Understanding Fund Administration in Private Markets

Fund administration plays a crucial role in ensuring transparency, compliance, and efficiency across private investment structures such as SPVs (Special Purpose Vehicles). Whether managing a venture syndicate, real estate deal, or private equity investment, proper administration safeguards both investors and fund managers.

The Importance of Fund Administration

Fund administration handles accounting, investor onboarding, performance tracking, and reporting. For an SPV fund, this includes SPV fees, capital tracking, and K-1 tax reporting.

Why Delaware SPVs Lead the Industry

A Delaware SPV offers flexible legal structures, robust investor protections, and simplified Form D and Blue Sky compliance. The Delaware Court of Chancery ensures fast dispute resolution, which is why most global investment entities choose Delaware.

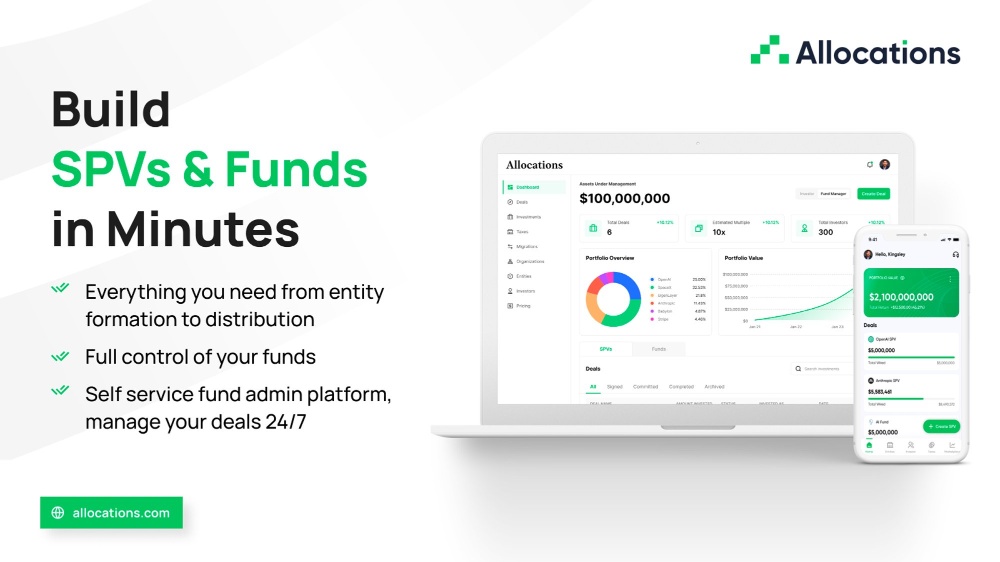

Streamlined SPV Setup with Allocations

Modern platforms like Allocations simplify SPV creation and fund administration with automated compliance, investor onboarding, and digital signatures.

Learn how to set up a Delaware SPV in minutes and maintain full compliance.

Transparent Pricing and Expert Support

Understand the Allocations fee structure to plan your fund operations with clarity. Their experienced team supports managers from setup to reporting.

For crypto-native investors, explore crypto SPVs for tokenized assets.