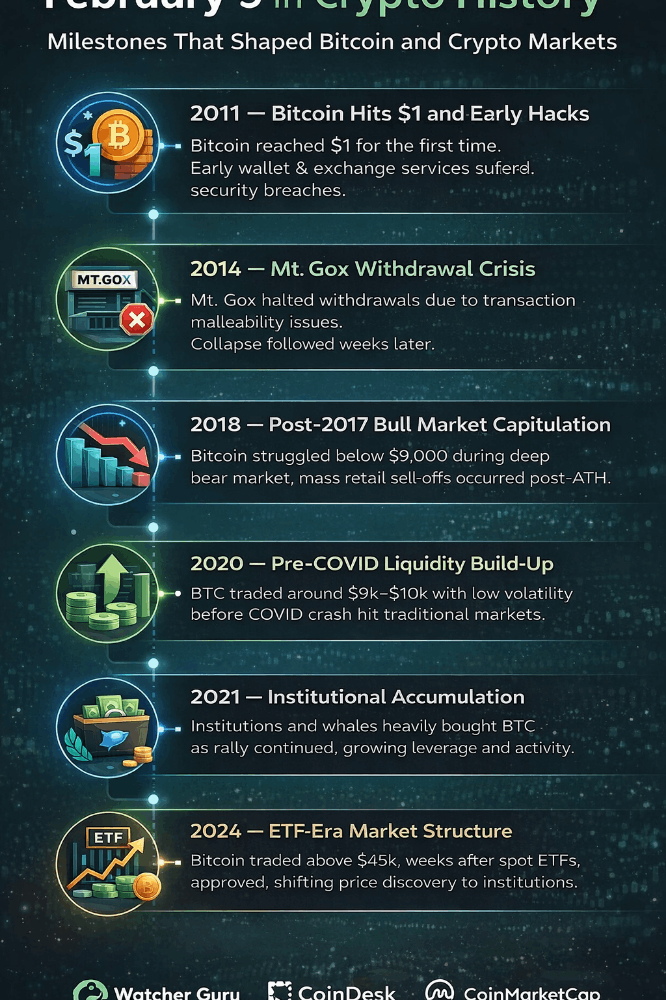

📅 February 10 in Crypto History

From Early Price Discovery to Modern Market Moves

February 10 has repeatedly proven to be a significant date in crypto, showcasing moments of price discovery, exchange risks, market volatility, and institutional participation. This blog highlights key historical milestones alongside current events to provide full context.

1️⃣ 2011 — Bitcoin Trades Near $1

In early February 2011, Bitcoin was hovering around $1, marking one of its first true price discovery moments. According to WatcherGuru, this milestone attracted wider attention beyond cypherpunks, establishing Bitcoin as a viable digital asset.

Impact:

Price discovery attracted both investors and hackers.

Demonstrated that value invites security risks even in early-stage markets.

2️⃣ 2011 — Early Exchange Hacks

Around the same period, several early Bitcoin exchanges and wallets suffered security breaches due to weak custody practices, lack of multisig, and hot-wallet storage.

Why it matters:

Feb 10, 2011 is part of Bitcoin’s first security stress test.

These early hacks influenced future exchange design, custody solutions, and risk awareness.

3️⃣ 2014 — Mt. Gox Withdrawal Crisis

By February 10, 2014, the Mt. Gox exchange had halted withdrawals, citing transaction malleability. Market confidence collapsed, foreshadowing the eventual loss of ~850,000 BTC.

Impact:

Triggered heightened regulatory scrutiny.

Showed the importance of exchange transparency and security protocols.

4️⃣ 2018 — Post-Bull Market Capitulation

On February 10, 2018, Bitcoin and major altcoins were deep in the bear market following the 2017 highs. Retail panic selling and margin liquidations dominated market behavior.

Impact:

Highlighted the effect of leverage and sentiment on market volatility.

Provided lessons on risk management for both retail and institutional participants.

5️⃣ 2020 — Pre-Halving Accumulation Phase

February 10 fell in a period where BTC hovered around $9,000–$10,000, ahead of the May 2020 halving. Long-term holders were increasing positions, anticipating supply shock effects post-halving.

Impact:

Showed the strategic role of HODLing and accumulation in shaping later bull runs.

6️⃣ 2021 — Institutional Accumulation

During the 2021 bull cycle, February 10 saw large institutional inflows, with on-chain data showing significant whale activity. Futures and options were increasingly influencing price discovery beyond retail participation.

Impact:

Market began transitioning from retail-dominated to institution-driven, laying the foundation for modern liquidity patterns.

7️⃣ 2024 — ETF-Driven Market Structure

By February 10, 2024, Bitcoin price action was heavily influenced by spot ETF inflows, arbitrage strategies, and derivatives trading, with BTC trading above $45,000.

Impact:

Demonstrated how institutional products now dominate short-term volatility.

Shifted price discovery away from retail-only spot markets.

8️⃣ 2026 — Major Exchange Operational Error

Today, February 10, 2026, Bithumb mistakenly credited customers with 620,000 BTC (~$42B). Most funds were reversed, but the event caused panic, showing that even the largest exchanges remain susceptible to human errors.

Impact:

Highlights systemic operational risk.

Demonstrates continued importance of liquidity monitoring and flow analysis (WatcherGuru).

🔑 Key Takeaways

February 10 reflects Bitcoin’s journey from early price discovery to institutionally influenced markets.

Price milestones, security breaches, bear-market sell-offs, and ETF-driven structures all occurred on this date historically.

Today’s operational errors reinforce the timeless principle: value attracts risk.