Cryptocurrency Cold Wallet: An Overview

What is a Cryptocurrency Cold Wallet?

A crypto cold storage wallet, also known as a hardware wallet, is a device with specifically designed hardware to encrypt and store your wallet’s seed phrase offline and in a safe environment. Hot wallets, on the other hand, store your seed phrase online. If a hacker has access to your computer, they can see your seed phrase and use it to steal your funds.

Cold wallets typically have physical buttons, or touchscreen buttons depending on the device, which are used for signing transactions on the blockchain. This makes it hard for scammers and hackers to steal your funds unless they physically hold the device. What’s more, each cold wallet is locked with a PIN number, a passphrase or 2FA. The fraudsters will also need to know that to unlock your wallet. Using a companion app, these wallets can store crypto assets including cryptocurrencies and NFTs. You can also trade, swap, stake and more with these apps, giving cold wallets the same functionality as hot wallets but with added security.

Using a companion app, these wallets can store crypto assets including cryptocurrencies and NFTs. You can also trade, swap, stake and more with these apps, giving cold wallets the same functionality as hot wallets but with added security.

What’s more, you can connect your cold wallet to a hot wallet like MetaMask or Phantom, which makes connecting to DeFi applications seamless. For every transaction you make, you will have to sign it with the buttons on your device.

How do Cold Wallets Work?

All cold storage crypto wallets have a seed phrase, consisting of 12 or 24 words, which you can use to restore your wallet and access your crypto funds in case something happens to your computer or smartphone. That’s because your crypto wallet and assets are stored on the blockchain. Using the seed phrase you actually prove that you own the cold wallet crypto.

Cold Wallets Store Your Seed Phrase Offline

Cold wallets generate and store the user’s private keys on the physical device. This means the seed phrase is never exposed on your computer screen while you’re connected to the Internet. This way, hackers can never see your seed phrase via your computer even if your computer is compromised.

If the user needs to restore a private key, they enter the seed phrase directly on the device itself, which is encrypted and offline.

You Need to Press a Button to Sign Transactions

Aside from keeping your seed phrase safe, cold wallets have another safety feature. You have to physically press buttons on the cold wallet to authorize transactions. This way, no one can authorize the transaction except the person who holds the cold wallet device.

To increase security, cold wallets use a PIN number, a passphrase or 2FA to unlock the device. If someone manages to steal your hardware wallet, they would need to know your access codes to unlock it.

Why Is The Seed Phrase Important?

The crypto wallet seed phrase, often made of 12 to 24 randomly generated words, is the backup key to your wallet. This sequence of words is linked to the private keys and acts as a mnemonic representation to retrieve access to the assets within the wallet.

For example, you create a crypto wallet and you don’t save the seed phrase. If you need to reinstall your operating system, someone steals your computer or your cold wallet breaks and you don’t know your wallet’s seed phrase, you won’t be able to access your digital wallet and your funds will be trapped.

To protect your seed phrase, you need to write it down on a piece of paper and store it somewhere safe. The best bitcoin cold wallet makers, like Ledger, sell metal seed phrase protectors that can withstand fire and damage.

Advantages of Cold Crypto Wallets

The main advantage of a cold wallet is enhanced security. Since you need to physically press buttons on the wallet, you are safe from remote access hacks.

Enhanced Security

The main advantage of cold crypto wallets is their superior protection against online vulnerabilities. Cold wallets aren’t connected to the internet, making them immune to cyber attacks.

This includes protection from hacking attempts, phishing schemes, malware infections and other malicious activities. By storing private keys offline, cold wallets ensure that access to your funds is protected.

Unauthorized Access Protection

Cold wallets require that you physically press a button to sign a transaction. In the unfortunate event that a malicious actor has gained access to your computer accounts and companion cold wallet app, they can’t move your funds without you pressing the buttons.

This acts as a physical barrier against unauthorized access and theft, giving you peace of mind that your funds are protected even when you sleep.

Long-Term Safekeeping

Crypto cold wallets are designed for the long-term storing of your crypto assets. That’s because the safety feature of pressing buttons to authorize transactions can become a nuisance if you plan to use your cold wallet device for active trading. What’s more, active trading requires that you connect to multiple decentralized apps, which could potentially pose a threat if they’re hacked.

Unlike hot wallets, which are designed for frequent transactions and daily use, cold wallets are better suited for “hodling”, which is for keeping your assets safe long-term.

Immune to Platform Failures

Online platforms and exchanges are known to experience downtimes, glitches and even hacks. For example, DeFi exchange Curve Finance had various Ethereum pools hacked where $52 million were stolen.

CoinEx lost $54 million in a hack. If you had funds in these two platforms or any other where the assets were compromised, you could have lost all your funds.

Cold wallets eliminate this risk because you have full control over your assets and how they move.

Cold Wallets vs Hot Wallets

Both cold wallets and hot wallets are designed to store your digital assets like cryptocurrencies and NFTs. But there are some differences between the two.

Assets Safety

One of the main differences between cold wallets and hot wallets is safety. Hot wallets provide you with a seed phrase visible on your computer screen or smartphone when you open a new wallet. Cold wallets, on the other hand, provide you with a seed phrase directly on the screen of the hardware wallet, which isn’t connected to the internet.

This means that unless someone looks directly at your hardware wallet’s screen when you read and write the 12 to 24 words, there is no way that they can know your seed phrase to steal your funds.

Transaction Execution

Another difference between these two types of wallets is how transactions are executed. You can sign transactions with one click using hot wallets, which makes it an excellent choice for frequent trading or using decentralized apps.

Cold wallets, however, have buttons that you have to physically press to sign the transaction. What’s more, you need to unlock your crypto cold wallet device with a PIN, a passphrase or 2FA. This makes signing transactions more complex but also safer.

Use Cases

Due to being safer, the best cold wallets are designed for long-term safekeeping. This means that once you buy your crypto assets, you send them to your cold wallet and you leave them there until you decide to sell.

Hot wallets are designed to be exploited daily. Connect your hot wallets to decentralized exchanges, yield farming protocols or NFT marketplaces and feel free to continuously sign transactions. You can always move your profits into your cold wallets for safekeeping.

How to Choose a Cold Cryptocurrency Wallet

Choosing the best cold wallet is a decision that requires weighing in several factors, including security features, supported cryptocurrencies, mobile app experience as well as pricing.

Security Features

This is the main reason to get a cold wallet. But there are nuances that you have to consider as not all cold wallets are created equal. For example, some users prefer Bluetooth connectivity so they can easily sign transactions on their smartphones without using cables.

Other users may consider Bluetooth as a liability and prefer to have air-gapped devices, meaning they have no wireless contact of any kind that could compromise security.

Also, look for wallets that have a proven track record of security, like Ledger and Trezor, which employ strong encryption methods. Additionally, consider the wallet’s recovery options. In case the wallet is lost or damaged you will have to use your seed phrase to access your wallet.

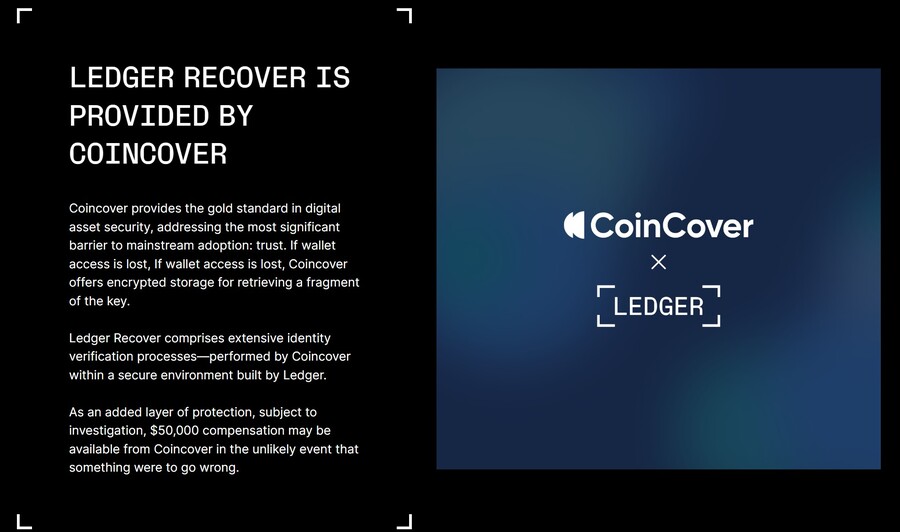

But sometimes you could lose your seed phrase as well. Every Trezor cold wallet has a solution for this via something called Shamir Backup where you split your seed phrase into several pieces. If one piece is lost or stolen, you can still recover your wallet. Ledger has recently employed a similar wallet recovery feature called Ledger Recover. This is a paid feature where you have to submit valid ID documents and a selfie recording. Once approved, your device will encrypt your seed phrase and split it into three fragments, which will be used to recover your seed phrase. Because your seed phrase is locked to your ID, you can be the only one who can request the recovery fragments.

Ledger has recently employed a similar wallet recovery feature called Ledger Recover. This is a paid feature where you have to submit valid ID documents and a selfie recording. Once approved, your device will encrypt your seed phrase and split it into three fragments, which will be used to recover your seed phrase. Because your seed phrase is locked to your ID, you can be the only one who can request the recovery fragments.

What is Shamir Backup?

Shamir Backup is a security standard that aims to protect your seed phrase. The way it works is your seed phrase is split up into pieces, called recovery shares, and you can store them at various places. If one of the pieces is lost or damaged, you can still recover your assets.

Recovery shares are sequences of 20 or 33 words that carry part of the cryptographic secret. When you combine the number of shares you create a master seed, which you can use to recover your wallet.

Supported Coins

Most crypto cold wallets support the most popular coins like Bitcoin, Ethereum and Solana, but they also support thousands of other coins and tokens. However, some wallets, like Blockstream Jade, support only Bitcoin and no other coin.

That is why you have to consider what you really need before buying a cold wallet. If you only want to hold Bitcoin and sell it in 10 years, then Blockstream Jade could be a perfect wallet; it’s cheaper, it’s reliable and it’s safe. But if you want to store multiple coins and do multi-chain swaps, then Trezor or Ledger wallets are typically the way to go.

Companion Mobile App

Even though cold wallets are designed to be offline storage devices, most of them come with companion mobile apps that allow you to monitor your portfolio, to initiate transactions, to stake your idle coins, to use decentralized apps like Uniswap and 1inch exchange, and more.

That is why it’s important to consider cold storage wallets that meet your requirements. Ledger’s Ledger Live app is one of the best companion apps, where you can stake your idle coins. This feature isn’t available in most other cold wallet apps.

Another valuable app is the Trezor Suite, which has similar functionalities to Ledger Live, but it can also help obscure your transactions with Coinjoin.

Device Cost

Recently, it was revealed that Mark Cuban lost nearly $900,000 to crypto hackers by installing a fake MetaMask app. If this happened to him it could happen to everyone. That’s why it’s important to own a cold wallet and never share your seed phrase regardless of the device’s cost.

However, if two or more devices share a similar price point while offering the same functionality, you could spend the extra money investing in crypto. Compare the wallets you are willing to get and see whether paying a premium is worth it.

Limitations of Cold Wallets

While cold wallets offer security advantages, there are some limitations to consider. Before opting for a cold wallet, weigh the benefits against the potential inconveniences associated with cold storage.

Susceptible to physical attacks. Someone could steal your hardware wallet or it could be damaged or lost. If you don’t have your seed phrase ready, you won’t be able to recover your assets.

Regular transactions. Cold wallets are designed for storage, which makes them inconvenient for everyday transaction signing. That’s because you have to physically press a button every time you wish to make a transaction. If you’re making hundreds of transactions each day, it could be tedious to approve them every time on your hardware wallet.

Cost. While hot wallets are free to use, cold wallets come with a purchase price. Of course, this is a small price to pay for the safety of your crypto assets. But you still have to weigh in whether you really need a cold wallet or not for your intended use cases.

Conclusion

The 10 best cold wallets for 2024 stand out not only for their robust security features but also for their user-friendly companion apps, a wide range of coin support and innovative functionalities. Whether you’re a beginner in the crypto space or a seasoned investor, buying a cold wallet is probably one of the most prudent investments you can make.

Consider the ELLIPAL Titan Cold Wallet to hold your crypto assets. It comes air-gapped transaction signing and it uses anti-tamper technology that deletes your private information if it detects tampering.