Crypto Newbies: Things to Consider when Using Crypto

Navigating the world of crypto can be daunting for newcomers.

Please note that experimenting with cryptocurrency can be risky, with prices fluctuating and plenty of scams in the field. No advice in this article should be taken as financial advice and any readers should do their own research before parting with funds or making any investment into crypto. We also recommend that should you wish to play, you maintain your funds in a hardware wallet. Not your Keys, not your Crypto, use exchanges at your peril.

If you’ve followed for a while you’re probably aware that we tend to like our crypto. Given the spike in popularity during covid it’s fair to say that plenty of others like their crypto too. But if you’re new to the world of cryptocurrencies figuring out what’s safe, how to store and where to get your crypto from can be an overwhelming experience. There’s foreign jargon, and plenty of bright lights encouraging you to “transact here!”.

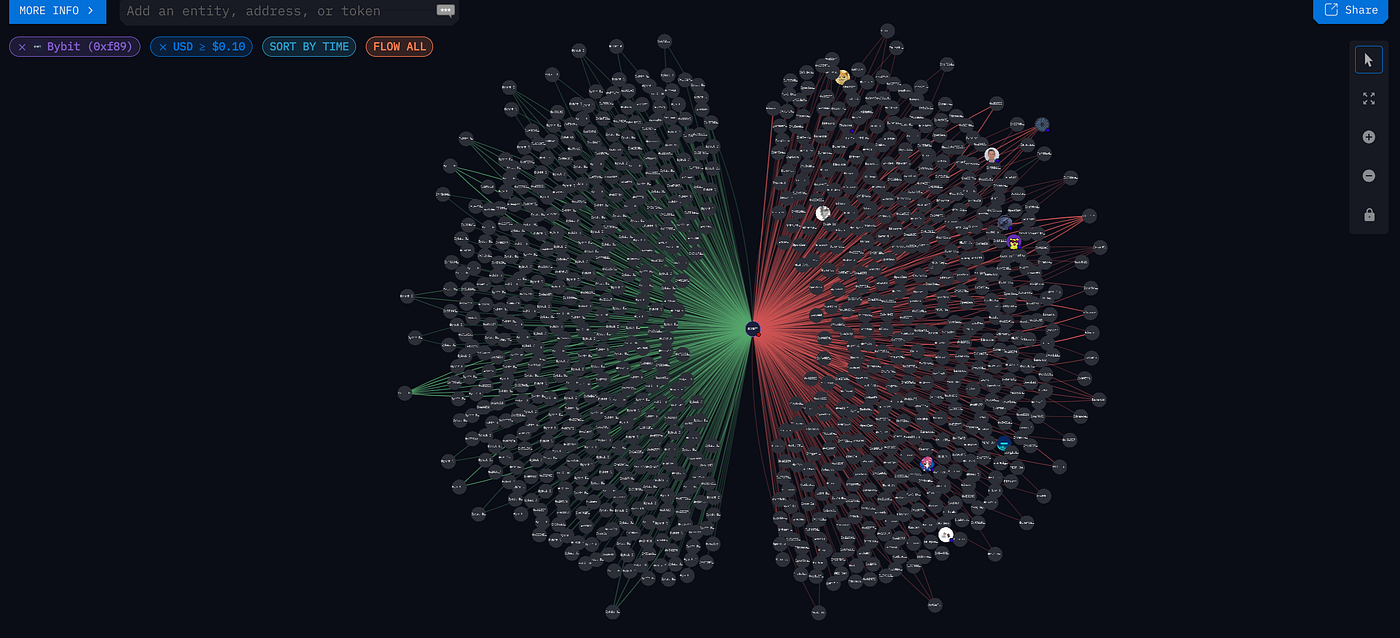

Today we’ll break some of this down and take some time to explain 10 things to assist newcomers in getting started. With many transactions daily, learning the basics can be tricky for newcomers. Source: Arkham Intelligence

With many transactions daily, learning the basics can be tricky for newcomers. Source: Arkham Intelligence

Educating Yourself

Like any new interest, it’s worth taking the time to educate yourself on how it works. There can be a lot of misinformation in the crypto space however there’s also plenty of information to get you moving along the way. You won’t need to become an expert but understanding that there’s different blockchains, what gas fees are, managing wallets and what cryptocurrencies work well for particular tasks will certainly make starting your journey easier.

Goals will also help you start the journey. Why are you experimenting with crypto? Are you looking to simply hold coins for the longer term or are you wanting to explore the ecosystem in greater depth. The knowledge required for both will vary, understanding your goals will help you in acquiring what you need.

Wallets and Storage

The foundation of cryptocurrency transactions is their ability to send funds in a decentralized or peer to peer manner. However there are different ways to manage your wallets. You can store your funds in a wallet on a centralized exchange however its important to understand that should you do this the funds will be vulnerable should the exchange run into problems. This has caused many to lose their coins over the years, with one notable collapse being the Mt Gox collapse in 2014. While you may want to keep some funds in an exchange for trading purposes, any tokens you intend to hold long term is best held in a hardware wallet, also known as a cold storage wallet. Hardware wallets remain the best way to hold your tokens. Source: Amazon.com

Hardware wallets remain the best way to hold your tokens. Source: Amazon.com

It’s also important to know that not all wallets work on all networks. Ethereum (ETH) has its own wallet, as does Solana (SOL) and many others. Understanding how your wallet works is essential in lowering the risk during transactions and storage, as using the wrong wallet on the wrong network can cost you your tokens in the worst case scenario.

When generating your wallet, be sure to securely store the seed phrase, as this is the key to being able to access your wallet across devices. While there’s many discussions about how best to achieve this, how you do it doesn’t matter but actually doing it does.

Gas Fees

Gas fees are an essential part of making the blockchain work, providing payment for mining to add the transaction to the ledger. Gas chains will vary according to demand and can be checked prior to transacting. However not all chains are equal. Gas fees vary from low on Polygon (MATIC) and Solana to extremely high at times for Ethereum to absolutely nothing on Nano (XNO). Because of this it’s quite common to transact on Ethereum (ETH) and end up paying more for gas than a small transaction is worth. Many a crypto fan has a story of moving 10 dollars of Ether costing them 25 in gas. Understanding that gas can vary and that sometimes there’s better options for shifting money can be a huge part in navigating the blockchain without burning your money on gas. Gas Fluctuates, it’s generally good to check beforehand. Source: EtherScan

Gas Fluctuates, it’s generally good to check beforehand. Source: EtherScan

The Big Two & Shitcoins

Crypto is a myriad of different networks and ecosystems, allowing projects to be launched for varying purposes. While its fair to say the big two currencies are Bitcoin (BTC)and Ethereum, with many people holding only those many other coins exist as well. However we should understand in the current market that the gold standard is still Bitcoin, with Ethereum coming in second place.

While many of these projects have viable backing and development plans and have experienced reasonably consistent growth, it’s important to know that there’s an arsenal of so called shitcoins in the crypto space as well.

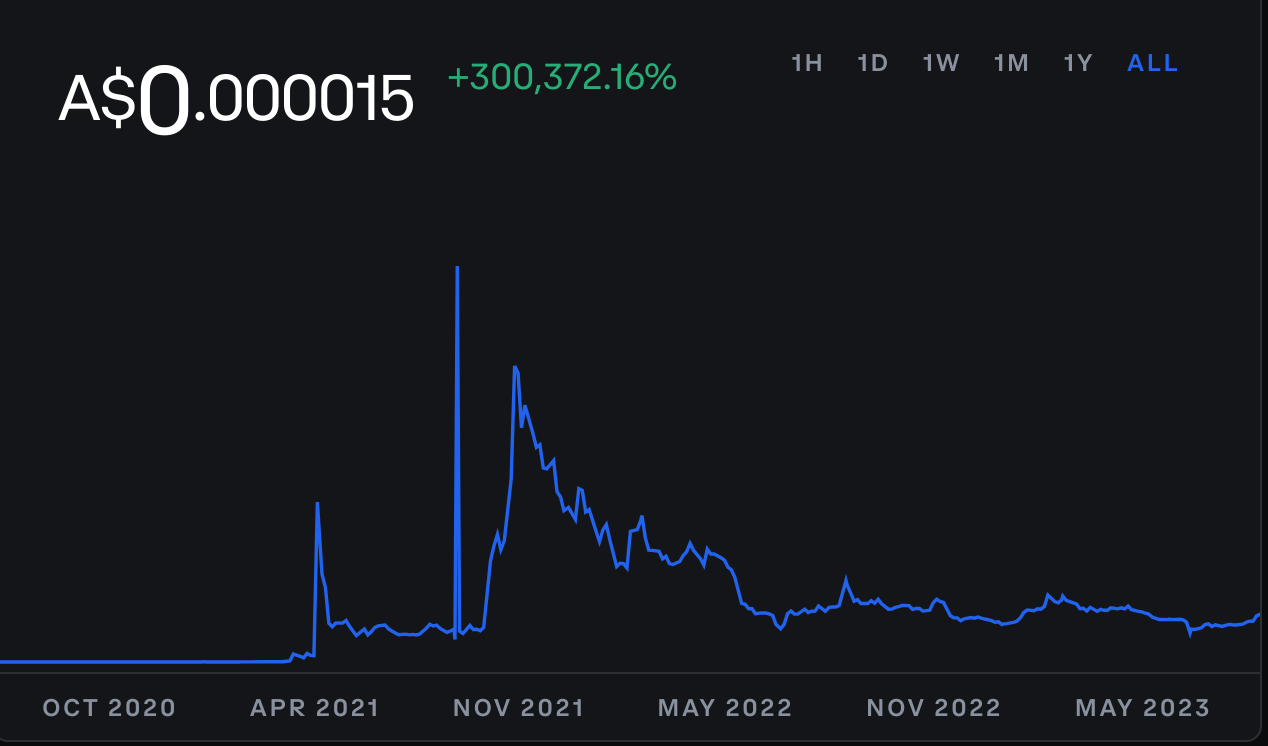

Known as memecoins, these projects often have little use however despite this fact it’s not uncommon to see incredibly high gains. Just $100 dollars in Shiba-Inu (SHIB) at the right time would have made you a millionaire, and plenty of twitter folk have made good money trading Dogecoin (DOGE) against the back of tweets by Elon Musk. SHIB made many a happy memecoiner. Look at that spike and dip. Source: Coinbase

SHIB made many a happy memecoiner. Look at that spike and dip. Source: Coinbase

However it’s important to understand that in a lot of cases while there’s good gains to be made there’s an extremely high risk you’ll become someone else’s exit liquidity. So should you wish to trade with memecoins, be aware of the risk’s in doing so beforehand.

Public Keys and Revoking Permissions:

Once you’ve installed you’re wallet and you’re ready to trade, it’s essential you understand the concept of public and private keys and how they tie into the permissions. While a full walk through is outside the scope of this article, generally speaking when you authorize a transaction in you’re wallet you’ll exchange keys with the other end, giving permission for the transaction to occur.

It’s important to understand exactly whats happening here though. When you sign a transaction with your wallet, the presentation of this private key can in the worst case scenario compromise your entire wallet should you connect to a malicious site.

Because of this it’s generally good practice to do two things for mitigation. Firstly, you should use separate wallets for separate things, which means keeping your investment wallet apart from your trading wallet.

Secondly you should regularly check your wallet permissions, revoking those that are no longer needed. Sites like revoke.cash can assist with this. And you should of course, check all sites for legitimacy before transacting. Use revoke.cash to remove unneeded permissions regularly. Source: revoke.cash

Use revoke.cash to remove unneeded permissions regularly. Source: revoke.cash

Understanding DEFI:

While some people chose to simply purchase and hold coins, others are interested in crypto because of Defi and its potential. Short for Decentralised Finance, DEFI is a decentralized banking in its essence, with the ability to earn from your tokens, secure loans and carry out other strategies for investment purposes.

Defi can be fun to experiment with, and has plenty of potential however you should understand that this is a mostly unregulated sector and comes with the associated risk of scams, rug pulls and ponzi schemes. Whilst we wouldn’t let that put you off entirely, it shows the importance of understanding your projects of interest. You should also conduct some research on the anatomy of a crypto scam, so that you can recognize one should one be put in front of you. While the technology has plenty of potential and can be financially lucrative, for some it simply isn’t worth the risk.

Understanding your long term goals will help in understanding if this is something you wish to experiment with.

StableCoins:

Stablecoins are a category of cryptocurrencies designed to maintain a relatively stable value, often pegged to traditional assets like fiat currencies (e.g., USD, EUR) or commodities. Unlike other cryptocurrencies that can experience significant price volatility, stablecoins aim to provide a more predictable and steady value, making them suitable for various use cases such as digital payments, remittances, and as a unit of account within blockchain ecosystems. They achieve stability through different mechanisms, including collateralization with real-world assets, algorithmic control, and centralized reserves. Tether (USDT), USD Coin (USDC), and Dai (DAI) are popular examples of stablecoins, each utilizing distinct methods to ensure price stability while leveraging the benefits of blockchain technology. Stablecoins attempt to hold their value according to their peg. Source: Coinbase

Stablecoins attempt to hold their value according to their peg. Source: Coinbase

Airdrops and Free Crypto:

Ever heard the saying money doesn’t grow on trees? Or even better, nothing comes for free? Well, in the crypto space, that’s not entirely true as there is numerous ways of obtaining free crypto should you wish to spend some time doing so. While some transactions can be small, worth less than a cent in value, others can be extremely lucrative with thousands of dollars worth of tokens acquired.

Crpyto faucets can be a way to earn tokens. Giving away micro transactions for participation and completion of various tasks, you can obtain free crypto in this manner, however it’s generally not worth considering if you’re time poor.

A much better way of accumulating free coins can be by participating in airdrop giveaways. These occur when new projects and coins wish to attract participants to the ecosystem, and pay rewards to those who complete tasks, use the network and promote things via social media. You’ll need to participate in various projects, however for those that do the payday can often be in the thousands so it can be worth considering should this be of interest to you.

Many exchanges use learn to earn program’s to bring participants onboard. Usually this means you’ll answer a few questions after joining and be given a small amount of tokens in return. While the amount given can vary, it can add up over time. Coinbase has around $30 USD in various tokens for participating in their learn to earn when we last checked, so it can be worth while. Learn to Earns are quick and easy. Source: Coinbase

Learn to Earns are quick and easy. Source: Coinbase

The last past of making the free coin roundabout go round is referral links. Using these means you’ll give someone a small commission for bringing you onboard. There’s usually no risk in doing this, it’s at no cost to yourself and doing so has many benefits along the way. The bonus is, once you’re established in the crypto space, you can also use and share your own referral links using that same reward strategy to accumulate a few extra tokens for yourself.

Scams, Hacks & Exploits:

Like anything in life, a mixture of people participate in the crypto scene. And due to it’s decentralized nature we often see nefarious programs and bad actors join the scene, as well as regularly reading about hacks when we look for project updates.

While explaining how the myriad of scams generally work is outside the scope of a single article, what you should know is that scams about and it’s not uncommon to be on the wrong side of a hack somewhere along the way.

Smart risk management can lower this risk, however it’s important to mention that while crypto can be extremely lucrative many traditional finance tips can still apply in this scenario.

Elon Musk won’t message you directly to discuss opportunities for investing in the latest memecoin. That add you saw on the crypto faucet promising to double your investment in a week, is a scammer. That antivirus warning you got visiting that new site shouldn’t be ignored.

While it’s perfectly safe to enter the crypto sphere, those who are reckless with their security won’t take long to have problems, so bear this in mind as you’re going about your journey. If in doubt, be cautious or double check. A simple google search is often extremely useful, and there’s plenty of open source tools for linking email addresses and exploring the blockchain.

Staying Updated & Getting Started:

If you’re participating in various project’s or hunting airdrops, you’ll need to understand how to stay informed. This can be done in various ways, however discord and telegram are both common ways. You’ll also be able to subscribe to email updates and and publications like medium will also help you receive updates. It can often be a good idea to use a secondary email for your crypto activities as it means you aren’t being overwhelmed with email updates or putting your main address at risk.

You can also find good long term price information here and here

So if you’ve read all this and you’re ready to participate then let’s get some referral links going on and get the free tokens flowing.

Earn free crypto for joining the learn and earn at coinbase here

Read to earn crypto via microtips on publish0x

Join the community on bulb and receive airdropped tokens each week by engaging with the community. Join via this link.

Ku-Coin is an exchange used for trading. Sign up and get a joining bonus via this link

🌟 Enjoyed this article? Support our work and join the community! 🌟

💙 Support me on Ko-fi: Investigator515

📢 Join our Telegram channel for exclusive updates or.

🐦 Follow us on Twitter

🖋️ Join the Medium Community

🔗 Articles we think you’ll like:

- OSINT Unleashed: 5 Essential Tools for Cyber Investigators

- What the Tech?! GPS Technology

✉️ Want more content like this? Sign up for email updates here