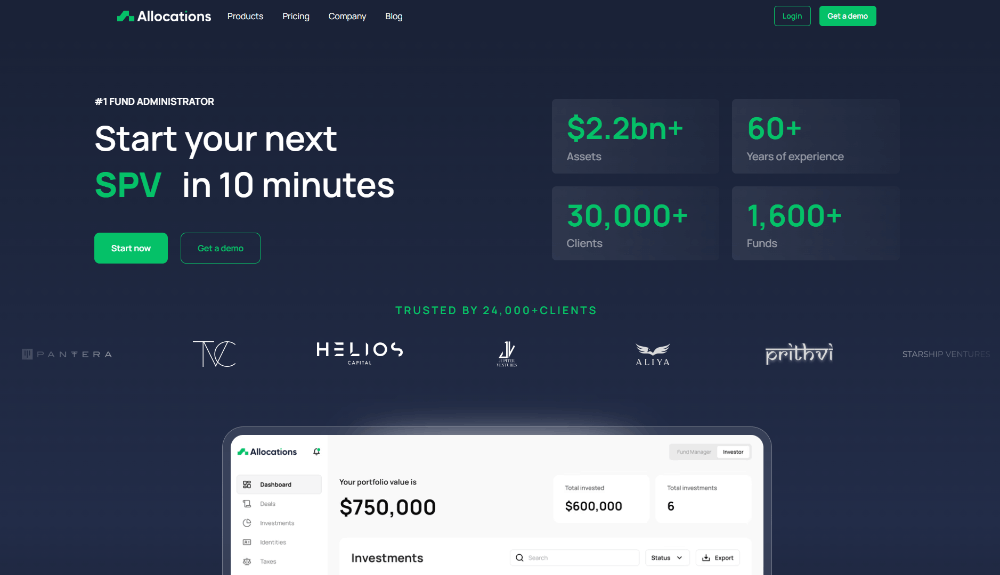

The Future of Private Equity SPVs is Powered by Allocations

In 2025, the evolution of the SPV platform landscape is all about automation and compliance. Allocations leads this shift by combining fund administration, 409a valuation tools, and private equity SPV creation into one integrated experience.

Investors can now launch, fund, and track deals entirely online — from capital calls to MOIC meaning and performance insights. See how quickly you can form an entity through Allocations Startup SPV.

Each special purpose vehicle formed through Allocations follows Delaware standards, ensuring legal strength and scalability for GPs and LPs alike.

Allocations’ software also supports custom SPV structures for different fund types. Explore that option at Allocations Custom SPV, or check out their expertise in digital asset funds via Allocations Crypto SPV.

Curious about pricing or fund setup details? Visit Allocations Fees and learn how the platform optimizes your private market investing journey.

If you’re wondering how much it costs to start, review the transparent Allocations Fees page and connect with the experienced Allocations Team for guidance.