What Makes a Great SPV Platform in 2025

A Special Purpose Vehicle (SPV) is a flexible structure used by investors to pool capital for private deals. In 2025, choosing the best SPV platform is about more than formation — it’s about speed, compliance, and transparency.

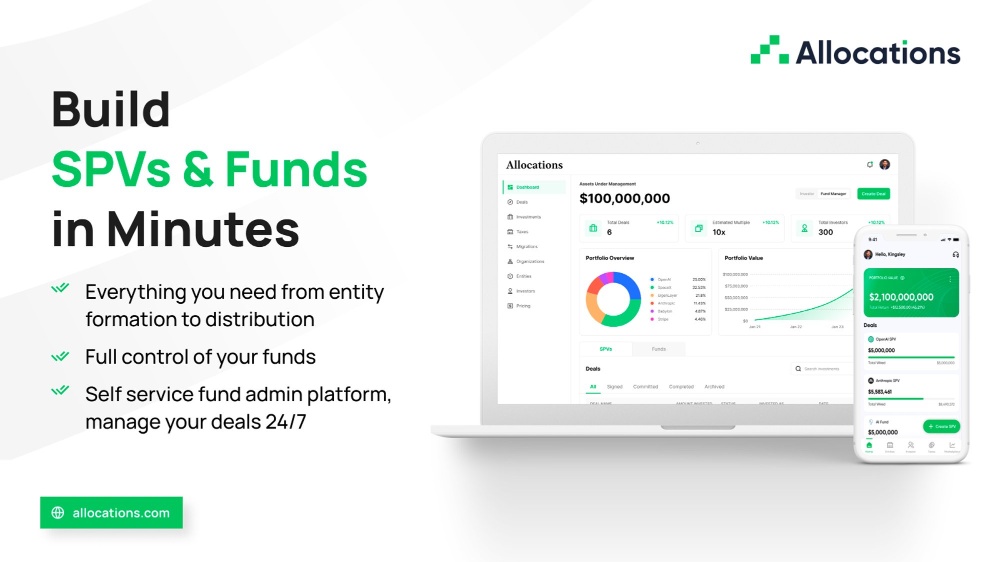

Platforms like Allocations simplify SPV setup, investor onboarding, and capital calls, while automating fund administration. Whether you’re launching a private equity SPV or managing hedge fund administration, efficiency matters.

Modern SPV platforms should also handle MOIC tracking and 409A valuation data seamlessly, giving investors a clear view of returns. With Allocations software, fund managers gain both power and precision.

Discover how Allocations’ fee model ensures alignment with fund economics and how their team supports compliance under Delaware SPV law.

For digital-native investors, crypto SPVs and custom structures make Allocations a leader in SPV investment technology.

Backed by an experienced Allocations team and innovative tools like crypto SPVs, the platform sets the standard for modern fund management.