Why a Proactive Sydecar Fund Transition Strategy Matters

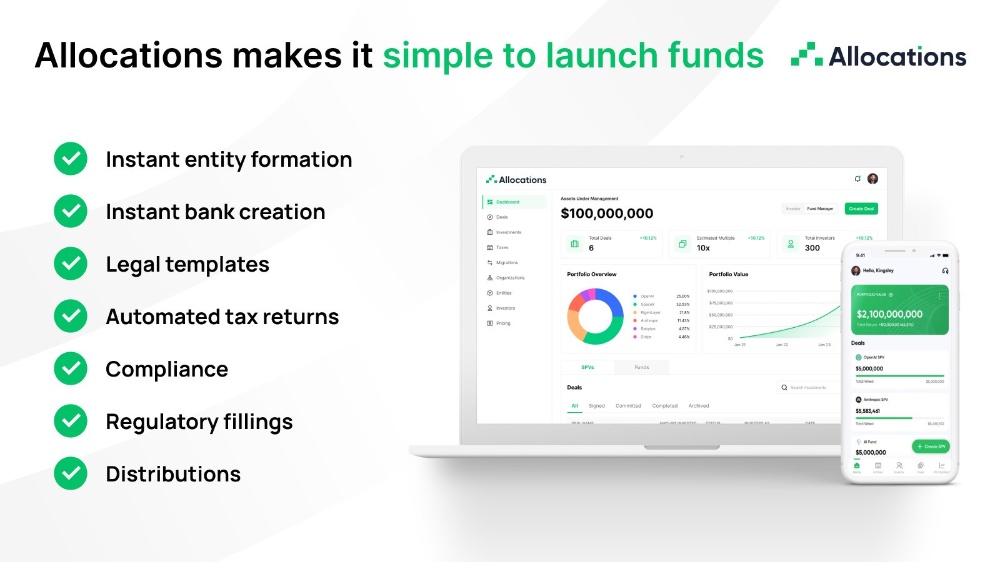

The news of Sydecar discontinuing fund product has made a well-planned sydecar fund transition a critical priority for managers. This process is far more than a technical data transfer; it is a strategic project that safeguards your fund's operations and investor trust. A reactive approach can lead to rushed decisions, data loss, and operational downtime. By viewing your sydecar fund migration as a strategic initiative, you can turn a mandated change into an opportunity for a significant operational upgrade. Partnering with a proven platform like Allocations provides the structure and expertise needed for a proactive transition.

A proactive strategy begins with a comprehensive audit of your current Sydecar environment. This involves documenting all aspects of your spv fund, including every spv account, investor detail, and historical transaction. This due diligence is the foundation for a clean break and ensures no critical information is overlooked during the move. The team at Allocations offers a structured framework and checklist to guide this initial phase, setting the stage for a seamless transition.

The ultimate goal of a proactive sydecar fund transition is to emerge on a stronger fund platform. Your move should not just replicate your old system but should deliver enhanced capabilities. By planning to migrate sydecar fund to Allocations, you position your spv company on a platform designed for the future, gaining access to superior automation, reporting, and scalability. This forward-thinking approach transforms a potential disruption into a definitive strategic advantage.

Upgrade your next deal with Luis.

Schedule here - https://calendly.com/luis-allocations