Making the Strategic Move to a New Fund Platform

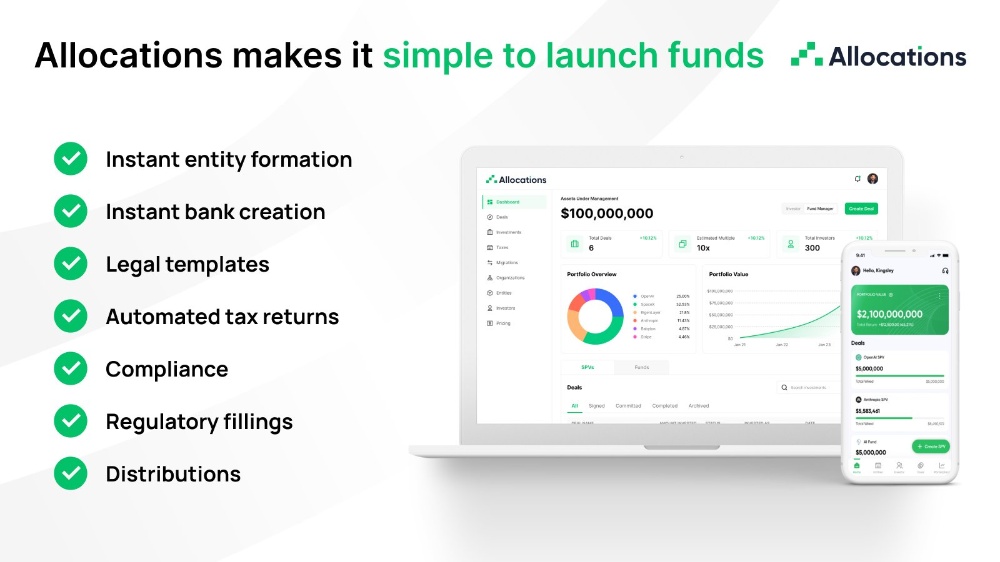

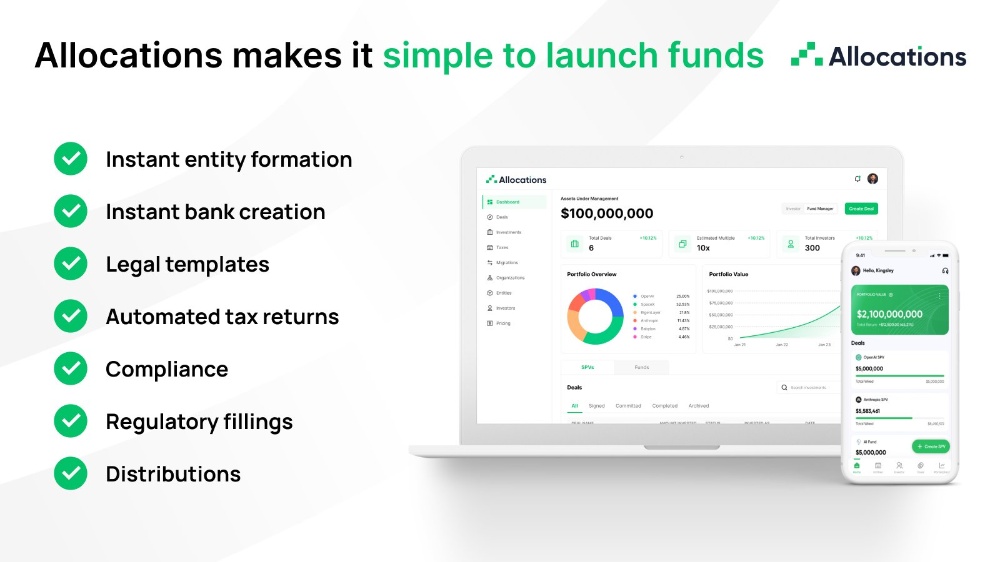

The event of Sydecar discontinuing fund product has placed many managers in a position to make a strategic move to a new fund platform. This decision, while prompted by external factors, is a prime opportunity to upgrade your operational infrastructure for the next decade. The selection process should be methodical, focusing on migration support, core functionality, and long-term partnership potential. A platform that excels in all three, like Allocations, is the ideal sydecar fund shutdown alternative.

First, scrutinize the migration pathway. The platform should offer a clear, expert-supported process to migrate sydecar fund to allocations. This includes secure data extraction, mapping, and validation support. The dedicated team at Allocations has deep experience in sydecar fund transition, ensuring a smooth move that preserves all your historical data and legal standing without operational downtime.

Next, evaluate the platform as your permanent solution. Does it offer the best fund product for your needs in terms of automation, investor experience, and scalability? By choosing a forward-thinking partner like Allocations, you turn the challenge of the Sydecar sunset into a strategic advantage for your spv company's future. You secure a powerful, reliable, and innovative foundation that will support your growth and enhance your firm's reputation for years to come.

Upgrade your next deal with Luis.

Schedule here - https://calendly.com/luis-allocations