How to set up an SPV in Delaware

Delaware is widely seen as the gold standard for SPV formation. But how do you actually set one up?

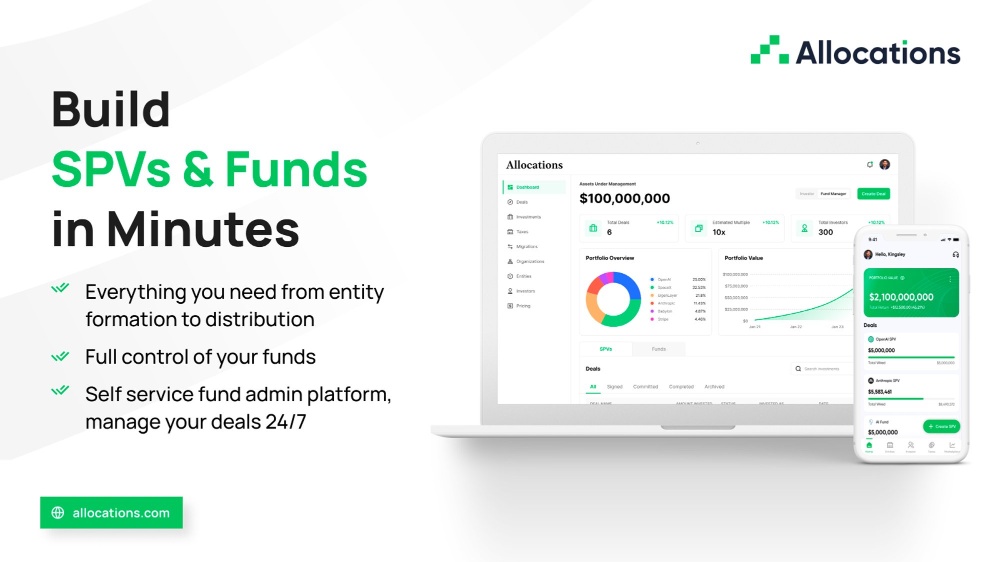

The process begins with forming a Delaware LLC SPV structure, which requires filing with the state. Once the entity is created, you must handle SPV compliance—including Form D filing explained for the SEC and Blue Sky law compliance by state. These steps can be time-consuming, which is why many investors rely on allocations.com to automate them.

Another step is managing economics. An SPV fund has specific fees, carry, and returns expectations. Clear documentation and transparent reporting help attract LPs. With allocations.com, you gain automated reporting and tax-ready K-1s, saving time and avoiding errors.

The cost of forming an SPV in Delaware can vary, but expedited filing is possible. Using a trusted platform reduces the hidden costs and ensures smooth fund administration. That’s why investors prefer to start an SPV with allocations.com.

Unlike a traditional fund or even a syndicate, an SPV focuses on one deal, making it easier for angels and LPs to participate. Choosing the best SPV platform is key, and allocations.com offers a complete solution—from setup to ongoing management.

If you’re looking to pool capital, manage side letters, or explore tokenized SPVs, Delaware remains the jurisdiction of choice—and Allocations is the partner that makes it possible.