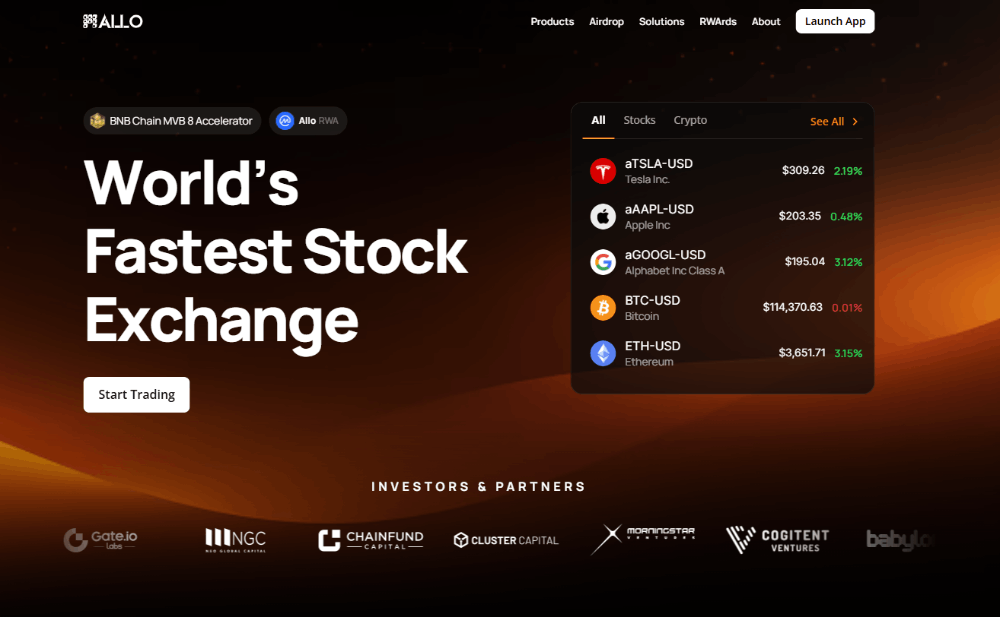

Allo and the Future of Tokenized Stock Exchanges

The rise of tokenized stock exchange 2025 projections highlights the disruptive power of blockchain in finance. Allo is at the forefront, bringing RWA tokenization for fund managers and RWA investment opportunities 2025 to reality.

Tokenization vs Securitization Explained

Tokenization digitizes real-world assets like equities, bonds, and real estate. Unlike securitization, it enables fractional ownership of tokenized shares, tokenized bonds and real estate, and even tokenization of private equity funds.

Why Choose Allo?

- Beginner-friendly: beginner’s guide to tokenized stocks and tokenized asset glossary

- Safe & transparent: addresses concerns like risks of tokenized stocks and is tokenized investing safe?

- Multi-asset: access tokenized funds on Allo and build diversified portfolios with Allo multi-asset portfolio management

By merging RWA token utility and governance with Allo staking opportunities, investors unlock new forms of yield and security.

Start your journey with Allo — the best RWA platform for investors and the bridge to next-gen investing.