Bitcoin Price Prediction: BTC Above $46,000 Amid ETF Green Light & Kiyosaki’s $150K Forecast

Bitcoin price has surged above $46,000 as the US Securities and Exchange Commission (SEC) approved 11 spot bitcoin exchange-traded funds (ETFs) on Wednesday. The approval came after a US congressional panel requested an SEC briefing on a fake tweet that claimed the regulator had authorized a bitcoin futures ETF. The tweet, which was later deleted, caused a brief spike in bitcoin’s price on Tuesday. The approval of spot bitcoin ETFs, which track the actual price of the digital asset, is seen as a major boost for the crypto industry, as it could attract more institutional and retail investors to the market.

Bitcoin price has surged above $46,000 as the US Securities and Exchange Commission (SEC) approved 11 spot bitcoin exchange-traded funds (ETFs) on Wednesday. The approval came after a US congressional panel requested an SEC briefing on a fake tweet that claimed the regulator had authorized a bitcoin futures ETF. The tweet, which was later deleted, caused a brief spike in bitcoin’s price on Tuesday. The approval of spot bitcoin ETFs, which track the actual price of the digital asset, is seen as a major boost for the crypto industry, as it could attract more institutional and retail investors to the market.

One of the beneficiaries of the SEC’s decision is Grayscale, the largest digital asset manager, which converted its flagship Grayscale Bitcoin Trust (GBTC) into a spot bitcoin ETF. According to Mom of Crypto, a popular crypto analyst, Grayscale and a favorable court ruling were the key factors that enabled the SEC to approve the bitcoin ETFs.

Meanwhile, Robert Kiyosaki, the author of Rich Dad Poor Dad, has expressed his bullish outlook on bitcoin, predicting that it will reach $150,000 soon. He also said that he will be buying more bitcoin, as he believes it is a better hedge against inflation than gold or silver.

Congress Asks SEC to Explain Fake Bitcoin ETF Tweet

On Wednesday, the GOP-controlled House Financial Services Committee wrote to the SEC, asking for an explanation on a hoax tweet from the SEC’s official X account the previous day. The fraudulent tweet on the SEC’s X social media account, which purported to approve Bitcoin ETFs, had an instant effect on the price of the cryptocurrency. The false information caused the price of Bitcoin to soar.

In response to what they saw as a good development, traders moved, hoping that the SEC would approve Bitcoin ETFs. But once the SEC corrected the false information and recanted the post, the mood of the market changed.

US congressional panel seeks briefing from SEC on fake post on bitcoin ETFs https://t.co/eQHzVPYnX1 pic.twitter.com/TK0q5HgeWV

— Reuters (@Reuters) January 11, 2024

Unrelated to the phony post, the SEC’s ultimate approval of the first Bitcoin ETFs to be listed in the United States had an impact on the price dynamics of the cryptocurrency. Overall, the episode shows how regulatory changes and false information may have a big instantaneous influence on bitcoin prices.

How Grayscale and Court Ruling Enabled Bitcoin ETFs: Crypto Mom

SEC Commissioner Hester Pierce, or “Crypto Mom,” disclosed that the Grayscale appeal from the previous year had an impact on the acceptance of spot Bitcoin exchange-traded funds (ETFs). Pierce noted that in order to obtain clearance for spot Bitcoin ETFs, issuers had been working for more than ten years.

United States SEC Commissioner Hester Peirce says the decision for spot Bitcoin ETFs could have been very different today if it weren’t for the Grayscale court case in October. https://t.co/28d4zvFhbl

— Cointelegraph (@Cointelegraph) January 11, 2024

In October 2023, the SEC reconsidered its position when the U.S. District Court of Appeals reversed the SEC’s decision to deny Grayscale Investment’s spot Bitcoin ETF application. Although the SEC recently approved 11 spot Bitcoin ETF applications, Pierce chastised the agency for a ten-year delay, saying it ought to have acknowledged its prior mistakes.

The approval of the ETF has a favorable effect on the price of Bitcoin since it improves institutional access and credibility, which may lead to a rise in demand for the cryptocurrency.

Bitcoin ETFs and Kiyosaki’s Bitcoin Price $150K Forecast

Author of Rich Dad Poor Dad Robert Kiyosaki believes that Bitcoin will soon hit $150,000 as a result of the U.S. SEC’s approval of spot Bitcoin ETFs. Kiyosaki, who is happy with his early Bitcoin investments, says he wants to buy more BTC and emphasizes that he prefers Bitcoin, gold, and silver to fiat money.

He believes that while silver may decline as investors sell to offset growing inflation, gold would skyrocket as a result of central banks’ ongoing purchases. Kiyosaki, who is well-known for calling fiat money “fake money,” has continuously supported alternative investments.

BITCOIN ETF. Yay. Glad I bought years ago. Bitcoin to $150k soon. Gold to the moon as Central Banks buy , store, and never sell. Silver to crash as silver stackers sell to pay bills, caused by rising inflation. Great news for silver stackers. Time to buy more as silver crashes.…

— Robert Kiyosaki (@theRealKiyosaki) January 10, 2024

His optimistic forecasts for Bitcoin range from $135,000 in the near future to $1 million in the event of a world economic disaster. This news supports the general market confidence that followed the SEC’s clearance and adds to the favorable sentiment around Bitcoin.

Bitcoin Price Prediction

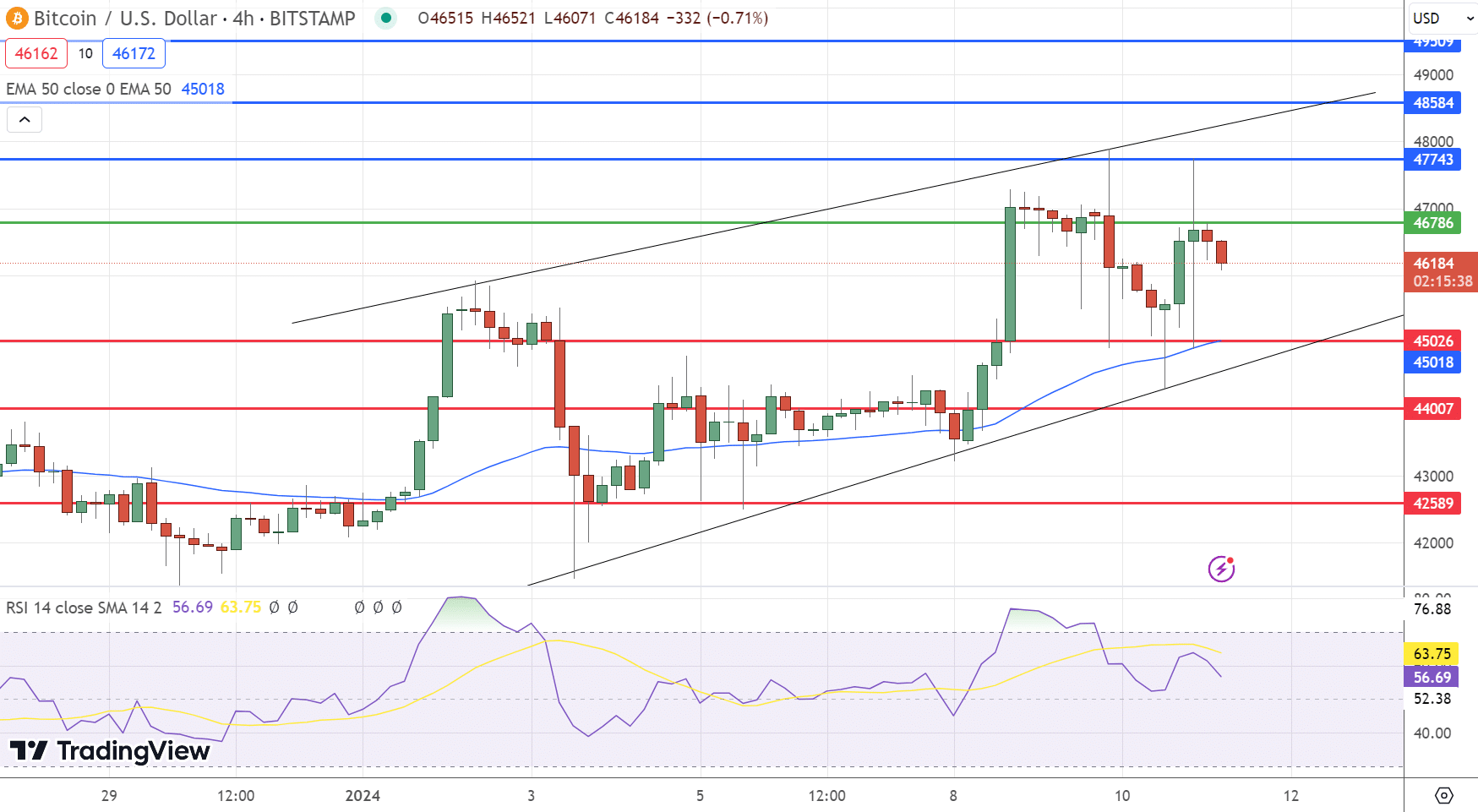

According to the 4-hour chart, bitcoin is trading within an upward channel, indicating a bullish trend. The pivot point, which acts as a support and resistance level, is at $46,786. The immediate resistance is at $47,743, followed by $48,584 and $49,509. The immediate support is at $45,026, followed by $44,007 and $42,589.

The relative strength index (RSI), which measures the momentum of price movements, is at 56, indicating a balanced market. The RSI is above 50, suggesting a slight bullish sentiment, but below 70, which would signal overbought conditions. The 50-day exponential moving average (EMA), which smooths out price fluctuations, is at $45,014, slightly below the current price. This indicates that bitcoin is in a short-term bullish trend, as it is trading above the 50 EMA. Bitcoin Price Chart

Bitcoin Price Chart

The chart also shows a double top pattern, which is a bearish reversal signal, at the $47,750 level. This means that bitcoin has failed to break above this level twice, and may face a downward pressure. However, the pattern is not confirmed until bitcoin breaks below the neckline, which is the support level connecting the two lows of the pattern, at around $44,500.

The overall trend for bitcoin is bullish, as it is trading above the pivot point and the 50 EMA, and within the upward channel. The short-term forecast is that bitcoin may test the resistance at $47,743 in the coming days, and possibly break above it if the market sentiment remains positive. However, if bitcoin falls below the support at $45,026, it may trigger a bearish reversal and head towards the neckline of the double top pattern at $44,500.