How to start investing in cryptocurrencies: A safe step-by-step guide

Investing in cryptocurrencies can be an exciting and potentially lucrative venture. However, before investing your money, it's important to understand what cryptocurrencies are, how they work, and the basic principles associated with them. This step-by-step guide will help you start investing in cryptocurrencies safely and knowledgeably.

Education: Basics of Investing in Cryptocurrencies

Before starting to invest in cryptocurrencies, it's recommended to familiarize yourself with the basic concepts and terminology associated with them. Here are a few key terms worth knowing:

- Blockchain: This is the technology on which cryptocurrencies are based. It's a distributed ledger of transactions that is secure and immutable .

- Cryptocurrency Wallet: This is where you store your cryptocurrencies. It can be in the form of a computer or smartphone application, hardware wallet, or even a paper wallet .

- Mining: This is the process of creating new units of cryptocurrencies by solving complex computational problems .

- Tokens: These are digital assets that represent value or access to specific services or products. They can be associated with specific projects or serve as universal means of exchange .

Understanding these basic concepts is crucial to grasp how cryptocurrencies operate and make informed investment decisions.

Research: Choosing the Right Cryptocurrencies to Invest In

Before making specific investments, it's important to conduct thorough research. Learn which projects have solid fundamentals, their history, and who their founders are. Analyze current news and trends related to the cryptocurrency market.

A good way to research cryptocurrency projects is by reading whitepapers, which contain detailed information about the goals, technology, and development plans of the project. Also, check expert opinions and community feedback related to the project .

It's important to make investment choices based on reliable information and analysis, rather than speculation or emotions.

Goal Setting: Long-Term or Short-Term Investing?

Before investing in cryptocurrencies, consider your goals. Are you investing to achieve quick speculative gains, or are you interested in the technology and long-term investing?

If you're interested in the technology, consider projects with innovative solutions and potential for long-term growth. If you're looking for quick profits, it may be worth considering more speculative projects.

It's important to have clearly defined investment goals to make appropriate investment decisions and avoid succumbing to emotions.

Choosing a Trading Platform: Secure Place to Invest

To invest in cryptocurrencies, you'll need access to a trading platform. Choose a reputable and secure cryptocurrency exchange. Before registering, check fees, supported cryptocurrencies, and user reviews.

Choosing the right trading platform is crucial for the security of your investments. Make sure that the platform you intend to trade on has adequate security measures, such as two-factor authentication and protection against hacks.

Also, remember to check if the platform supports the cryptocurrencies you require. Some platforms only support the most popular cryptocurrencies like Bitcoin and Ethereum, while others offer a wider selection of projects.

Purchasing Cryptocurrencies: Choosing the Right Projects

After registering on your chosen exchange, you'll be able to fund your account and start purchasing cryptocurrencies. You can choose to buy popular cryptocurrencies like Bitcoin or Ethereum, or explore lesser-known projects with growth potential.

It's important to make purchases according to your investment goals and project analysis. Avoid suspicious projects promising quick profits. Remember that the cryptocurrency market is highly volatile, so making informed investment decisions is crucial.

Security: Secure Your Cryptocurrencies

Security is crucial when investing in cryptocurrencies. After purchasing cryptocurrencies, create a secure cryptocurrency wallet to store your coins outside the exchange. There are several types of wallets to choose from:

- Hardware Wallet: This is a physical device that stores your cryptocurrencies offline. It's the safest option since private keys are stored offline.

- Mobile Wallet: This is a smartphone application that allows you to store cryptocurrencies. Choose a wallet that offers strong security features like password and two-factor authentication.

- Paper Wallet: This is a physical record of your private keys that can be stored in a secure place. It's a good option for those who want to store their cryptocurrencies offline but requires extra caution regarding security.

Regardless of the chosen storage method, it's important not to share your private keys and passwords with third parties. Also, remember to regularly back up your wallet to avoid losing access to your cryptocurrencies.

Diversification: Minimize Investment Risks

Diversification is a key element of effective investing. Don't invest all your funds in one cryptocurrency. Diversification helps minimize risk if the value of one cryptocurrency significantly decreases.

Consider investing in different projects with growth potential. You can consider purchasing cryptocurrencies from different sectors such as finance, technology, or entertainment.

However, remember that diversification is not a guarantee of profit, and it's important to regularly monitor your investments.

Continuous Analysis: Monitor Your Investments

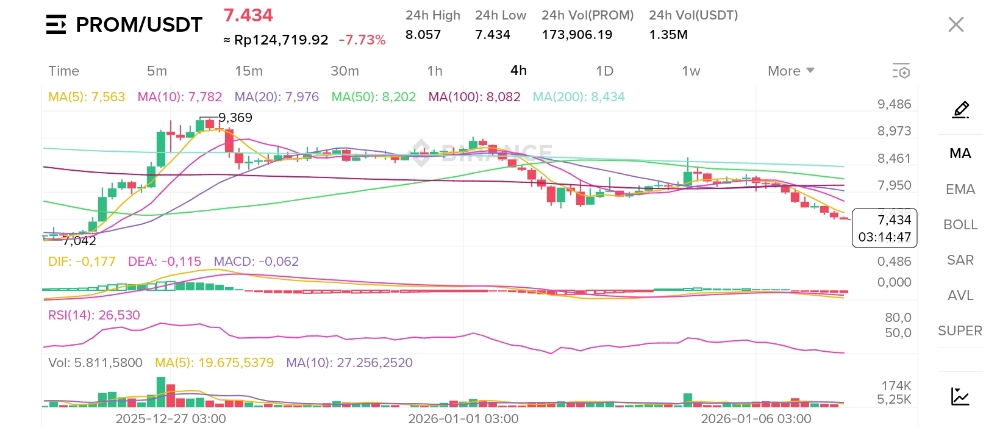

Monitoring your cryptocurrency investments is important, but avoid the trap of frequent trading based on short-term price fluctuations. Remember that the cryptocurrency market is highly volatile, and frequent transactions can lead to losses.

Instead, regularly analyze your investments and assess their growth potential. You can follow project-related news, analyze their fundamentals, and react to major market changes.

However, remember that investing in cryptocurrencies carries risk, so making informed investment decisions is important.

Risk Preparedness: Investment Risk

Investing in cryptocurrencies involves a certain level of risk. Remember that the value of cryptocurrencies can fluctuate, and there is a possibility of losing invested funds. Be prepared for the possibility of losses and don't invest more than you can afford to lose.

It's important to invest only the funds you can afford to lose. We don't recommend investing money needed for daily life or that could affect your financial stability.

Remember that investing in cryptocurrencies is a long-term process, and profits may only be realized after some time. Be patient and make investment decisions based on reliable information and analysis.

Summary

Investing in cryptocurrencies can be an exciting and profitable venture, but it requires proper knowledge and informed decisions. Before investing, understand what cryptocurrencies are, conduct research, and define your investment goals. Choose a secure trading platform, purchase appropriate cryptocurrencies, and secure your investments. Also, remember to diversify, regularly analyze, and be prepared for potential losses. Investing in cryptocurrencies carries risks, so making informed investment decisions is crucial.