US employment data in January unexpectedly increased stronger than forecast: Could the FED delay the

The US economy recorded unexpected news when the number of new jobs in January increased significantly higher than forecast. This may create more pressure for interest rate cuts by the US Federal Reserve (FED![]()

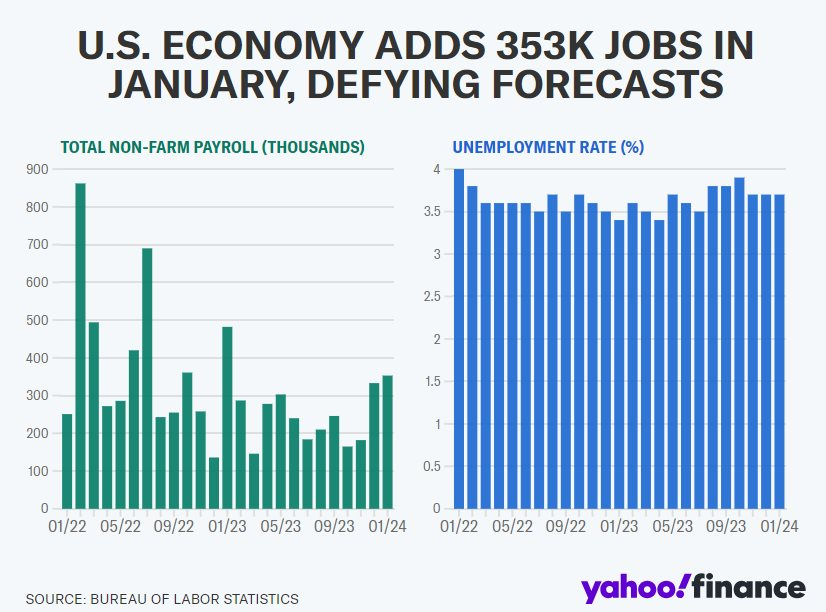

The number of new jobs grew unexpectedly in January, once again proving that the US labor market is still very solid and ready to support economic growth. Specifically, according to a new report released on February 2, 2024 by the US Department of Labor, employers created 353,000 new jobs - much higher than Dow Jones' prediction of 185,000 new jobs. Unemployment rate remained at 3.7%, lower than forecast of 3.8%. Wage growth is also higher than forecast. Average hourly earnings, a key measure of inflation, rose 0.6% in January - more than double estimates. Compared to the same period last year, wages increased by 4.5%, much higher than the forecast of 4.1%. The wage increase comes as the average number of hours worked fell to 34.1, or 0.2 hours less. Among occupations, business and professional services had the strongest growth with 74,000 new jobs. Other top-increasing industries included health care (70,000), public sector jobs (36,000), retail trade (45,000), social assistance jobs (30,000) and manufacturing (23,000). Besides, the report also pointed out that employment data in December 2023 was better than the original - adjusted to increase to 333,000 jobs, an increase of 117,000 jobs compared to the previous estimate. November 2023 data was also adjusted to increase by 9,000 to 182,000 jobs. While the report demonstrates the resilience of the US economy, it also raises questions about when the US Federal Reserve might start cutting interest rates.

Wage growth is also higher than forecast. Average hourly earnings, a key measure of inflation, rose 0.6% in January - more than double estimates. Compared to the same period last year, wages increased by 4.5%, much higher than the forecast of 4.1%. The wage increase comes as the average number of hours worked fell to 34.1, or 0.2 hours less. Among occupations, business and professional services had the strongest growth with 74,000 new jobs. Other top-increasing industries included health care (70,000), public sector jobs (36,000), retail trade (45,000), social assistance jobs (30,000) and manufacturing (23,000). Besides, the report also pointed out that employment data in December 2023 was better than the original - adjusted to increase to 333,000 jobs, an increase of 117,000 jobs compared to the previous estimate. November 2023 data was also adjusted to increase by 9,000 to 182,000 jobs. While the report demonstrates the resilience of the US economy, it also raises questions about when the US Federal Reserve might start cutting interest rates.

“As you can see, this is a booming jobs report,” said George Mateyo, chief investment officer at Key Private Bank. It is a testament to the Fed's recent stance of ruling out a rate cut in March. Furthermore, strong employment growth combined with faster-than-expected wage growth could point to a rate cut. Rates will be delayed further into 2024 and will cause some investors to readjust their thinking.” The January jobs data was released as economists and policymakers closely monitor employment figures to find direction for the economy. The country's GDP growth also exceeded expectations. The fourth quarter saw GDP increase sharply by 3.3% compared to the previous year, closing a year in which the economy was always expected to decline. The growth occurred even as the US Federal Reserve continued to raise interest rates to cool inflation

The Atlanta Fed's GDPNow tracker is aiming to predict a 4.2% GDP increase in the first quarter of 2024. Economic dynamics, employment and inflation create a complex picture as the Fed looks to loosen monetary policy. Earlier this week, the Fed once again kept its benchmark interest rate unchanged and indicated that it may proceed with a rate cut, but not until inflation shows signs of cooling further. Chairman Jerome Powell also pointed out during the press conference that central banks remain concerned about the impact of high inflation on consumers, especially those at lower income levels.