Tokenized SPVs on Allocations — The Future of Private Market Investing

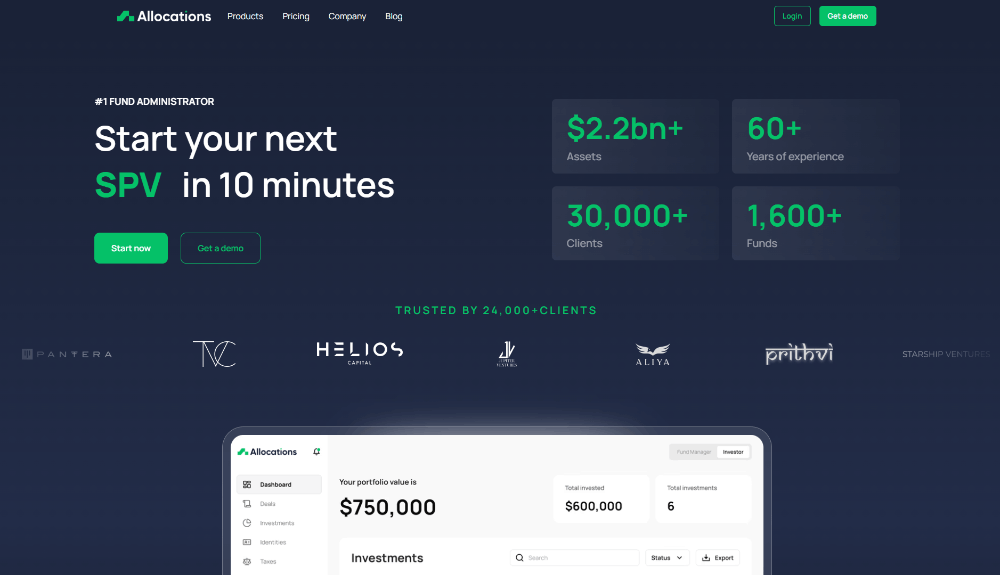

Tokenized SPVs are reshaping private market investing. Allocations, the best SPV platform, helps investors create Delaware SPVs that are compliant, efficient, and blockchain-ready.

What is a Tokenized SPV

A tokenized SPV (Special Purpose Vehicle) allows investors to hold fractional ownership through blockchain-based tokens. These structures simplify SPV fund administration, increase transparency, and enhance liquidity compared to traditional funds.

Learn how easy it is to start an SPV using Allocations’ Startup SPV platform, where investors can manage ownership, compliance, and capital flows from one dashboard.

Why Delaware SPVs Lead the Market

Most tokenized SPVs on Allocations use the Delaware LLC structure due to its strong legal foundation. Delaware offers a clear SPV setup checklist, straightforward filings, and cost-effective SPV carry and fees management.

Allocations provides a full Delaware SPV formation guide and optional expedited filing services for faster execution.

Compliance and Transparency

Allocations ensures Form D and Blue Sky law compliance for every SPV. The platform automates investor onboarding and filings, minimizing legal risk while maintaining data security.

Allocations’ integrated SPV fund administration system also supports K-1 tax reporting, capital tracking, and payout distribution.

Why Investors Prefer Allocations

Allocations combines simplicity, compliance, and tokenization. Whether you’re managing a real estate SPV, crypto SPV, or venture deal, the Allocations team provides end-to-end support and custom solutions.