Crypto Volatility Index

VIX

If you have ever traded stocks, you likely experienced how risky the market can be. To express the risk level of the stock market, several risk measures were developed of which the most common is volatility. In the late 1980s, two researchers, Menachem Brenner, and Dan Galai, introduced ideas for gauging the volatility of the stock market. Based on this theoretical work, in 1992 Bob Whaley developed volatility index or VIX to quantify the volatility of the market.

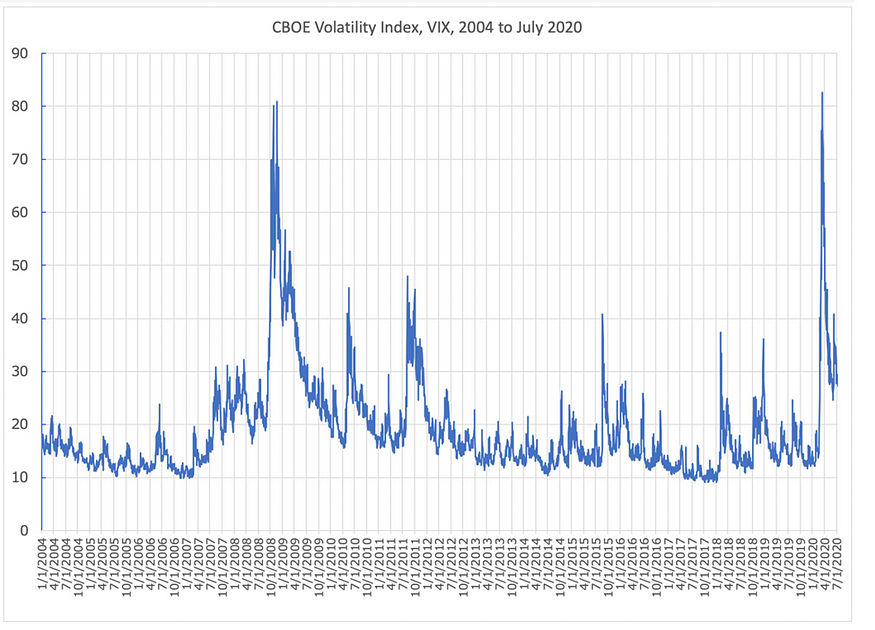

Referred to as “fear index”, VIX reflects the stock market’s expectation of volatility based on S&P 500 index options. We can put it this way: The higher VIX index number is, the more uncertain market participants are about the stock market. Below is the VIX chart which clearly shows that during crises, such as 2008 financial crisis or 2020 Coronavirus Pandemic, VIX increases dramatically. Now, if you wonder whether there is an index gauging the volatility of the crypto assets, the answer is yes. CVI is for the crypto market what VIX is to the stock market. Created by COTI team, CVI Index measures the expected volatility of the crypto market based on the cryptocurrency option prices. Like VIX, CVI is calculated based on 30-day prices of options traded on exchanges.

Now, if you wonder whether there is an index gauging the volatility of the crypto assets, the answer is yes. CVI is for the crypto market what VIX is to the stock market. Created by COTI team, CVI Index measures the expected volatility of the crypto market based on the cryptocurrency option prices. Like VIX, CVI is calculated based on 30-day prices of options traded on exchanges.

How is CVI index calculated?

Unlike VIX which is calculated based on the S&P 500 index options traded on The Chicago Board Options Exchange, CVI is a decentralized index which means it doesn’t depend on one central exchange but gets the data from multiple sources. To achieve this, the CVI platform uses Chainlink, the decentralized oracle network, which through the external adapters retrieves options data from multiple independent oracles which are cryptocurrency exchanges in this case. Once data is received from each node, it’s combined to produce an index value.

From the exchange-traded options data two indices, CVI-BTC and CVI-ETH are computed which then are combined into the final CVI value according to the market capitalization of Ethereum and Bitcoin at the time of calculation. Finally, adaptive EMA smoothing is applied to this value to produce final CVI index value.

Though CVI doesn’t have an upper limit, most values of the index fall into 0–200 range.

Trading

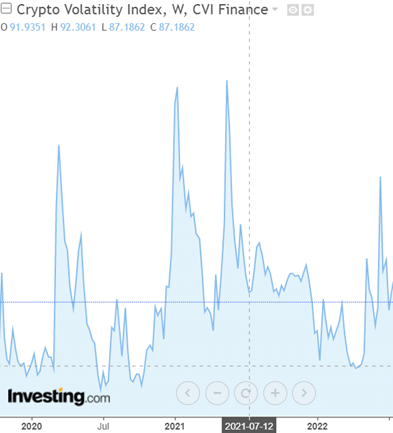

CVI index can be traded for hedging purposes especially if one expects big moves in the market. During such events the crypto market can be highly volatile. The sharp spikes on the chart below support the notion that sometimes crypto traders may experience wild swings which is what happened in the beginning of Coronavirus crash. The highest value of CVI was 158.4 on 17 May 2021 when Tesla CEO Elon Musk tweeted that the carmaker company may stop taking Bitcoin as payment due to environmental concerns. As a result, Bitcoin lost 27% of its value in that week which drove the whole crypto market down. Another idea might be shorting the index after a big spike. As you can see, volatility tends to drop after a significant increase. One can exploit this mean-reverting tendency of volatility by shorting it after a sharp surge.

Another idea might be shorting the index after a big spike. As you can see, volatility tends to drop after a significant increase. One can exploit this mean-reverting tendency of volatility by shorting it after a sharp surge.