5 Important Bitcoin Insights This Week as BTC Price Hits ‘Uptober’ Up 5%

.

Shantanu Gupta

Shantanu Gupta

·

Follow

Published in

Coinmonks

4 min read

·

Oct 2, 2023

Listen

Share

More

Introduction:

Bitcoin enthusiasts welcomed the month of “Uptober” with enthusiasm as BTC price experienced a robust 5% surge, crossing the $28,000 mark. This positive start to October marked Bitcoin’s strongest weekly close since mid-August, raising questions about what the coming weeks hold for the world’s largest cryptocurrency. In this article, we delve into five significant aspects of Bitcoin’s recent performance and the potential implications. BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

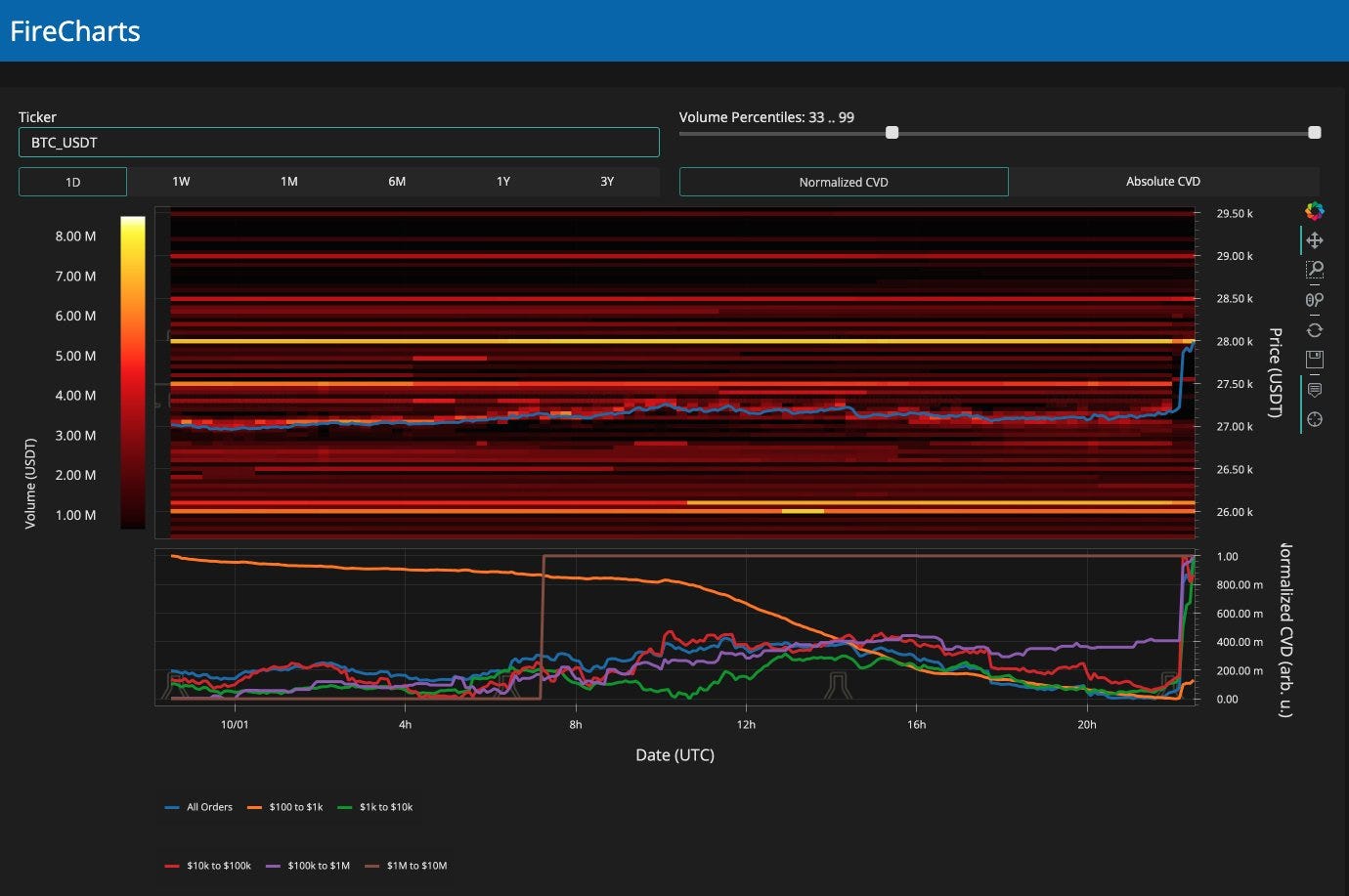

- Bulls and Price Reversal Risk: As the week concluded, Bitcoin saw a sudden and significant price surge, with the cryptocurrency almost reaching $28,000. Some analysts warned of potential price reversal risks after this rapid growth, with exchange order book trends indicating a need for substantial volume to clear the $28,000 to $29,000 price range. The direction of the market now largely depends on spot traders.

BTC/USD 1-day chart with 200-week simple moving average (SMA). Source: TradingView

BTC/USD 1-day chart with 200-week simple moving average (SMA). Source: TradingView

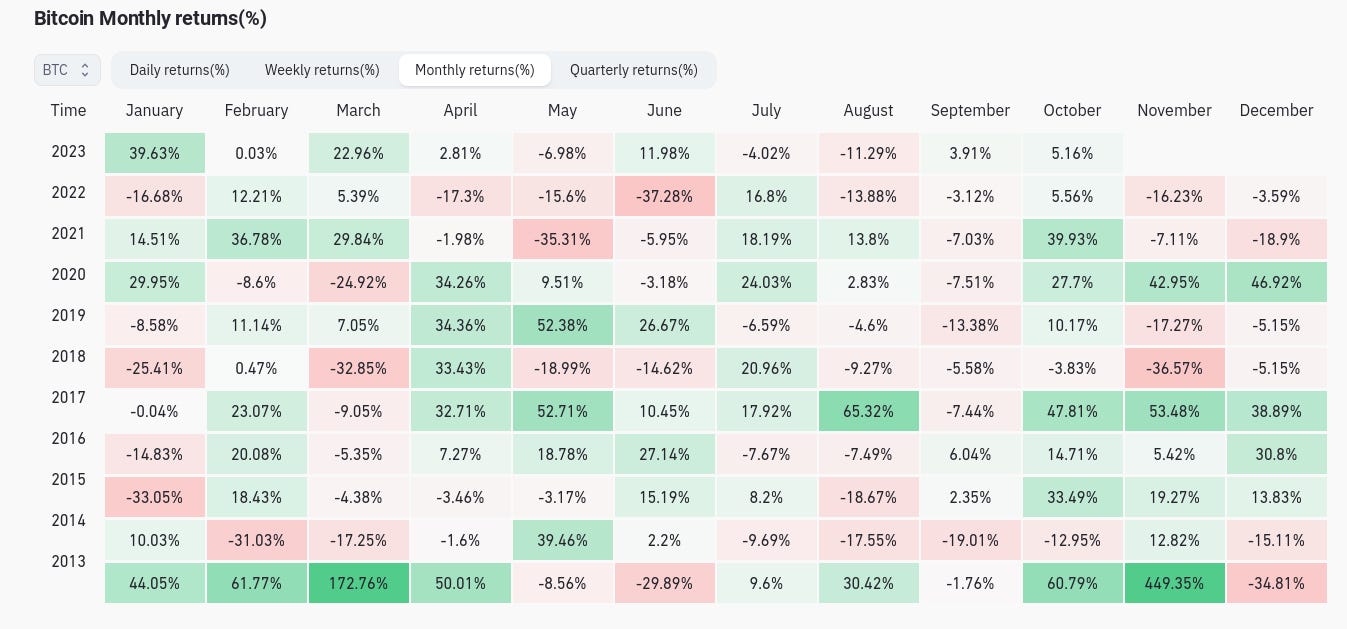

2. “Uptober” Resurgence: In contrast to the previous year, which started with a slight dip, this year’s October appears to align more with the historical trend of a bullish “Uptober.” According to data from CoinGlass, Bitcoin has not closed October at a lower price than it started since 2018. Market commentators have expressed optimism, suggesting that Bitcoin is in the midst of a significant trend change. BTC/USD monthly returns (screenshot). Source: CoinGlass

BTC/USD monthly returns (screenshot). Source: CoinGlass BTC/USD order book data for Binance. Source: Keith Alan/X

BTC/USD order book data for Binance. Source: Keith Alan/X

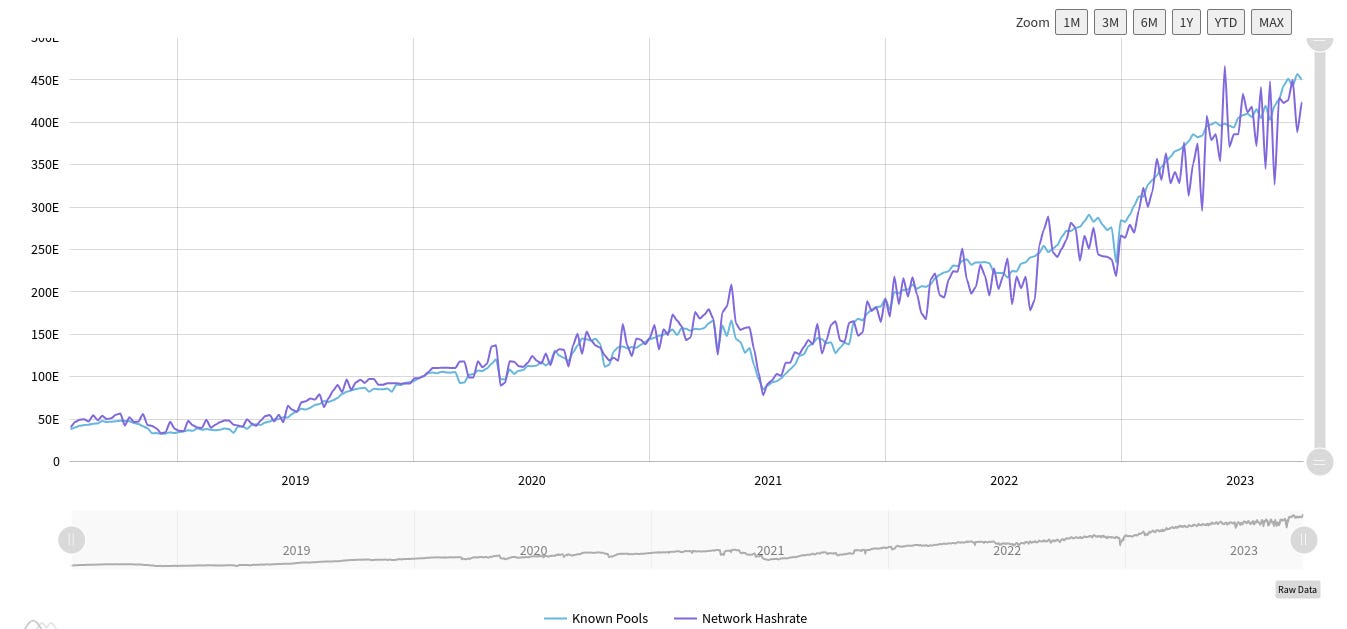

3. Bitcoin Fundamentals vs. Spot Markets: Despite the bullish sentiment on spot markets, Bitcoin’s network fundamentals are not entirely echoing the enthusiasm. Network difficulty is expected to decrease by 0.7% at its next automated readjustment on October 2, which is in contrast to the recent trend of increasing difficulty. Hash rate, the estimated processing power on the network, remains high, leading to debates about whether price follows hash rate or vice versa. Bitcoin network fundamentals overview (screenshot). Source: BTC.com

Bitcoin network fundamentals overview (screenshot). Source: BTC.com

4. Federal Reserve Speakers and Macro Outlook: While Bitcoin experiences excitement in early October, United States macroeconomic data remains relatively calm. Lawmakers recently averted a government shutdown, removing Ukraine aid as a sticking point. Market participants are closely watching for insights from Federal Reserve officials ahead of the next Federal Open Market Committee (FOMC) meeting on November 1, which will decide interest rate policy. Bitcoin raw hash rate data (screenshot). Source: MiningPoolStats

Bitcoin raw hash rate data (screenshot). Source: MiningPoolStats

5. Dollar Liquidity and Bitcoin’s Path: Considering the relationship between global liquidity and asset performance, it’s noteworthy that some analysts are observing a divergence between net U.S. dollar liquidity and BTC/USD. This divergence suggests that Bitcoin’s path of least resistance could be sideways to higher in the coming years. However, the potential for choppy market conditions in the short term remains. Fed target rate probabilities chart. Source: CME Group

Fed target rate probabilities chart. Source: CME Group

Conclusion:

Bitcoin’s strong start to “Uptober” has brought renewed optimism to the cryptocurrency market. Traders and investors are closely monitoring Bitcoin’s price movements, especially considering historical trends and the ongoing debate about network fundamentals. Additionally, insights from Federal Reserve officials and the evolving relationship between liquidity and Bitcoin’s performance add further layers of complexity to the cryptocurrency landscape. As always, it’s essential for market participants to conduct their research and exercise caution when making investment decisions.

If You Like The Content Clap,Follow,Share. And If It Helped You In Your Journey Donate To Support.

Goodbye to 9 to 5 Transform Your Financial Future with Crypto Cash Flow. Copy, Paste, and Profit with Our Cryptocurrency Cash Blueprint And So Many Ways — Start Your Journey Today!

ABSOLUTE BEGINNER (WITHOUT ANY SKILL OR EXPERIENCE) HOW TO MAKE HUGE PROFITS IN A SHORT TIME WITH CRYPTO! I’ll Show You How to Make Huge Money with Totally Automated Crypto Trading Robots And More.

128

Bitcoin

Cryptocurrency

Blockchain

Bitcoin News

Bitcoin Price

128

Follow

Follow

Written by Shantanu Gupta

1.94K Followers

·

Writer for

Coinmonks

Crypto, Blockchain, and Metaverse Content Creator | Encouraging You to Become a Profitable Crypto Trader💵🚀 and Explore the Digital Frontier.

More from Shantanu Gupta and Coinmonks

Shantanu Gupta

Shantanu Gupta

Can These Altcoins 1000x in the Crypto Bull Run?Top Altcoins and High Growth Crypto Coins to Buy….

The cryptocurrency market is abuzz with anticipation as analysts predict a potential bull run in 2024. As seasoned investors and crypto…

5 min read

·

Dec 14, 2023

154

Velvet.Capital

Velvet.Capital

in

Coinmonks

🚨Velvet.Capital Token Distribution (Airdrop)🚨

🚨 Airdrop Alert🚨: DeFi Asset Management Done right! Everything you need to know for Velvet.Capital’s Token Distribution & Airdrop!

4 min read

·

Dec 30, 2022

45K

1224

Harshita Katiyar

Harshita Katiyar

in

Coinmonks

Best Stock Market APIs

An API (Application Programming Interface) is a set of rules and protocols that allows different software applications to communicate and…

31 min read

·

Jun 29, 2023

704

6

Shantanu Gupta

Shantanu Gupta

in

Coinmonks

Top 7 Unreleased Crypto Tokens With 100x Potential In Upcoming Bull Run Don’t Miss💥

A couple of exciting headlines that followed several months of bad news have generated fresh interest in Bitcoin and the crypto markets.

6 min read

·

Jul 17, 2023

474

4

Recommended from Medium

Crypto Promo

Crypto Promo

Top 10 Best Crypto Launchpads and IDO Platforms for 2024

Crypto launchpads and IDO platforms have become increasingly popular ways for crypto projects to gain visibility and secure funding. By…

10 min read

·

Nov 19, 2023

181

Cryptonica Editorial

Cryptonica Editorial

The Major Crypto Predictions for 2024

From the anticipated impact of the Bitcoin halving, ETFs, and Price Rises to the proliferation of NFTs, DeFi, and the metaverse, many…

8 min read

·

5 days ago

153

1

Lists

Modern Marketing57 stories

Modern Marketing57 stories

·

384

saves

My Kind Of Medium (All-Time Faves)59 stories

My Kind Of Medium (All-Time Faves)59 stories

·

190

saves

Generative AI Recommended Reading52 stories

Generative AI Recommended Reading52 stories

·

639

saves

Captain Crypto

Captain Crypto

These 5 Cryptocurrencies Could Make You A Millionaire By 2024-End

2021 was a monumental year of crypto. The industry empowered many individuals to make their first million through digital assets. 2022…

3 min read

·

Dec 14, 2023

71

Crypto With Lorenzo

Crypto With Lorenzo

in

Crypto Insights AU

11 Small- to Mid-Cap Cryptos to Buy in 2024

Many are searching for 100, 200, or even elusive 1000x gems, banking on a few killer partnerships, listing on major exchanges or mass…

·

19 min read

·

5 days ago

259

2

Costa Martinez

Costa Martinez

The Crypto Market About To Explode

Hey guys, welcome back. So it’s official, the Bitcoin ETFs have finally gone live, which has been months in the making. And my goodness did…

·

7 min read

·

Jan 13

316

5

Jayden Levitt

Jayden Levitt

in

Level Up Coding

You’re Too Focused on Bitcoin When Looking Further Out on the Risk Curve Is Where You’ll Gain the…

Everything changed once I stopped treating my investments like a sports team.

·

6 min read

·

6 days ago

458

5