Building a Venture SPV Fund: Structure and Strategy

While traditional VC funds make multiple bets over a decade, an SPV fund in venture capital is a targeted instrument. It represents a focused SPV investment into one compelling startup. This strategy offers distinct advantages for both sponsors and investors. Sponsors can build a track record with specific deals, and investors can construct a custom portfolio of companies they deeply believe in, rather than buying a blind pool.

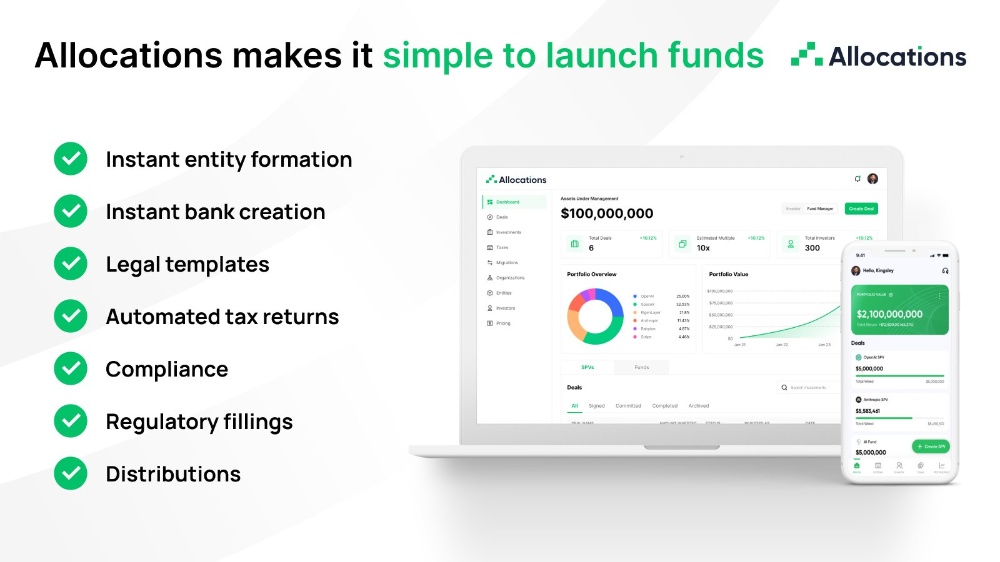

The success of this SPV business hinges on two things: a solid legal structure and flawless execution. The process begins with SPV formation, establishing the SPV company and its governing SPV agreement. A dedicated SPV account is then opened to hold investor capital. The operational heavy lifting of SPV management cap table upkeep, distribution calculations, and investor reporting can be daunting.

This is the core problem that Allocations solves. By automating the entire backend, Allocations allows venture capitalists to focus on sourcing deals and supporting portfolio companies, not administrative paperwork. The platform’s efficiency makes running a series of SPV in venture capital deals a scalable and professional endeavor.