Is $PROM Ready for a Massive Rebound? A Deep Dive into the Modular ZkEVM Layer 2

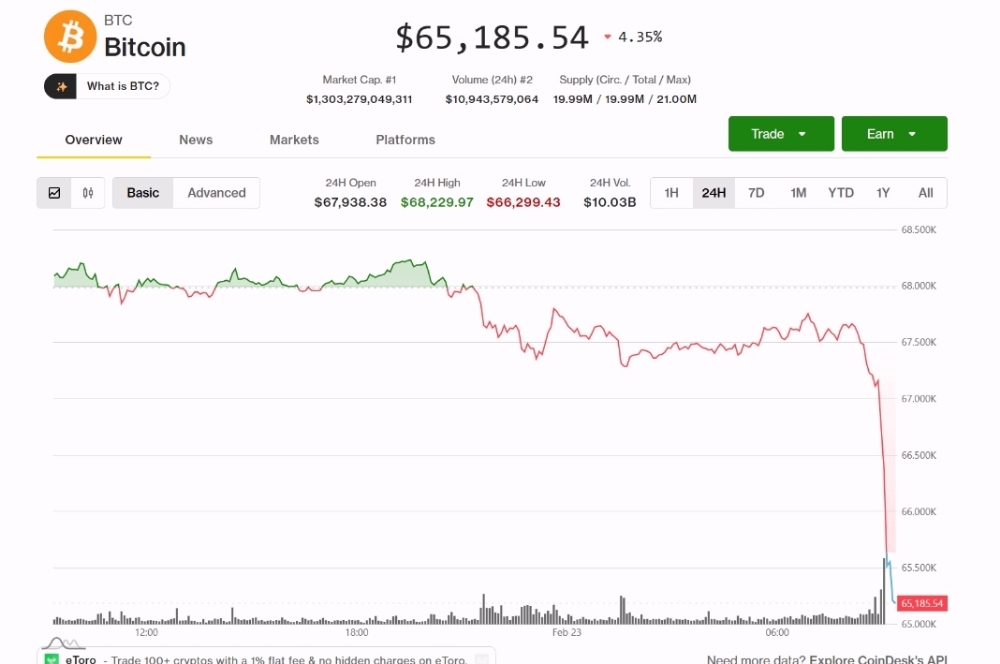

As we navigate the opening weeks of 2026, the crypto market is showing a mix of volatility and opportunity. One asset that has caught the eye of institutional and retail investors alike is Prom (PROM). After a significant correction from its recent highs, the token is now sitting at a critical technical juncture.

Is this a "buy the dip" moment, or is there more downside to come? Let’s break it down.

📉 Technical Analysis: Hunting for the Bottom

Looking at the latest 1D (Daily) and 4H (4-Hour) charts from Binance, the technical setup is screaming "Oversold."

Extreme RSI Levels: On the 4-hour timeframe, the Relative Strength Index (RSI) has dipped to 27.65. Historically, any reading below 30 indicates that the selling pressure is exhausted, often leading to a "Dead Cat Bounce" or a full trend reversal.

The "Line in the Sand": The most critical support level sits at $6.81. This level has acted as a historical floor. As long as PROM holds above this price, the long-term bullish structure remains intact.

Moving Average Resistance: Price is currently trading below the 200-day MA. A confirmed breakout above $7.91 would be the first major signal that the short-term bearish trend has shifted to a recovery phase.

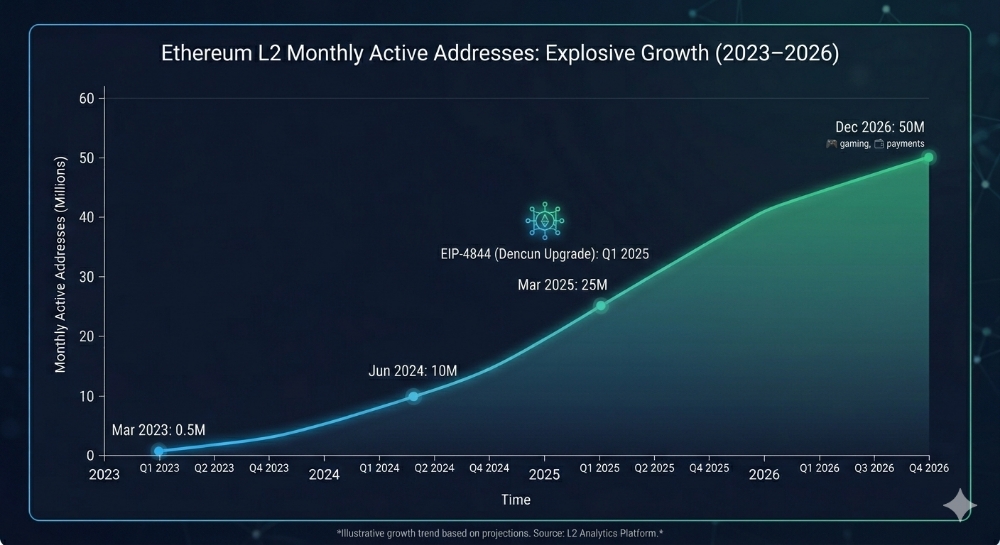

🛠️ Fundamental Strength: Why PROM is Unique

Unlike many Layer 2 solutions that dilute their value with billions of tokens, PROM stands out with its scarcity model.

Fixed Supply: With only 19.25 million tokens in total supply, PROM’s price action is highly reactive to increases in network demand—similar to the supply dynamics of Bitcoin.

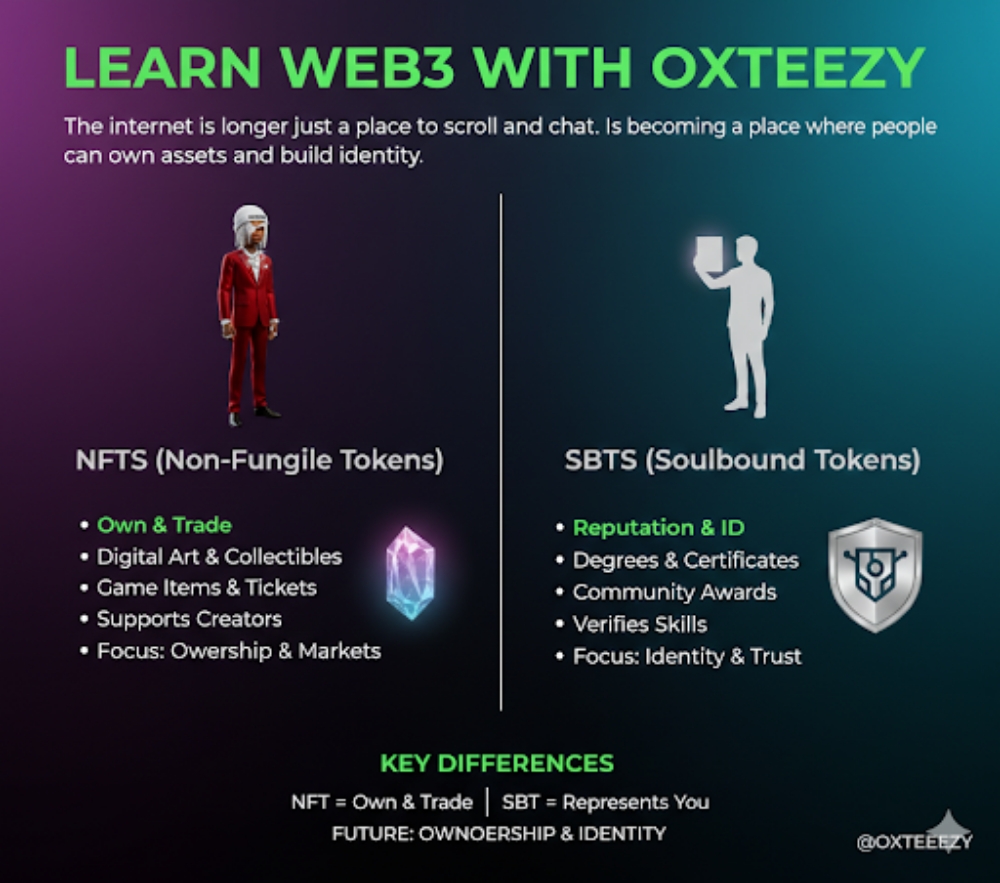

Modular ZkEVM Advantage: Prom’s evolution into a modular ZkEVM allows for seamless interoperability across multiple chains (Solana, Cosmos, and EVM chains). This "Bridge-to-Everything" roadmap for 2026 is a massive fundamental catalyst.

DAO Governance: The upcoming validator program in Q1 2026 is expected to lock up more circulating supply, potentially creating a "supply shock" that drives prices higher.

💡 Long-Term Investment Strategy

For investors looking at a 2026-2030 horizon, the current price offers an interesting Risk-to-Reward ratio.

Accumulation Zone: Consider Dollar Cost Averaging (DCA) in the $7.00 - $7.45 range.

Target Milestones: * Short-term: $8.60 (Testing the MA resistance).

Mid-to-Long term: $12.50 - $15.00 (Returning to previous cycle highs).

Risk Management: A daily close below $6.80 would invalidate this bullish thesis, suggesting a move toward the next major support at $5.75.

📊 Visual Data Summary

(Insert the Visual Analysis Label here)

Final Verdict:

PROM is currently in a "Value Zone." While the immediate trend is bearish, the combination of extreme oversold indicators and a robust L2 roadmap makes it a top candidate for a recovery play this quarter.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Always perform your own research (DYOR) before investing in digital assets.

#PROM #Layer2 #ZkEVM #CryptoAnalysis #Altcoins2026 #Binance #BulbApp