LiquidChain vs BlockchainFX: The Best 2026 Crypto Presale

A deep dive into the 2026 presales of LiquidChain and BlockchainFX. Compare L3 infrastructure with multi-asset trading super apps for 100x potential.

Smart Money’s Choice: LiquidChain vs. BlockchainFX Presale Comparison

The Shift to Utility-First Presales

As we enter the first quarter of 2026, the cryptocurrency presale landscape has undergone a radical transformation. The "meme-driven" funding models of 2024 and 2025 have been largely replaced by Infrastructure-as-a-Service (IaaS) and Fintech-DeFi hybrids.

At the forefront of this shift are LiquidChain ($LIQUID) and BlockchainFX ($BFX). While both projects have raised significant capital, they serve two distinct sectors of the digital economy.

[Image showing a comparison table: LiquidChain (Infrastructure) vs BlockchainFX (Consumer App)]

LiquidChain: The Technical Powerhouse

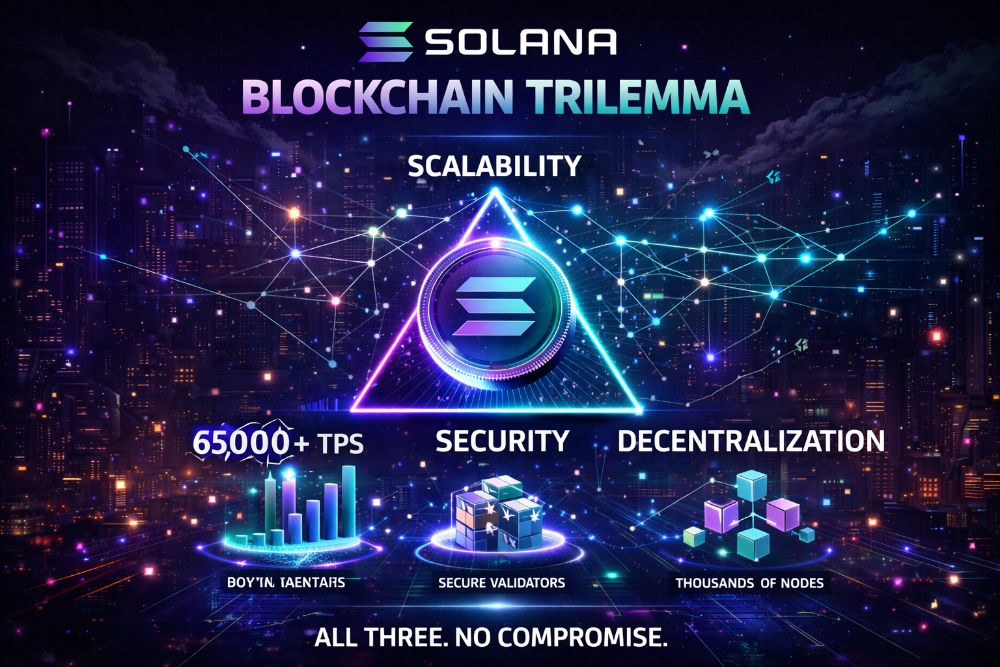

LiquidChain is positioned as the "Connective Tissue" of the blockchain world. Their Layer-3 model is designed to unify the liquidity of Bitcoin, Ethereum, and Solana—three ecosystems that have historically functioned as isolated islands.

Why Smart Money is Buying $LIQUID:

- Trust-Minimized Proofs: Unlike bridges that are prone to exploits, LiquidChain uses verifiable on-chain proofs.

- Productive Presale: With staking rewards exceeding 12,000% APY in the early phases, investors are earning a yield while the mainnet is finalized for its Q3 2026 launch.

- Institutional Alignment: 35% of the 11.8 billion token supply is locked for long-term development, ensuring the team remains incentivized beyond the initial pump.

BlockchainFX: The All-in-One Fintech Solution

If LiquidChain is the "Internet Protocol," BlockchainFX is the "Web Browser." It is an all-in-one Web3 super app that bridges the gap between the $2.5 trillion crypto market and the $500 trillion global traditional finance market.

Why Smart Money is Buying $BFX:

- Revenue Sharing: BlockchainFX redistributes up to 70% of its trading fees to the community in the form of USDT.

- Regulatory Moat: The project holds an international trading license from the Anjouan Offshore Finance Authority (AOFA), a rarity for new presales.

- Proven Traction: With over 19,500 participants and $12.2M raised, the project has already cleared its soft cap and is moving toward its $14M hard cap.

The 2026 Verdict

For the sophisticated investor, the choice isn't "either/or." LiquidChain provides exposure to the structural growth of the crypto-native economy, while BlockchainFX provides a hedge through traditional asset integration and stablecoin yield.