The Rise of Crypto Financial Infrastructure for Corporates

The foundation of global finance is shifting as companies build robust crypto financial infrastructure to manage and grow their digital assets.

Digital Asset Treasury Companies (DATCOs) now provide tools for onchain treasury management, tokenized corporate treasuries, and institutional crypto exposure. These firms help enterprises turn Bitcoin and Ethereum corporate holdings into yield-generating reserves.

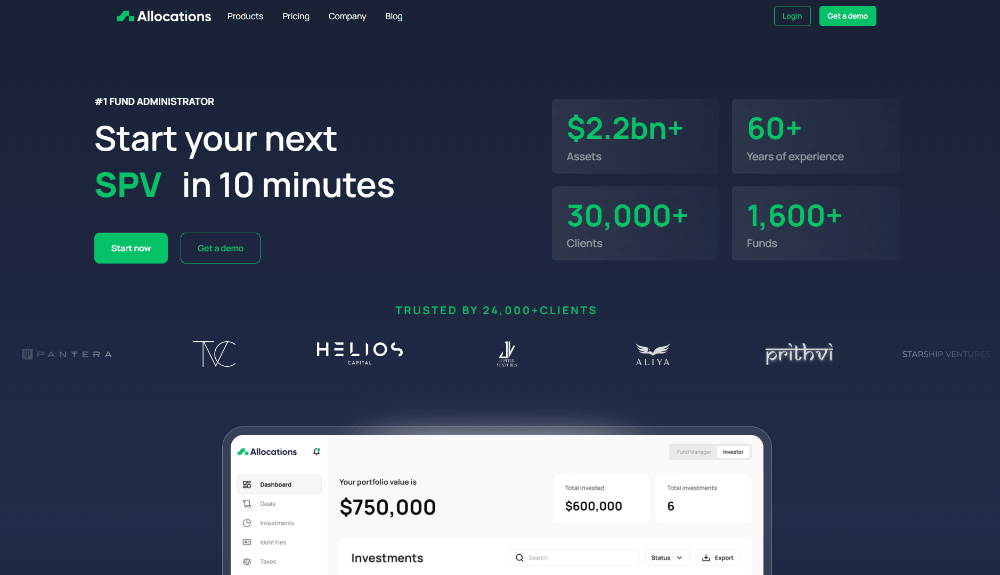

Platforms like Allocations Crypto SPV enable efficient setup for Corporate Crypto Treasuries, while maintaining compliance with regulatory standards.

For corporates exploring digital diversification, Allocations also supports Delaware SPV formation, transparent pricing, and customized fund structures. You can explore options through Allocations Custom SPV and review cost details at Allocations Fees.

As blockchain corporate finance evolves, treasury management tools are becoming critical infrastructure — bridging traditional balance sheets with tokenized assets. Learn how your company can start with Allocations Startup SPV and connect directly with the Allocations Team.

For personalized guidance, reach out to the Allocations Team or check the transparent pricing guide at Allocations Fees.