Single vs. Double – When to Leverage Dual Tokenomics

Understanding Tokenomics

Tokenomics development refers to the design and implementation of a cryptocurrency or blockchain project's token system. It defines the creation, distribution, utility, and value of tokens within a platform's specific ecosystem. In simpler terms, it's like the economics behind the tokens that make a blockchain project function.

Key Components of Tokenomics

While the terms might sound complex, the core concepts are quite straightforward. Here's a breakdown of the key components that make up a robust tokenomics model:

- Token Supply

- Token Distribution and Allocation

- Vesting Schedules and Lock-up Periods

- Token Utility

- Token Demand Mechanisms

Why Your Business Should Care About Tokenomics

A well-designed tokenomics model can transform your business by creating a new economic system, fostering user trust with transparency, and driving engagement through valuable and useful tokens. This not only attracts early adopters through funding opportunities but also fosters a thriving ecosystem where value is efficiently exchanged and captured.

Why Dual Tokenomics is Needed

While a well-designed single token model can be effective for many blockchain solutions, there are situations where a dual tokenomics development approach can offer distinct advantages. Here's why exploring a dual tokenomics development might be the right call for your project:

- Addressing the Limitations of Single Token Systems: A single token can struggle to balance the often-conflicting needs of governance and utility. Dual tokenomics development solves this by separating governance and utility functions, fostering a more stable and predictable environment.

- Enhancing Economic Incentives and Network Effects: A dual tokenomics can create a more robust incentive structure within your platform. This two-pronged approach can really help your network to grow and thrive. It'll attract and retain users who will contribute to the overall value and sustainability of your network.

- Improving Scalability and Sustainability: As your platform grows, a single token can become a bottleneck for transactions. Dual tokenomics development allows the creation of a more scalable solution.

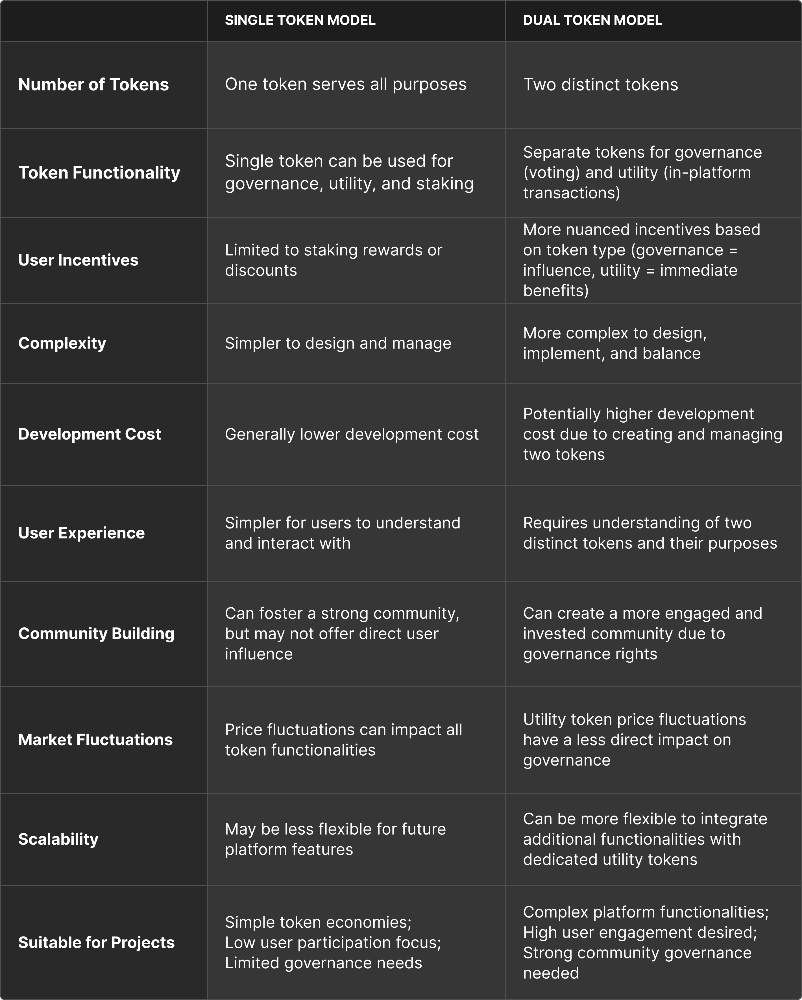

Single Token vs. Dual Token Models

Choosing between a single token or a dual token system for your blockchain project development is a critical decision. Here's a table outlining the key differences to help you make an informed choice.

Single Token vs. Dual Token Models

Here are some additional factors to consider when deciding if a dual tokenomics development is right for you:

- Project Complexity: For complex blockchain project development with intricate governance structures and diverse user needs, a dual tokenomics can provide a clearer and more manageable framework.

- Target Audience: If your blockchain platform caters to a broad audience, a dual tokenomics development can help simplify user experience by offering a dedicated utility token for everyday transactions.

- Long-Term Vision: If your project has a long-term vision with potential for significant growth and feature expansion, a dual token system can offer greater flexibility to accommodate future needs.

Ultimately, the decision to implement a single or dual token system depends on the specific goals and functionalities of your blockchain solution development. Consulting with experienced tokenomics development experts can help you assess your options and design a system that optimizes the success of your project.

Types of Projects That Thrive with Dual Tokenomics Development

Here, we explore some prominent project types that can leverage the power of dual tokenomics:

Decentralized Governance (DAOs): DAOs thrive on dual tokens. Governance tokens empower holders to vote on key decisions, while utility tokens fuel the DAO ecosystem for fees, features, and rewards. This separation streamlines decision-making for a healthy DAO.

Decentralized Finance (DeFi): Dual tokens empower DeFi. Governance tokens give users a voice in shaping the platform (parameters, fees, new products), while utility tokens fuel DeFi activities (lending, borrowing, staking). This fosters participation and innovation.

Blockchain Gaming Platforms: Players have a say (voting on features, assets, rules) with governance tokens, while utility tokens fuel in-game actions (purchases, upgrades, play-to-earn). This fosters community ownership and active engagement, driving the game's success.

The Metaverse and Virtual Worlds: Dual tokens architect the Metaverse. Governance tokens empower users to vote on rules (land rights, asset creation) and shape the virtual world, while utility tokens fuel the Metaverse economy (land purchases, experiences) fostering a sense of ownership and driving user contribution.

Social Media Platforms: Governance tokens give users a voice in platform rules (policies, moderation, revenue), while utility tokens fuel user actions (tipping, rewards, access). This fosters user control and a fairer social media experience.

These are just a few examples of how dual tokenomics development can empower various blockchain projects. By carefully considering the project's goals, target audience, and governance needs, businesses can leverage the distinct advantages of dual tokens to create a dynamic and sustainable ecosystem that fosters user engagement and drives long-term success.

What Tools and Resources Are Available to Help with Dual Tokenomics Development?

Embarking on a dual tokenomics journey requires the right tools and resources at your disposal. Here's a breakdown of some key options to consider:

Blockchain Development Platforms: Consider existing blockchain platforms for token development if your team has strong blockchain expertise. Building a dual token system from scratch requires in-depth knowledge of smart contract development and best practices in tokenomics, making it complex.

Online Communities: Leverage online blockchain communities for general knowledge on dual tokenomics (trends, insights). However, navigate with caution due to time commitment and varying information quality. They may not be ideal for in-depth, sustainable tokenomics development guidance.

Tokenomics Development Companies: Here's where expertise meets experience. Partnering with a reputable tokenomics development company is often the most effective way to implement a successful dual token system. These companies house a team of specialists who understand the intricacies of tokenomics design, development, and implementation.

Case Studies: Projects with Dual Tokenomics Model

In this section, we'll look at some real-world examples of how dual tokenomics development is being used in different types of projects.

Play-to-Earn Gaming (Axie Infinity – AXS & SLP)

This popular play-to-earn game uses a well-designed dual tokenomics. AXS, the governance token (ERC-20), allows players to influence the game's development through voting on proposals. Smooth Love Potion (SLP), the utility token (ERC-20), is earned by playing the game and used for breeding in-game creatures (Axies) or participating in the marketplace. This dual approach incentivizes long-term engagement (through AXS) and fuels the in-game economy (through SLP).

Metaverse Platform (The Sandbox – SAND & LAND)

This virtual world platform leverages SAND, the governance token (ERC-20), for voting on platform upgrades and content creation tools. LAND, a non-fungible token (NFT), represents virtual land parcels within The Sandbox. LAND owners can customize their plots, create interactive experiences, and even monetize them. This dual system fosters a thriving user-driven virtual world where players have a stake in the platform's future (through SAND) and the power to create unique experiences (through LAND).

Decentralized Exchange (Uniswap – UNI & WETH)

A Decentralized Exchange (DEX), Uniswap uses UNI, the governance token (ERC-20), for voting on key decisions like protocol fees and liquidity pool parameters. Wrapped Ether (WETH), a tokenized version of Ethereum (ERC-20), serves as the primary trading token within the Uniswap DEX. This separation of functions ensures a stable and efficient trading environment where users can influence the platform's direction (through UNI) while seamlessly conducting their trades (using WETH).

Decentralized Derivatives Exchange (dYdX – DYDX & USDC)

A decentralized derivatives exchange, dYdX uses DYDX, the governance token (ERC-20), for voting on protocol upgrades, trading fees, and risk parameters. USDC, a stablecoin pegged to the US dollar (ERC-20), is used as the primary collateral and settlement asset for margin trading on the platform. This dual system makes it easy for users to trade in a secure and transparent way. They can have a say in how the platform is run (through DYDX) while using a stable asset for their trades (USDC).

Why Choose Rock’n’Block for Your Dual Tokenomics Development

In the fast-paced world of blockchain technology, it can be tough to keep up with all the moving parts of dual tokenomics development. That's where Rock'n'Block comes in – your go-to partner for building a rock-solid and successful dual token system. Our blockchain experts design & implement robust dual token systems tailored to your project. We leverage cutting-edge advancements for maximum impact and craft compelling white papers!