Tokenized Stocks vs Traditional Stocks — Why RWAs Matter in 2025

11

Main difference:

- Traditional stocks trade during set market hours and settle in days.

- Tokenized stocks can be traded 24/7 with instant settlement of tokenized equities and fractional ownership.

Benefits driving RWA investment opportunities 2025:

- Cross-border stock investing blockchain removes barriers and reduces costs.

- RWA liquidity solutions create new secondary markets for illiquid assets.

- Tokenized stock exchange 2025 is likely to expand access to bonds, real estate, and private equity.

Use cases:

- Invest in tokenized US stocks from anywhere.

- Buy portions of private equity via tokenization of private equity funds.

- Add tokenized bonds and real estate to a diversified portfolio.

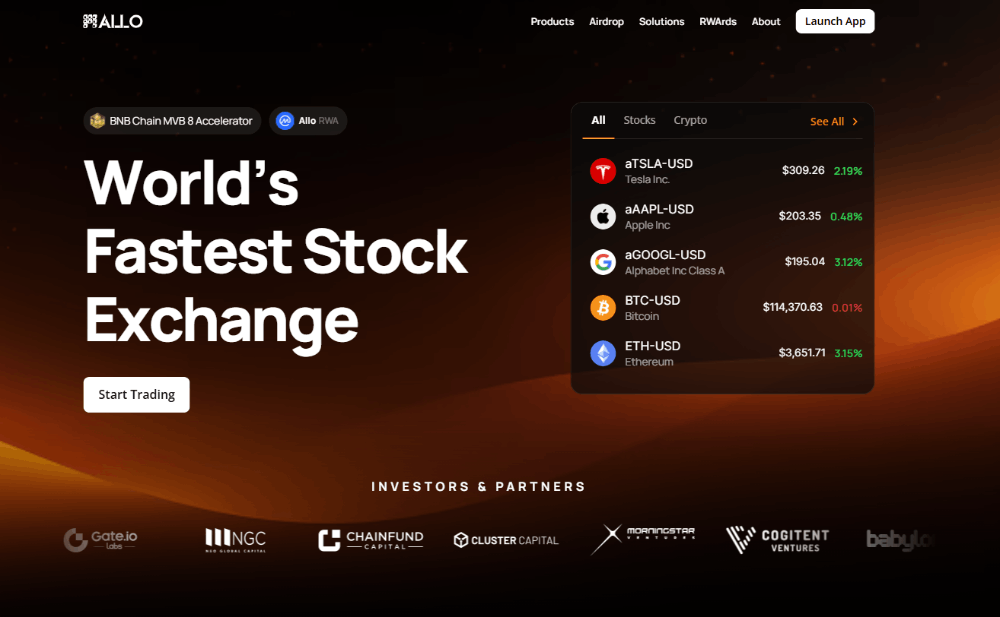

Where Allo fits: Allo is building the world’s first exchange for tokenized stocks with 24/7 trading, low fees and instant settlement — already tokenizing RWAs and offering tools for fund managers. Discover Allo for trading and learn how tokenized investing works on Allo. Check product notes about Allo decentralized stock exchange on Allo.

Quick note on synthetic vs tokenized stocks: synthetics are useful for speculation; tokenized stocks give ownership claims and RWA benefits. See Allo resources for details.