eToro Rolls Out 24/5 Trading & ERC‑20 Tokenized US Stocks — 100 Tickers on Ethereum

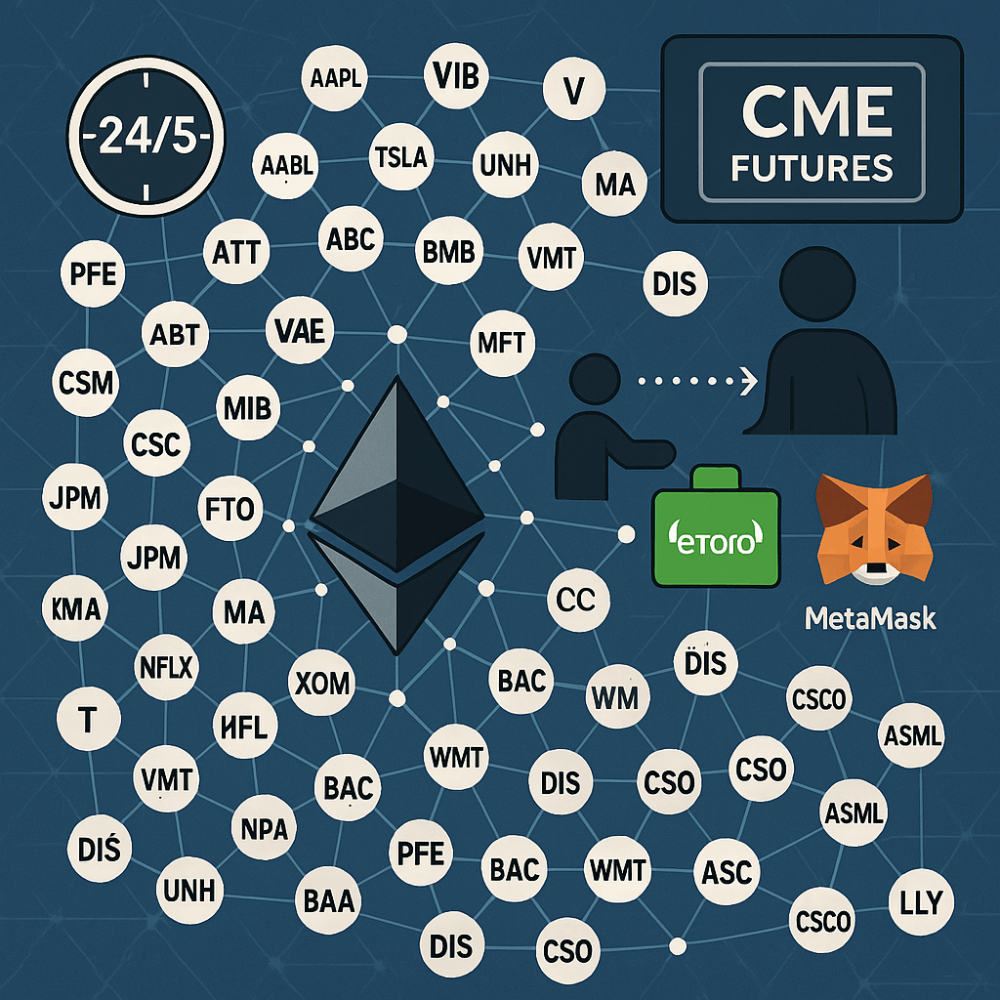

In a major evolution toward a tokenized finance future, eToro announced via its global "eToro Unlocked: Trade Without Boundaries" webinar that it’s launching **24/5 trading and tokenized stocks** across its platform. The rollout will support around **100 of the most popular U.S.-listed stocks and ETFs**, enabling trading five days a week, 24 hours a day, through conventional and tokenized formats.

For the first time, eToro will issue these equities as **ERC‑20 tokens on the Ethereum blockchain**, fully convertible to and from the underlying traditional stock holdings in user accounts. Tokenization enables users to move assets on-chain, self-custody them in wallets like MetaMask, and potentially integrate them into DeFi protocols.

This step extends eToro's existing tokenized asset offerings, which began in 2019 with tokenized gold (GOLDX) and silver (SLVX). Co-founder Yoni Assia emphasized that regulatory milestones—such as MiCA in Europe and the GENIUS Act in the U.S.—now provide legal grounding for this expansion. He described tokenization as a tool to democratize access to finance by removing geographical and operational boundaries.

Additionally, eToro is rolling out **spot-quoted futures** in collaboration with CME Group, offering users flexible access to futures markets using familiar spot pricing in accessible contract sizes. These enhancements allow eToro’s global user base to respond to market events around the clock from one seamless interface.

In short, eToro’s strategy bridges traditional equity markets and blockchain-based finance—ushering in a new era where real-world assets can co-exist and be traded across both worlds.