The Bull Is Back? Top 10 Cryptos to Buy on Coinbase in 2024

Let me try to set the scene for you:

I had just completely botched the August edition of this feature, and was looking to come up with a theme for September’s. Meanwhile, Bitcoin and ether had traded sideways for two months. Pictured: mid-June through mid-August.

Pictured: mid-June through mid-August.

And as boredom set in, there was finally a big move . . . to the downside. Bitcoin dropped 15% in three days and hit a two-month low against the U.S. dollar.

Suddenly, the hottest and most volatile asset class in history was . . . depressing. It seemed as if the skies would always be gray.

Do I follow Michaël van de Poppe because we kinda share a first name? . . . yes. CNBC, August 28

CNBC, August 28

But just in time, the U.S. Securities & Exchange Commission got spanked in court, again, this time against Grayscale, and scuttlebutt was beginning to bubble that the SEC was going to buckle and bless a spot Bitcoin ETF before Labor Day. lol that anybody thought it would

lol that anybody thought it would

In the half-hour after the Grayscale decision was decided, Bitcoin pumped $1,700. But what took no time to create also took very little time to destroy:

Classic Bart Simpson pattern.

And that was just the last straw for me. We can’t have nice things. I decided to log off and touch grass.

But what I should have done was sell a kidney, half my liver and three feet of small intestine to load up on some more: That Grayscale hop-and-drop that was my last straw? It’s that little blip in the bottom left.

That Grayscale hop-and-drop that was my last straw? It’s that little blip in the bottom left.

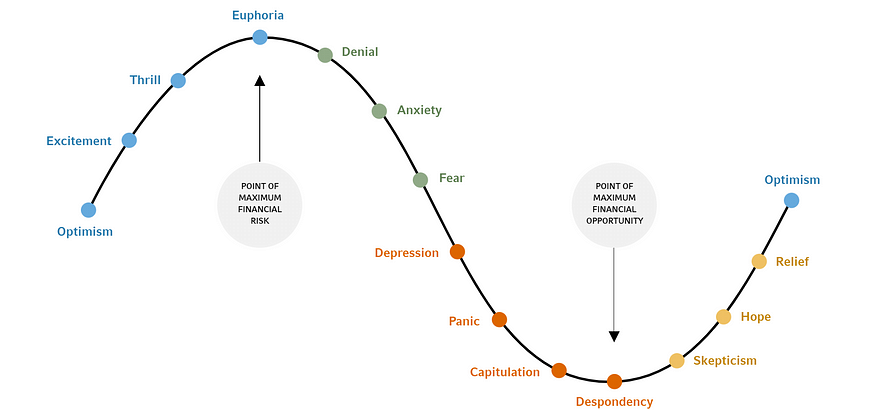

I failed to recognize that this is a natural phenomenon of the bull-bear-bull cycle: If you look real close to the top. you can see Matt Damon’s “Fortune Favours The Bold” crypto.com ad. (Russell Investments)

If you look real close to the top. you can see Matt Damon’s “Fortune Favours The Bold” crypto.com ad. (Russell Investments)

To be fair, some people smarter than me picked up on this:

I do have an English degree, but I’m nobody’s idea of a grammar nazi . . . except for this one. There were not literal tumbleweeds rolling across crypto. Come on, man.

“Buy when there’s blood in the streets” is a cliché often attributed to Warren Buffett but actually uttered by Baron Rothschild. This seems like a useful corollary: Buy when there’s tumbleweeds in the streets.

So The Bull is Back, Right?

Not sure why you’re asking me, considering I whiffed on this move, but if everybody is saying it, it must be true, right? 17.7 million hits can’t be wrong, can they?

17.7 million hits can’t be wrong, can they?

Well, since you asked, that’s starting to make me nervous. Buffett may never have insinuated blood in the streets, but he did say to be fearful when everyone else is greedy. Or, as I said when BTC was last above $60,000: If everyone’s on the bandwagon, who pushes?

According to everyone and their brother-in-law, a bull run is destined for 2024 because of Bitcoin’s halving (which obviously will happen), the spot ETF (which has somewhere between a 98.7% and a 99.8% chance of happening), and the broader macro environment, especially in the United States.

And here’s where it’s all going to get weird.

Look, as much as I have a big honkin’ hard-on for Arthur Hayes and his recent U.S. economic analysis, I’m not at all positive that the Federal Reserve has stuck its soft landing. Gun to my head, I do agree that they will cut rates in 2024 — hell, the Biden Administration might cut stimmy checks directly to people if it means they get reelected — but they might not even be able to stop the runaway dumpster fire that is the global economic status quo. Pictured: everydamnbody.

Pictured: everydamnbody.

And if we’re throwing darts at that, we might as well all admit that nobody knows whether the Bitcoin ETF will be bullish, either. One analyst thinks the ETF alone will drive BTC to $1 million, while J.P. Morgan weighed in with an opinion that the ETF will be buy the rip, sell the drip. And there are literally two million other cryptos not named Bitcoin — how in the hell can we know how BTC’s ETF will (or won’t) influence them? Literally. Two million. WTF are we even doing.

Literally. Two million. WTF are we even doing.

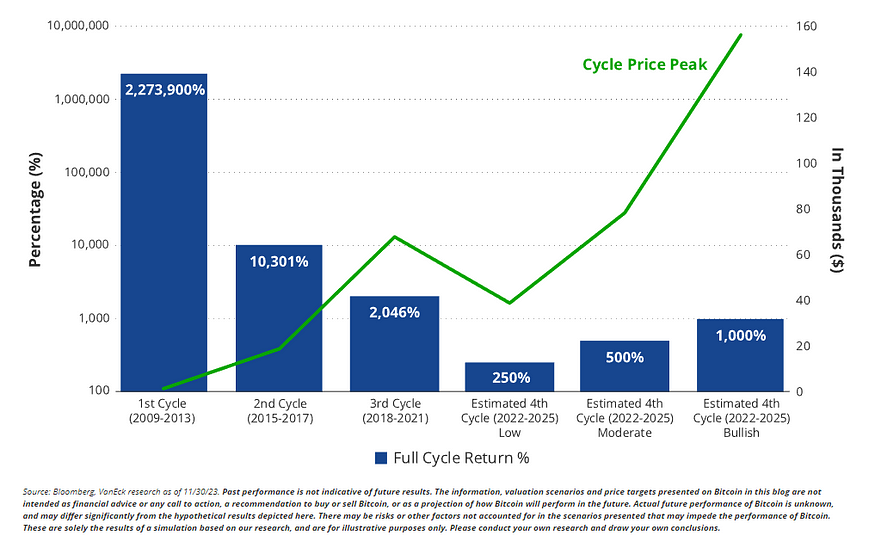

Now, once we acknowledge that we’re all just spitballing about that, we should probably come clean and say that we’re only just guessing about what Bitcoin will do after its halving. As VanEck put it in their 2024 predictions (you may have to squint to see it): If your bull cycle lasts longer than four years, consult Peter Schiff. (VanEck)

If your bull cycle lasts longer than four years, consult Peter Schiff. (VanEck)

Everyone has to issue such legal ass-covering because we are all scarcely better than reading tea leaves and goat entrails. If they knew, it would be insider trading, and then they’d have to plead the One Two Three Four FIFFFF!

If they knew, it would be insider trading, and then they’d have to plead the One Two Three Four FIFFFF!

I don’t know. You don’t know. Crypto influencers on social media promising 20x! 50x! 100x RETURNS!! definitely don’t know. (However, I’ll do one thing they won’t and revisit my 2023 calls.) And for Satoshi’s sake, stop asking ChatGPT what the price of Bitcoin is going to be.

This is why we stack every month, picking projects that have a long-view horizon and socking money in them. I didn’t invent this strategy, of course; it’s called dollar-cost averaging, and if you’re not going to take my word that it’s the best, perhaps you’ll listen to Forbes, who also nailed the relative bottom: Forbes, August 30

Forbes, August 30

All ten of these tokens are available for purchase on the primary Coinbase app, in addition to its Wallet. As always: next to each coin is how much I’d allocate out of a $100 position. However, I Am Not A Financial Advisor™, and I don’t know your specific investment needs. Assume that I have owned all of these coins at some point, own most of them now, and will likely own several of them whenever you’re reading this. Not enough to matter. #DYORAlso, full disclosure: I have long exposure to COIN through ownership of the Ark Innovation ETF.

1. Bitcoin (BTC) — $40

2023: 🔼 155.8%

Wait, so after coming out swinging with the bear case for Bitcoin, this idiot is still putting it at #1?

Yup, and lemme tell you why.

As inaugural member of the Fantasy Sports Writer Hall of Fame (but why is that a thing?), all-time highest-grossing actor on a per-movie basis, and personal idol of mine Matthew Berry annually states, the secret to success is “minimizing risk and giving yourself the best odds to win.”

And there is no better option to do that than the king crypto.

The ETF might be a sell-the-news event, and the bull market from this year’s halving might not be in the realm of previous spikes, and the world economy might be so dire that people stack food and ammunition instead of sats.

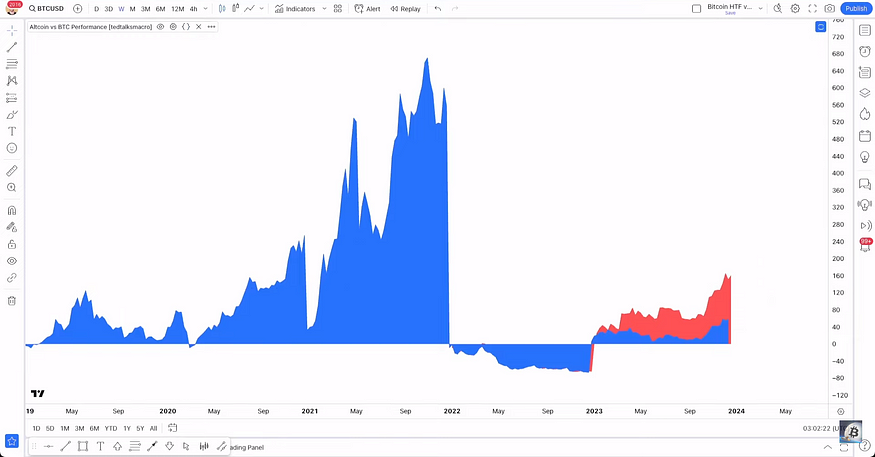

But all the trend lines are pointing in the right direction, and have been all year. As tedtalksmacro noted in a recent video, Bitcoin has outperformed altcoins for all of 2023: Measured by YoY growth, Bitcoin (red) has outperformed altcoins (blue) since basically the beginning of the year. (tedtalksmacro/YouTube)

Measured by YoY growth, Bitcoin (red) has outperformed altcoins (blue) since basically the beginning of the year. (tedtalksmacro/YouTube)

Now, tedtalksmacro posted this as a reason why altcoins were going to “explode in 2024.” I respect his analysis (seriously; “miketalkstedtalksmacro” was on my short list of 𝕏 screenname possibilities), yet why on earth would altcoins pump in ’24 when Bitcoin is kicking the door down to the new year with all the momentum?

And what if the SEC rugpulls everyone and stiffs the BTC ETF?

That would suck for Bitcoin, of course, but it would be terrible for alts, who rely on traders reaping profits from the orange coin to fuel their rockets:

Assuming everything stays as it has, which is dangerous but all we have to go on.

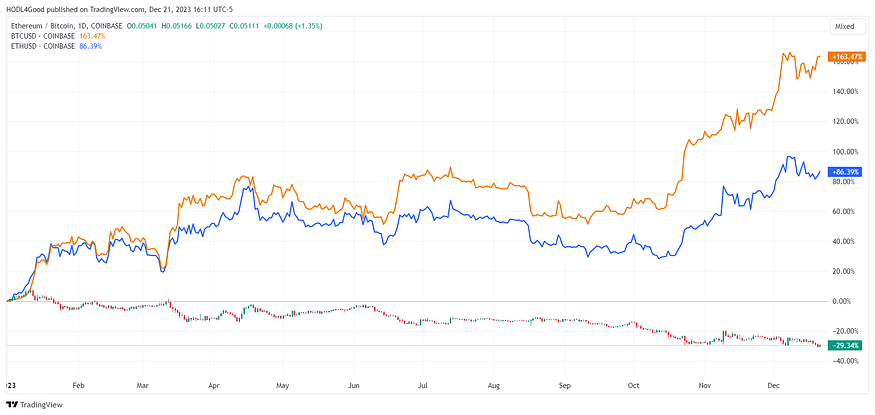

Ask yourself this: Where are we in this cycle? Not in Ethereum, which not only hasn’t flippened Bitcoin, it’s flapped and still flopping: The king vs. the prince. (TradingView)

The king vs. the prince. (TradingView) TradingView technical analysis for ETH/BTC over 1-month timeframe. Looks like my gas tank when I’m waiting for prices to drop.

TradingView technical analysis for ETH/BTC over 1-month timeframe. Looks like my gas tank when I’m waiting for prices to drop.

And if you look at what’s been beating Bitcoin recently, it hasn’t been the diamonds, it’s been the dogsh*t: Bitcoin compared to Dogecoin (yellow) and Shiba Inu (red). You can see the line for Bonk in the night sky somewhere above Uranus. (TradingView)

Bitcoin compared to Dogecoin (yellow) and Shiba Inu (red). You can see the line for Bonk in the night sky somewhere above Uranus. (TradingView)

This is the end of the old cycle and beginning of the new . . . in my opinion.

2024 Price Projection: If you’re pressing me into making a call, I think we clear all-time highs in BTC after the halving and flirt with 100K by the dawn of 2025, where macro events will kick it up to about $160,000 for a tidy little 10x from the bear-market low.

Every other coin on this list has an investable reason why they might outperform Bitcoin. If it doesn’t have one, I’d rather have BTC.Pictured: 2024. (:::Crypto Memes:::/GIPHY)

2. Chainlink (LINK) — $15

2023: 🔼 168.2%

Chainlink has a unique place in the crypto stratosphere because it’s diversified amongst many narratives that are poised to cash in during 2024 and beyond. As an oracle network, Chainlink takes data that’s off-chain and validates it on-chain. This is essential for the deployment of smart contracts, which power everything from decentralized finance (a.k.a. DeFi), to on-chain gaming (a.k.a. GambleFi), to financing loans using NFTs as collateral (a.k.a. NFTFi, and no, I’m not making that up). And every time a validation is made, the validator gets paid in LINK. It’s a Wonderful LINK.

It’s a Wonderful LINK.

In previous iterations of this feature, I’ve discussed how Chainlink is partnering with SWIFT, the Society for Worldwide Interbank Financial Telecommunication. That collaboration, along with several others, continues.

But this month Chainlink outlined their plans to be the focal point for a feature that I think will begin in earnest after the Bitcoin spot ETF: real-world asset tokenization. Translation: assets that aren’t native to crypto — equities, securities, intellectual property, real estate, even fine art and other collectibles — can be fractionalized and traded 24/7 in a liquid, decentralized, transparent market, available to an entirely new generation of investors. This may or may not be a good thing. Can’t wait for me and the boys to 𝘢𝘱𝘦 𝘪𝘯𝘵𝘰 a Van Gogh.

This may or may not be a good thing. Can’t wait for me and the boys to 𝘢𝘱𝘦 𝘪𝘯𝘵𝘰 a Van Gogh.

The upside for LINK is therefore mind-bogglingly huge, as the token could be the backbone of trillions of dollars’ worth of trade in the decades to come. On the granular level, LINK also opened a second round of staking and sold out in six hours.

2024 Price Projection: The conventional wisdom is that altcoins that go through a crypto winter never regain their previous highs. LINK’s ATH was just short of $53. I think it defies that axiom, which would be a 3.5x this year alone.If he could fit his head through that shirt, he can do anything.

3. Ethereum (ETH) — $12

2023: 🔼 90.8%

I’ve already probably pissed off the ETH maxis with my analysis of ether vs. Bitcoin. So let’s continue.

Contrary to Raoul Pal (whose efforts I otherwise also respect a great deal), there’s no tailwind on the immediate horizon to boost ETH past BTC. Ethereum Improvement Proposal 4844 will bring what Ethereans are calling proto-danksharding to the network. It’s hoped that introducing shard blob transactions (seriously, that’s what they’re called) will increase computational efficiency and decrease Ethereum’s often-exorbitant gas fees. Pictured: me before keto.

Pictured: me before keto.

The problem is, it’s already been pushed back from the latter half of 2023 to sometime in 2024 — in fact, at this moment it doesn’t even have a release date. And we’re assuming a lot by thinking that ETH will bounce when it makes this hard fork; when Ethereum merged to a proof-of stake network in 2022, the result was a 30% drop in eight days. ETH also swiftly slumped 15% vs. BTC.

ETH also swiftly slumped 15% vs. BTC.

ETH backers are also hyping Ethereum as being next in line after the Bitcoin spot ETF is approved. Which makes sense . . . except that for all the dilly-dallying the SEC is doing vis-à-vis the BTC ETF, they’re being even more glacially slow determining whether or not ether is an illegal security. They’ve still yet to answer The Ethereum Question, and judging by their delay of the ETH ETF until May, they’re in no hurry.Pictured: Washington, D.C.

Focusing on American domestic politics for an annoying second (though trust me, as 2024 marches on it will only get worse): Crypto has become a political football, but the issue cuts across the traditional left/right divide. On one side, Senator (and former presidential candidate) Elizabeth Warren (D-MA) continues squishing her nose and honking about the evils of crypto, recruiting Senator (and former presidential candidate) Mitt Romney (R-UT) to the cause. Meanwhile, a bipartisan bloc of pro-crypto members of Congress have allied against them, most notably Sens. Cynthia Lummis (R-WY) and Kirsten Gillibrand (D-NY), co-sponsors of the “Responsible Financial Innovation Act.”

My point is: the Biden Administration is in, politically speaking, a real pickle. Many polls have him in a hotly-contested race with, or even losing to, an opponent facing possible prison time. He can ill afford to lose any more voters. Moving too much toward or away from crypto — in either direction — will cost him support from people who otherwise might be inclined to vote for him. The safest course of action would be a Solomonic splitting of the baby: allow BTC, which is definitely not a security, to have its ETF, while allowing the SEC’s red tape to act as a pocket veto when Ethereum comes calling.Seriously, does anybody see the Biden Administration embracing the degen cryptos?

2024 Price Projection: I don’t think ETH gets its ETF this year, and while proto-danksharding sounds cool, all that does is allow Ethereum to catch up to its layer-1 competitors in tech. But I do think the rising crypto tide lifts ether’s boat, and it also flirts with its all-time highs of $4,900 for about a 2x return.

4. Injective Protocol (INJ) — $10

2023: 🔼 2717.3%!

In the immortal yet understated words of Clark W. Griswold, Jr., HALLELUJAH! AND HOLY SH*T! Where’s the Tylenol?

Where’s the Tylenol?

I wish I could claim a bunch of credit for spotting Injective in November 2022 when it was under $2.50, but if I saw this coming I wouldn’t’ve been so timid.I mean, something called “Injective” is inherently a little scary.

If you want to talk narratives, Injective is almost through upgrading its mainnet. They’re already billing themselves as “the fastest layer-1 built for finance,” but the Volan upgrade is practically promising Jesus Christ in a cup:

I’m nowhere near ready; I still have all my Christmas lights up.

But this incredulous run is less about self-aggrandizement and more about simple supply and demand, as seen in INJ’s tokenomics:

According to numbers from DefiLlama, INJ’s current market cap is $2.972 billion, while its fully diluted volume is $3.528B, meaning more than 80% of tokens are already in circulation. Of that, more than $1 billion is staked on-chain. And every week thousands of INJ tokens are burned, further reducing the available supply. Low supply + high demand = 🚀.

2024 Price Projection: Most altcoins typically only get one shot at mooning. LINK did more than a 111x over the two years from May 2019–2021. Polygon (MATIC, 2023: 🔼 28.0%) did twice the work in half the time, launching 206x from Decembers 2020–2021.

Might this be INJ’s turn? Maybe. It might seem dangerous to buy a token that’s up 28x, but if it’s destined for 100x or more, then there’s still 3.5x worth of juice left to squeeze out of that lemon.

Just be careful not to ride it all the way back down.“Meteoric rise” implies a meteoric fall.

5. Stacks (STX) — $8

2023: ⬆️ 620.55%

Another name for which I would break both arms patting myself on the back and tooting my own horn for catching a double on since July . . . except I only did it the once, and for three bucks.

So, yeah — nailed it.Did I merely predict it would happen or by speaking my prediction into the universe make it so? Quite a conundrum.

The elevator pitch for Stacks is simple: it turns Bitcoin from a currency to a full-fledged smart-contract platform, just as Ethereum and all the other layer-1 alts labeled as “Ethereum-killers” like Cardano (ADA, 2023: 🔼 141.7%) and Algorand (ALGO, 2023: 🔼 29.2%). This enables Bitcoin to do what seemed unthinkable just a few months ago: host NFTs, DeFi, and all the other use cases that make crypto bros want to FOMO.

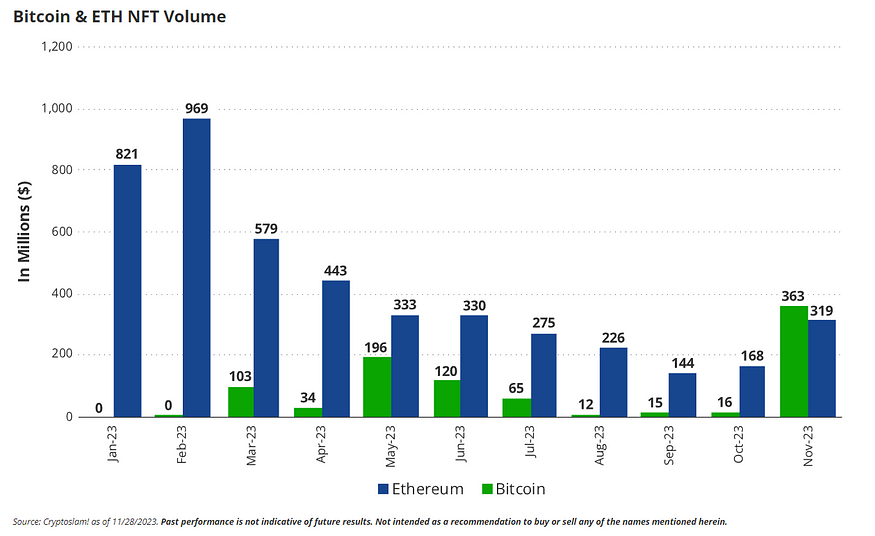

At first, it didn’t seem like much was going to come of it, because the whole point of Bitcoin was, as originally laid out by Satoshi Nakamoto in the whitepaper, a form of digital money, which is fungible. But eventually developers made a BRC-20 token to create Ordinals NFTs, and that improved to ORC-20 and so on, until what began as a niche novelty has suddenly exploded in popularity, to the point where Bitcoin just outpaced Ethereum in NFT sales: If you look real close in early 2023, you can see the cringey conversation between Jimmy Fallon and Paris Hilton. (VanEck/Cryptoslam!)

If you look real close in early 2023, you can see the cringey conversation between Jimmy Fallon and Paris Hilton. (VanEck/Cryptoslam!)

You guys . . . what if the real “Ethereum-killer” was Bitcoin all along? PLOT TWIST

PLOT TWIST

2024 Price Projection: VanEck thinks that Stacks will be a top-30 coin in 2024, which looks like a slam-dunk as it’s jumped from #54 to #40 on CoinMarketCap’s rankings just since they published their year-end predictions. At current market cap rates, though, that only implies about a 33% gain.

Dare I suggest instead that STX doubles again in 2024?Yes, Mr. President.

6. Fetch.ai (FET) — $5

2023: ⬆️ 664.0%. . . except . . .

. . . and I’m LOVIN’ EVERY MINUTE OF IT!

AI is still one of the hot narrative plays working these days, both in equities (check NVIDIA, up more than 20% since Nov. 1) and in crypto. Could it just be that simple as picking the one that has “AI” in its name?

Well . . . yeah.

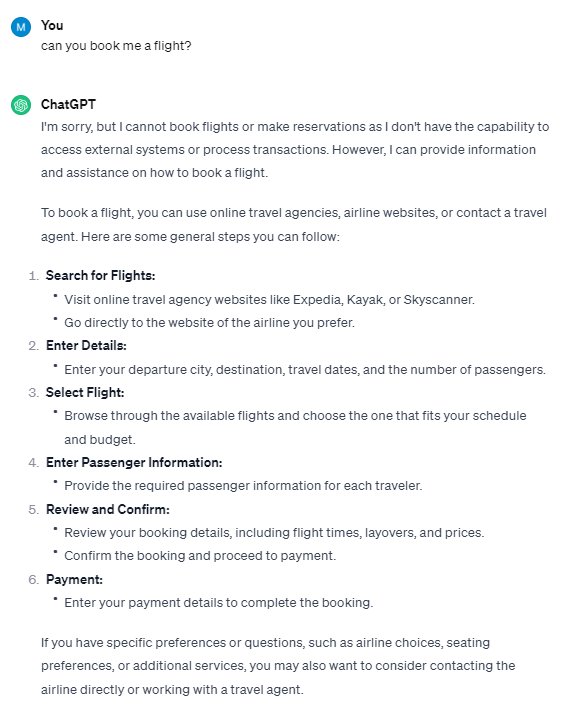

As ChatGPT explained it to me in February:

Fetch.ai is a blockchain platform that aims to advance artificial intelligence (AI) by creating a decentralized digital economy where AI agents can interact with each other and with the world around them.

The platform provides a decentralized infrastructure that allows AI agents to securely share data and collaborate to solve complex problems.

. . . blah blah blah, can someone translate this to human, please?

Okay, fine. Recently, Fetch.ai introduced DeltaV, a search-based AI platform that uses natural language to actually do stuff other than plagiarize term papers. What do I mean by that? Take a look at what it can do thus far:I used to work in the travel reservation industry and this basically eats that job.

Seriously, I asked ChatGPT to book me a flight. This is what it said: could have replaced this with “Ask DeltaV.”

could have replaced this with “Ask DeltaV.”

Let’s check in with what 𝕏 is doing with their AI assistant, Grok: like there’s any sentient creature in the known universe who doesn’t know they’re dating . . . actually, ChatGPT doesn’t, because its knowledge base only goes up to January 2022

like there’s any sentient creature in the known universe who doesn’t know they’re dating . . . actually, ChatGPT doesn’t, because its knowledge base only goes up to January 2022

Yep, DeltaV looks like the real deal. My only regret is that I can’t ask DeltaV about itself because I’m not whitelisted. Apparently this press badge is meaningless. I have also been a journalist, so AI is really wrecking me these days. (In case you were wondering: fedora no, trench coat yes.)

I have also been a journalist, so AI is really wrecking me these days. (In case you were wondering: fedora no, trench coat yes.)

2024 Price Projection: I first recommended FET after it tripled in January. It then surged 60% in February, but gave all that back and then some into the summer. Now, if you were lucky enough to catch that bottom, you’ve bagged a triple since then. But if not, don’t sweat it: you’ll get another.

7. Immutable (IMX) — $4

2023: 🔼 457.5%

Both VanEck and Coinbase have marked GameFi as a sector they are paying close attention to in 2024. While Coinbase isn’t so gauche as to make a call in that regard, they have noted the ultimate failure of most play-to-earn titles and are looking to a game to take the lead and “captur[e] the attention of mainstream gamers that sit outside of many ‘crypto first’ communities.” But VanEck has found their hero, calling for Immutable to be a top-25 coin by 2025, and again that prediction is looking solid as IMX has risen from #42 to #31 on CoinMarketCap’s countdown just since they called their shot.

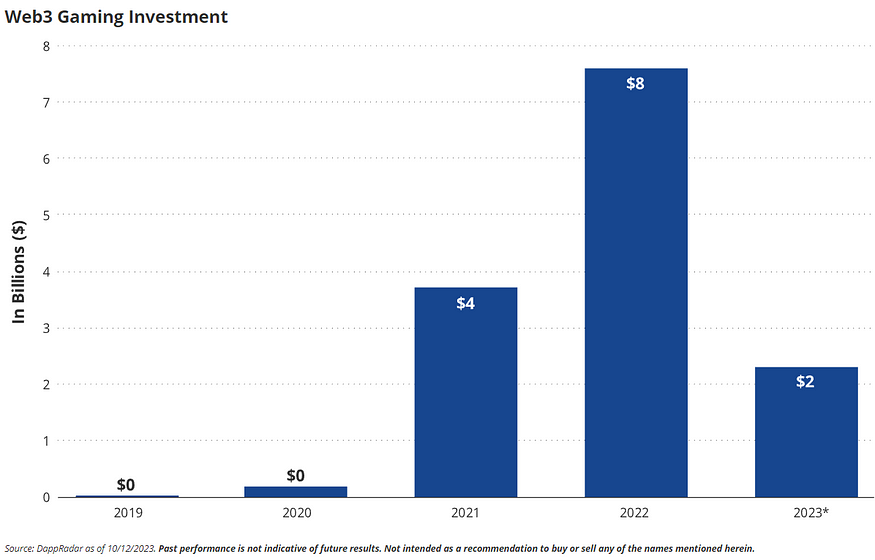

Immutable’s secret sauce is its game pipeline. According to this chart published by VanEck, funding for web3 games has slowed down since its peak: Looks like a middle finger. (VanEck/DappRadar)

Looks like a middle finger. (VanEck/DappRadar)

While other blockchain-based game companies took their cash and pumped out boring grind farms mostly played by bots, Immutable built from the ground up, funneling assets into building great games, and not simply “a game with NFTs.”

That’s bearing fruit beginning right now, and will continue into 2024:

Merry Christmas.

If that weren’t enough, they’re also partnering with industry titan Ubisoft to mainstream web3 gaming.

2024 Price Projection: IMX needs to 2.5x to whack its all-time high of $5.79. I say it gets there with ease on its way to 4x.

8. Helium (HNT) — $3

since Coinbase listing July 12: 🔼 365.1%

Helium also sits at the nexus point of a couple of different crypto trends, as measured by its multiple listings in Binance’s 2024 Industry Map. It’s an infrastructure play, which means it gets to rub shoulders with Chainlink. But it’s also part of an emerging narrative called DePIN, or Decentralized Physical Infrastructure Networks. DePIN uses blockchain technology to create ground-up platforms that harness multiple nodes to flesh out the Internet of Things (IoT).

Imagine an app that uses crowdsourced location data from everyone’s cell phone to create real-time traffic updates.not one that’s owned by Google

The IoT is kind of like that for smart devices, and Helium pays operators in HNT tokens to run hotspots so that the millions of devices in their network can communicate.

IoT is a burgeoning trend in general, but Helium has another ace in the hole: they’ve partnered with T-Mobile to provide 5G wireless service for as low as five bucks a month . . . if you live in Miami. But the more they bootstrap a nationwide (hell, worldwide) wireless network, the more they can democratize cell phone service and drive the price down.

2024 Price Projection: Helium will rise.I am also a dad, and let’s hope AI doesn’t rob that from me.

HNT is currently hovering about seven bucks (or, about six weeks of cell service in Miami). I would love it if HNT set new all-time highs, but the top of the pyramid is about $56, and I don’t know if it’s got enough gas for an 8x. So let’s logorithmically split the difference and tag it for just under 3x, or about $20 square.

9. Storj (STORJ) — $2

2023: ⬆️ 194.3%

This sounds familiar . . .

We’re getting to the part of the list where I don’t like to use excess verbij.

2024 Price Projection: Storj is basically an evergreen play, as the world is generating data at an accelerating rate. So while I do think it takes out its all-time high, I’m not in any hurry to do it in 2024. Now sitting around 75 cents and with a market cap one-tenth the size of Filecoin (FIL, 2023: 🔼 130.1%), a return to its $3.50 ATH is not out of the question. But STORJ is incredibly volatile: it rushed up 6x in four months, then took more than a 45% haircut during the last ten days of the year. Let’s say it touches four bucks, but then settles toward $2.75.

⏸️⏸️⏸️⏸️⏸️Don’t look back in anger.

Before I get to my final wheel-spin of 2023, I do want to review my calls from last year. A few of the names will be familiar, as they’ve made repeat performances in this year’s. That piece is still worth reading, though, as I tee off on the crook Sam Bankman-Fried and the bigger crooks who have made him Public Enemy #1.hint

1. Bitcoin — $50 (2023: 🔼 155.8%) Obviously nailed it, and while I tabbed it as the safu play, it outgained most of the rest of my list. So those times I blessed anyone who just wanted to shove all-in and spend their entire monthly allocation in BTC was the right call. Hell, doing a “top-1 list” those months would have saved me a lot of time and effort.

2. Uniswap (UNI) — $10 (2023: 🔼 40.0%) As the world’s predominant decentralized exchange and automated market maker, Uniswap was in primo position to take advantage of the extra traffic that came their way when the SEC sued Binance and Coinbase in June. Binance made a $4 billion payoff to the U.S. Department of Justice, but the SEC is still squawking. For political reasons as outlined above, I don’t think much will come of it in 2024, but I’m down for investing in UNI on a multi-year timeframe, as bureaucrats tend to bless what they’re told to and ban everything else.

3. Chainlink — $9 (2023: 🔼 168.2%) LINK actually did outgain BTC on the year, so while I left money on the table, I’m still counting this as a W.

4. Ethereum — $8 (2023:🔼 90.8%) I was wary of ETH because of regulation. Turns out I should have been on performance.

5. Polygon — $7 (2023:🔼 28.0%) I wasn’t wary of Polygon because of regulation, which was silly because it’s an Ethereum layer-2, so in the end it goes where ETH goes. While it finished up for the year, it got clobbered on the Night of Gensler Misery, and only made it back to black in December. If all goes well with Ethereum’s proto-danksharding, layer-2s will benefit, but I’m comfortable holding off until we get regulatory clarity, especially with MATIC, which the SEC named again when it took another swing at Kraken.

6. Litecoin (LTC) — $6 (2023: 🔼 3.9%) A lesson on how past performance doesn’t guarantee future results: Litecoin was supposed to blow up when it had its halving, yet it collapsed 47% peak-to-trough in July and August. It’s been dragged up by the broader market increase in the autumn, but (as past performance suggests) from here on out I want BTC, not LTC: Litecoin in Bitcoin terms, showing that after the halvings (smiley faces), LTC slumps against BTC. Believe it or not, this was in a piece written by the Litecoin Foundation. (TradingView/nasdaq.com)

Litecoin in Bitcoin terms, showing that after the halvings (smiley faces), LTC slumps against BTC. Believe it or not, this was in a piece written by the Litecoin Foundation. (TradingView/nasdaq.com)

7. Stellar Lumens (XLM) — $4 (2023: 🔼 81.65%) I still think I’m early buying into XLM and Ripple’s token XRP (XRP, since Coinbase relisting July 13: 🔻 30.85%) as a long-term play into central bank digital currencies. But as they say on Wall Street and in “Silicon Valley,” being early is the same as being wrong. I should have just bought Bitcoin.

8. Curve DAO Token (CRV) — $3 (2023: 🔼 15.2%) This was another attempt to play a DeFi/DEX, and really it’s another miss, as I might as well have just bought more Uniswap.

9. Cardano — $2 (2023: 🔼 141.7%) This did do well, and it did beat its benchmark ETH on the year, and I still think it’s long-term a great play (stake it and you get an extra 2% APY). But in the short term it’s on the same SEC sh*tlist as Polygon and . . .

10. Solana (SOL) — $1 (2023: 🔼 921.0%) Yes, I obviously left a lot of meat on the bone by only betting a buck, but you have to remember Solana was left for dead following FTX’s collapse, having fallen 56% in November 2022 after tumbling 69% from the November ’21 top and after plummeting 81% more following the collapse of LUNA in spring ’22. So while an aggressive investor could have seen trending hashtags like #deadcoin as a sign to start gobbling up SOL left and right, I wasn’t comfortable doing it with more than 1% of my portfolio . . . or yours.Show me the person who was all-in on SOL a year ago, and I’ll show you someone who’s on the way to getting 𝘳𝘦𝘬𝘵.

That said . . . I think we missed the biggest part of the move. SOL is starting to feel, as Messari’s Ryan Selkis wrote about the whole cryptosphere just after the peak of 2021, “a little toppy.” If absolute sh*tcoins mooning are the sign of the end, the Solana chain has generated more than 72 thousand in the last month.

So with that in mind, here comes my $1 lottery-ticket play for 2024:10. Bonk (BONK) — $1

since Coinbase launch Dec. 14: 🔻 33.4%

Yes, I know it’s a Solana memecoin, and yes, I know it’s down more than 75% since the peak just after Coinbase listed it less than three weeks ago. But this is our last dollar, and I want something with 100x potential.

What are the odds that all the trash Solana is pumping out leads people back to Bonk? And what if it’s the coin that becomes the mascot of the bull run, the same way Dogecoin (DOGE, 2023: 🔼 28.75%) and later Shiba Inu (SHIB, 2023: 🔼 30.8%) were the last bull’s pets? Better than nothing?

If BONK flippens SHIB, that’s a 7.5x. If this prediction becomes reality . . .

I think that’s a hotter take than anything I’ve said.

. . . that’s an 12x. If it gets to where DOGE is now, that’s more than a 15x. If it matches SHIB’s all-time market cap, that’s a 65x. If it hits DOGE’s all-time highs, that’s almost a 120x.

2024 Price Projection