JPMorgan Warns of Incoming Bitcoin Selloff With Anticipated $3 Billion Grayscale Outflow

Share quote to Twitter

Share quote to Twitter

Global investment bank JPMorgan has warned of additional outflow from Grayscale’s bitcoin fund, cautioning that it will put “further pressure on bitcoin prices over the coming weeks.” The bank’s analyst also explained that the $3 billion inflow into new spot bitcoin exchange-traded funds (ETFs) “reflects a rotation from existing bitcoin vehicles” or “from retail investors shifting from digital wallets held with exchanges/retail brokers to cheaper spot bitcoin ETFs.”

JPMorgan Warns of Looming Bitcoin Selloff

JPMorgan analyst Nikolaos Panigirtzoglou shared his bitcoin’s price outlook on Linkedin Friday, specifically the impact of spot bitcoin exchange-traded fund (ETF) launches and outflows from Grayscale’s bitcoin fund. Grayscale converted its bitcoin trust (GBTC) into a spot bitcoin ETF after the U.S. Securities and Exchange Commission (SEC) approved it along with 10 other funds on Jan. 10.

“The bitcoin price declined by more than 10% since the launch of spot bitcoin ETFs last week,” the JPMorgan analyst described. “It appears that profit taking, i.e. buy the rumor/sell the fact dynamics, took place in recent days as we had previously feared. The price of BTC rose past $47K in anticipation of the spot bitcoin ETF approval but dropped after the approval. At the time of writing, the cryptocurrency is trading at $41,697.

“The $1.5bn outflow from the Grayscale’s GBTC fund in particular has acted as a drag. It looks like GBTC investors who over the past year had been buying the GBTC fund at a significant discount to NAV to position for its eventual ETF conversion, have been taking full profit post ETF conversion by exiting the bitcoin space entirely rather than shifting to cheaper spot bitcoin ETFs,” Panigirtzoglou detailed.

Noting that he has previously estimated that up to $3 billion had been invested into GBTC in the secondary market during 2023 to take advantage of the discount to NAV, the JPMorgan analyst explained:

If the previous $3bn estimate proves correct and given $1.5bn has exited already then there could be an additional $1.5bn still to exit the bitcoin space via profit taking on GBTC thus putting further pressure on bitcoin prices over the coming weeks.

Cumulatively, Grayscale’s bitcoin ETF has seen an outflow of 50,106.59 BTC since Jan. 12, valued at over $2 billion.

Panigirtzoglou also shared his analysis of the other spot bitcoin ETFs that launched on Jan. 11, including Blackrock’s Ishares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC).

“Outside GBTC, the other spot bitcoin ETFs got a decent $3bn of inflow in only four days: Thursday 11th, Friday 12th, Tuesday 16th, and Wednesday 17th. This is comparable to the inflows seen during previous bitcoin product launches such as the launch of CME bitcoin futures or the launch of futures-based bitcoin ETFs,” the JPMorgan analyst noted, adding:

As expected most of this $3bn of inflow reflects a rotation from existing bitcoin vehicles such as futures-based bitcoin ETFs which show outflows of close to $300mn since last Thursday or from retail investors shifting from digital wallets held with exchanges/retail brokers to cheaper spot bitcoin ETFs.

Weekly NFT Sales Dip — Ethereum Outshines Bitcoin, Solana and Avalanche Record Gains

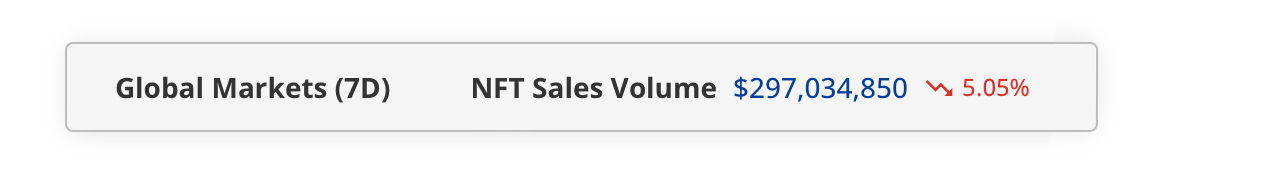

- The latest statistics indicate a further decline in non-fungible token (NFT) sales this week, showing a 5.05% decrease compared to the previous week. Sales of NFTs reached $297 million, with Ethereum leading the way this week. Ethereum’s sales amounted to $106 million, overtaking Bitcoin’s $70 million in sales over the same seven-day period.

Ethereum Leads in Weekly NFT Sales, Outperforming Bitcoin as Digital Collectibles Market Experiences Overall Decline

Sales of non-fungible tokens (NFTs) have seen a 5.05% decrease from the previous week, yet there’s been an 82.40% rise in buyers and a 77.46% increase in sellers. Recently, Bitcoin had been leading in sales, but Ethereum has now captured the leading position with $106 million in NFT sales, marking a 28.15% increase from last week. Meanwhile, Bitcoin’s total sales amounted to $70,367,439, reflecting a 35.25% downturn according to cryptoslam.io metrics. NFT sales between Jan. 13, 2024 to Jan. 20, 2024, according to cryptoslam.io metrics.

NFT sales between Jan. 13, 2024 to Jan. 20, 2024, according to cryptoslam.io metrics.

Solana witnessed a 35.07% uptick in sales, reaching $59 million over the past week. In contrast, Polygon experienced a downturn, with sales totaling $25.33 million, a 43.02% decline from the previous week. Among the top five blockchains for NFT sales, Avalanche enjoyed a 22.13% increase, culminating in $14.24 million in volume. Arbitrum also stood out with a significant 26.02% increase, securing $3.27 million in NFT sales over the same seven-day period.

This week’s leading NFT collection was Solana’s Cryptoundeads, achieving $15.9 million in sales. Trailing behind was Bitcoin’s Uncategorized Ordinals, with a total of $13.32 million in NFT sales, a decrease of 41.53%. From the Bitcoin blockchain, only two collections made it into the top ten, with Bored Ape Yacht Club (BAYC) and Cryptopunks also securing spots in the top ten rankings.

The highest-priced NFT sold this past week was “Lif3 V3 Positions NFT #9,” commanding a price of $698K. Following closely was Polygon’s “Lif3 V3 Positions NFT #15,” which sold for $245K. In third place was Solana’s “Boogle #047,” which fetched $219K three days ago. Additionally, notable sales were observed on the BNB, Bitcoin, and Flow blockchain networks, with high-priced sales ranging from $40K to $73K.

Mad Money Host Jim Cramer Sees 'Nasty Beginning to Bitcoin Selloff'

Share quote to Twitter

Share quote to Twitter

Jim Cramer, the host of CNBC’s Mad Money show, has warned of a bitcoin selloff. While cautioning investors about investing in bitcoin and the newly launched spot bitcoin exchange-traded funds (ETFs), he said: “I’m not as stridently against these new investment vehicles as Gary Gensler is … At this point, Bitcoin’s been around for 15 years, it’s fairly well-established, and I don’t want to try to stop anyone from speculating in this stuff, as long as they do their research.”

Jim Cramer’s Bitcoin Prediction

Mad Money host Jim Cramer weighed in on the bitcoin price outlook several times this week, particularly focusing on how the U.S. Securities and Exchange Commission’s approval of spot bitcoin exchange-traded funds (ETFs) could affect its trajectory. Cramer is a former hedge fund manager who co-founded Thestreet.com, a financial news and literacy website.

The price of bitcoin pushed above $47K in anticipation of the SEC approving spot bitcoin ETFs. However, after the approval, it plunged to a low of nearly $40K on Friday. At the time of writing, BTC has slightly recovered and is trading at $41,589. Commenting on the BTC price decline, Cramer wrote on social media platform X Thursday:

Nasty beginning to the bitcoin selloff.

“Someone’s probably going to try to make a stand here but as we said last night you can’t have an asset double in value by hundreds of billions of dollars in anticipation of an ETF and then almost no one shows up,” the Mad Money host added. In a follow-up post on Friday, he opined: “You knew they would make a stand on bitcoin here. Let em try to hold it up for a couple of days.”

Many people challenged Cramer’s statement, arguing that the launch of spot bitcoin ETFs was far from a flop. “It was the biggest ETF launch of all times,” one wrote. Others noted that bitcoin ETFs had already surpassed silver as the second-largest commodity ETF and witnessed massive inflows in just a few days.

Many X users view Cramer’s bearish statements about bitcoin’s price as a bullish sign. The “Cramer effect” has become a popular meme in the crypto world, with many observing that BTC often does the opposite of what Cramer predicts. If he’s bullish, expect a bearish swing, and vice versa.

While maintaining his skepticism, Cramer stated on Wednesday that he’s not necessarily against investing in bitcoin. The Mad Money host proceeded to reference JPMorgan Chase CEO Jamie Dimon who said this week that he won’t tell people what to invest in but his personal advice is to stay away from bitcoin.

“I’m taking a page from Jamie Dimon here — this is a caveat emptor situation. You can make up your own mind about what to do with these spot bitcoin ETPs [exchange-traded products], I just want to make sure you know what, exactly, you might be putting your money in and how little went into these funds versus how much bitcoin went up,” Cramer described.

Referencing SEC Chair Gary Gensler stating that the regulator’s approval of spot bitcoin ETFs doesn’t mean an endorsement of bitcoin, Cramer stressed:

I’m not as stridently against these new investment vehicles as Gary Gensler is … At this point, Bitcoin’s been around for 15 years, it’s fairly well-established, and I don’t want to try to stop anyone from speculating in this stuff, as long as they do their research. Of course, I’m not totally sure what your research would be, but that’s not my problem.

Last week, Cramer said BTC is topping out. The prior week, he said bitcoin cannot be killed and it’s a ” technological marvel” that is “here to stay.”