Tokenized Corporate Treasuries – Bridging Traditional Finance and Blockchain

Tokenized corporate treasuries are merging traditional finance with blockchain-based infrastructure. Companies can now digitize reserves, issue tokenized assets, and even earn treasury yield from staking while maintaining full transparency.

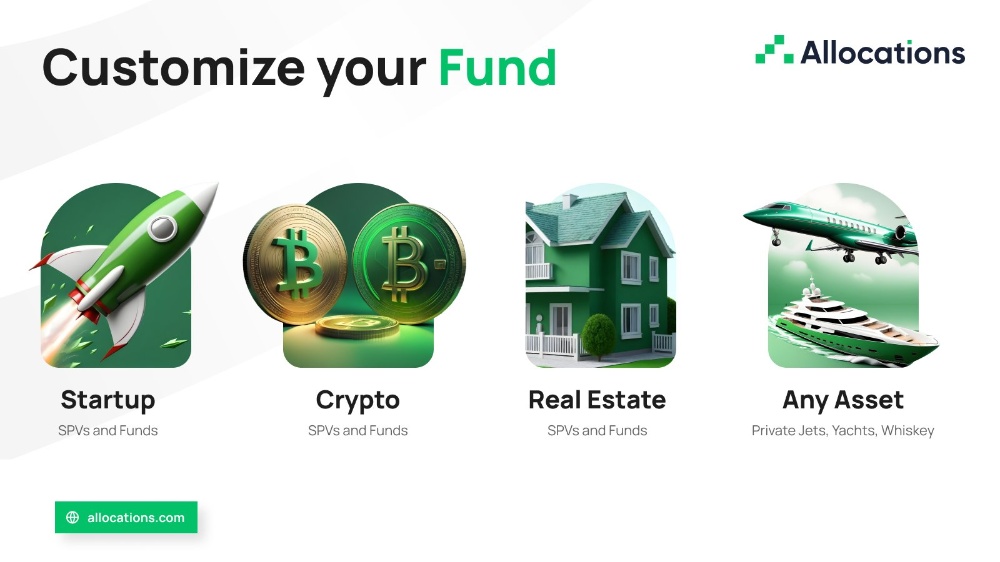

Leading Digital Asset Treasury Companies (DATCOs) use Allocations Crypto SPV to manage this innovation securely. Each SPV is tailored to compliance standards, making it suitable for both private and public companies holding Bitcoin.

With Allocations Software, firms gain access to efficient tools for fund administration, Digital Asset Treasury management, and institutional crypto exposure.

Businesses exploring Delaware SPV setups for corporate finance can start via Allocations Startup SPV. For more advanced structures, Allocations Custom SPV supports complex tokenized strategies.

To estimate your cost and formation timeline, visit Allocations Fees and connect with experts from the Allocations Team.

Allocations’ expertise extends to crypto fund creation, hedge fund administration, and real-time analytics. Meet the Allocations Team to discover how corporate treasuries are evolving onchain.