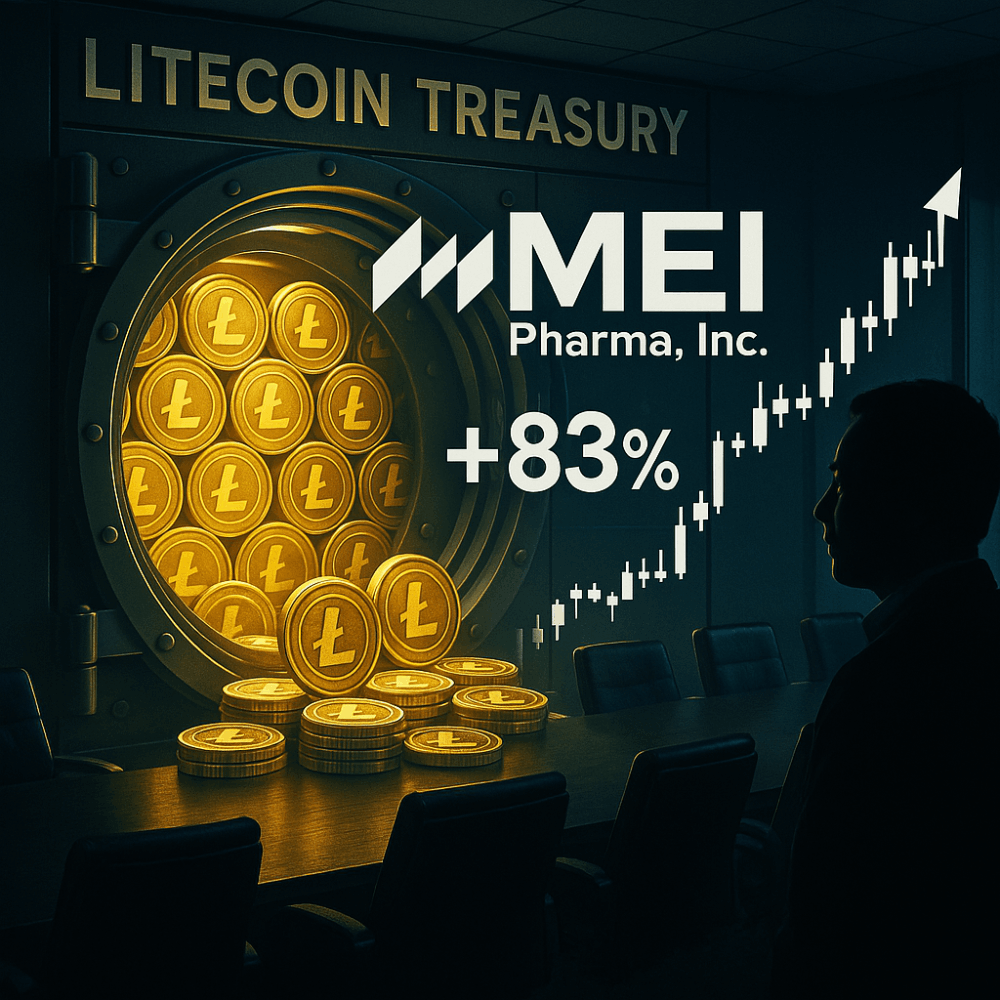

MEI Pharma Goes Full Crypto — Litecoin Treasury Boosts Stock 83%+ in Wall Street Debut

MEI Pharma (NASDAQ: MEIP), a U.S.-based biotech company, has shocked markets by unveiling a new “Litecoin Treasury” strategy—making LTC a core part of its treasury holdings. Following the announcement, MEIP’s shares soared over 83% in premarket trading, continuing from a 16.58% gain the day before and reaching intraday highs near $9 before settling around $6.30. The trading volume exceeded 13 million shares—dramatically above its three‑month average of just 26,000.

Backing the initiative, the company secured approximately $100 million in PIPE funding led by Titan Partners and GSR, with direct involvement from the Litecoin Foundation. Notably, Litecoin founder Charlie Lee has also accepted a position on MEI Pharma’s board, signaling deep institutional alignment with blockchain leadership.

This strategic move—dubbed the “LTC micro‑strategy”—marks a new era in how institutional entities approach digital assets. Instead of Bitcoin, MEI Pharma is placing its bet on Litecoin, betting on the asset’s liquidity and stable positioning within the crypto ecosystem. It positions LTC as a credible treasury reserve rather than speculative altcoin.

If other corporations follow suit, Litecoin could emerge as a significant institutional-grade crypto asset. MEI Pharma’s maneuver is proof that altcoins can serve real balance‑sheet functions—making LTC one to watch in the evolving narrative of digital asset adoption.