The Future of Private Market Investing with Allocations

Private market investing is no longer reserved for big institutions. Thanks to digital tools like Allocations, individual investors and family offices can now access world-class opportunities with the same efficiency as professional funds.

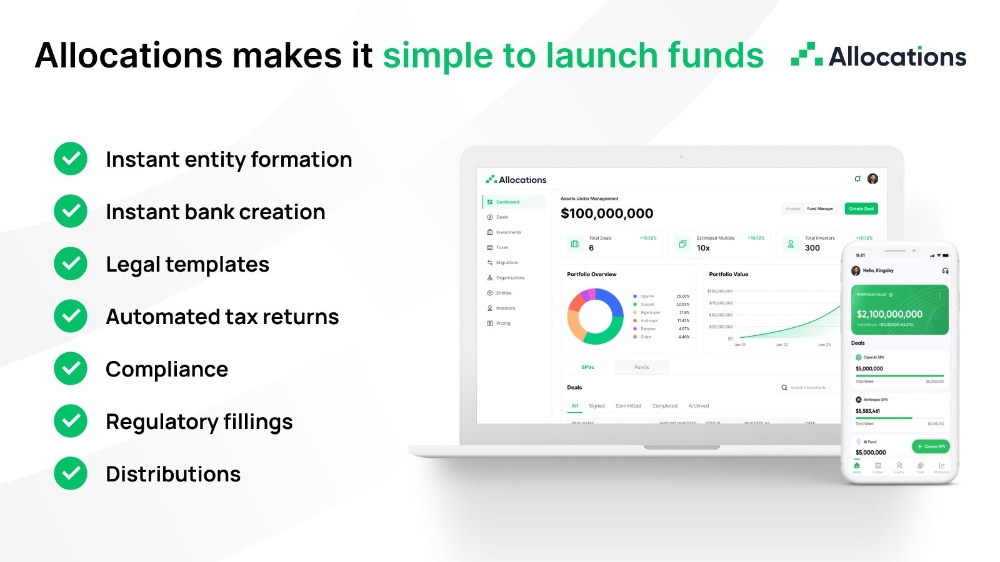

Allocations makes it simple to start an SPV and pool capital for a single investment — whether it’s a startup, real estate asset, or crypto deal. Their Delaware SPV structure ensures investor protection and smooth SPV fund administration for every transaction.

Transparency is key in private market investing. Allocations keeps SPV carry and fees clear for all participants — you can review full details here. Each SPV is designed to meet Blue Sky law and Form D compliance requirements, simplifying regulatory hurdles for deal leads.

For crypto-native investors, Allocations’ crypto SPV solution bridges traditional finance and tokenized assets. Meanwhile, if your investment requires unique deal terms or side letters, the platform’s custom SPV services can tailor structures to fit.

Behind the scenes, an experienced Allocations team manages compliance, filings, and fund administration — ensuring every SPV operates seamlessly from launch to exit.