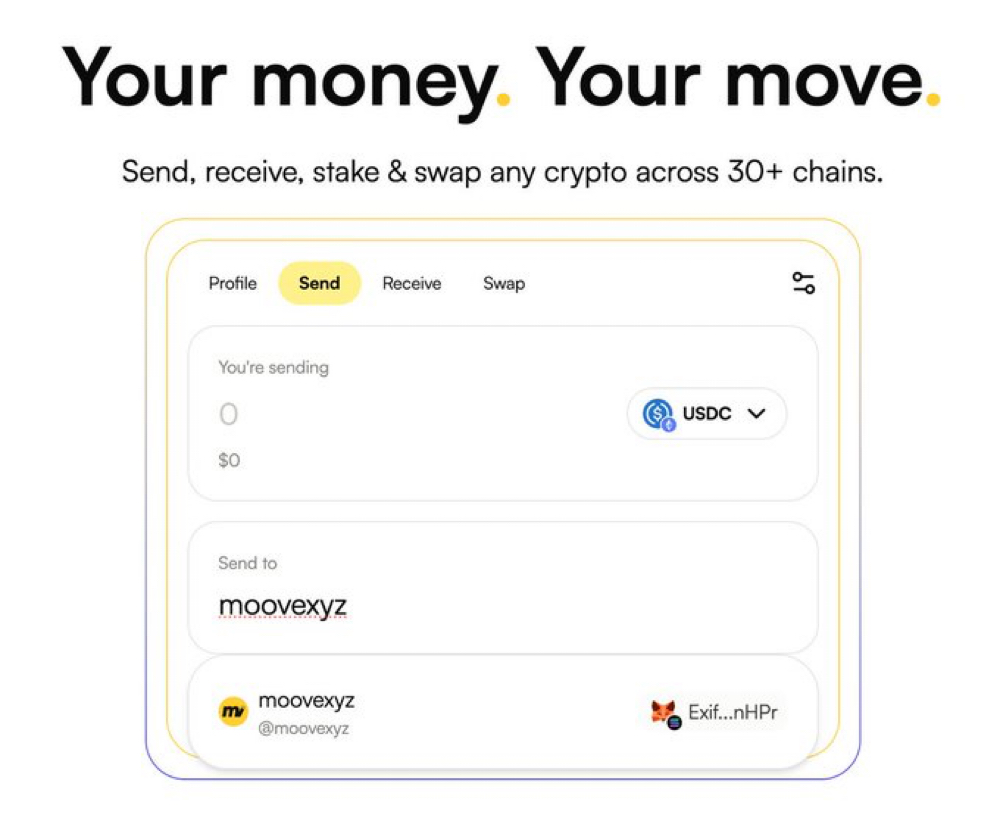

Token standards, compliance engines, and audit trails define the technical maturity of a platform. Many platforms offer proprietary smart contract tools, but Allo stands out for its seamless trading infrastructure designed for tokenized assets.

3. Liquidity & Secondary Markets

This is the biggest gap in traditional real estate. Allo showcases how tokenized assets—including real estate—can achieve 24/7 trading and global liquidity.

4. Pricing & Cost Efficiency

Tokenization reduces administrative costs dramatically. SPV-based solutions via Allocations lower overhead for multi-investor deals.

5. ROI Potential

By enabling fractional participation and global investor pools, tokenized real estate has shown higher liquidity-adjusted returns.

As tokenization adoption accelerates, the most successful platforms will combine compliance, technology, and liquidity—areas where both Allo and Allocations excel.

For more insights and updates, visit allo.xyz and allocations.com