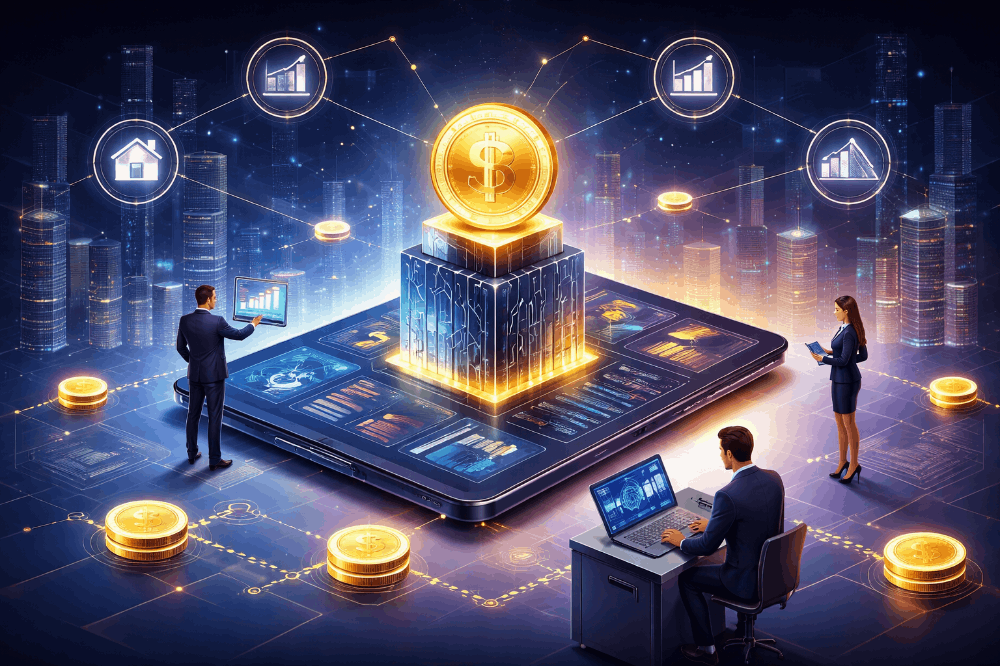

Tokenization of Traditional Finance Assets Unlocks Global Liquidity

Global liquidity has long been restricted by geography and intermediaries. The tokenization of traditional finance assets removes these barriers by enabling borderless access to real-world value.

Allo finance enables this transformation through the allo protocol, which converts traditional assets into interoperable on-chain tokens. This makes allo crypto a gateway to real-world exposure without the inefficiencies of legacy systems.

Within the allo defi ecosystem, tokenized assets can be traded, staked, or used as collateral. As an allo rwa platform, Allo connects institutional-grade assets with decentralized liquidity pools.

Advanced users benefit from allo perps, while long-term holders earn through allo staking. The allo trading platform ensures seamless participation across markets. If you’re exploring what is allo protocol, it is a scalable bridge between TradFi and DeFi, with allo finance explained through real utility.

Tokenization powered by Allo brings efficiency, access, and trust to global finance.

Learn more about Allo’s tokenized finance solutions at:

👉 https://allo.xyz