Good and Bad Practices of Cryptocurrency in Today's Time

Introduction:

Cryptocurrencies have gained significant popularity in recent years, revolutionizing the way we perceive and utilize money. As with any innovative technology, there are both good and bad practices associated with cryptocurrencies. This article will explore the positive and negative aspects of cryptocurrency practices in today's time. By understanding these practices, users can make informed decisions and navigate the cryptocurrency landscape more effectively.

I. Good Practices of Cryptocurrency:

1.Security Measures and Best Practices:

- Strong Passwords: Using unique and complex passwords for cryptocurrency wallets and accounts.

- Two-Factor Authentication (2FA): Implementing 2FA to add an extra layer of security.

- Hardware Wallets: Utilizing hardware wallets, such as Ledger or Trezor, to store cryptocurrencies offline securely.

- Regular Software Updates: Keeping wallet software up to date to address security vulnerabilities.

2.Thorough Research and Due Diligence:

- Understanding Projects: Conducting research before investing in cryptocurrencies, including examining the project's whitepaper, team, roadmap, and community.

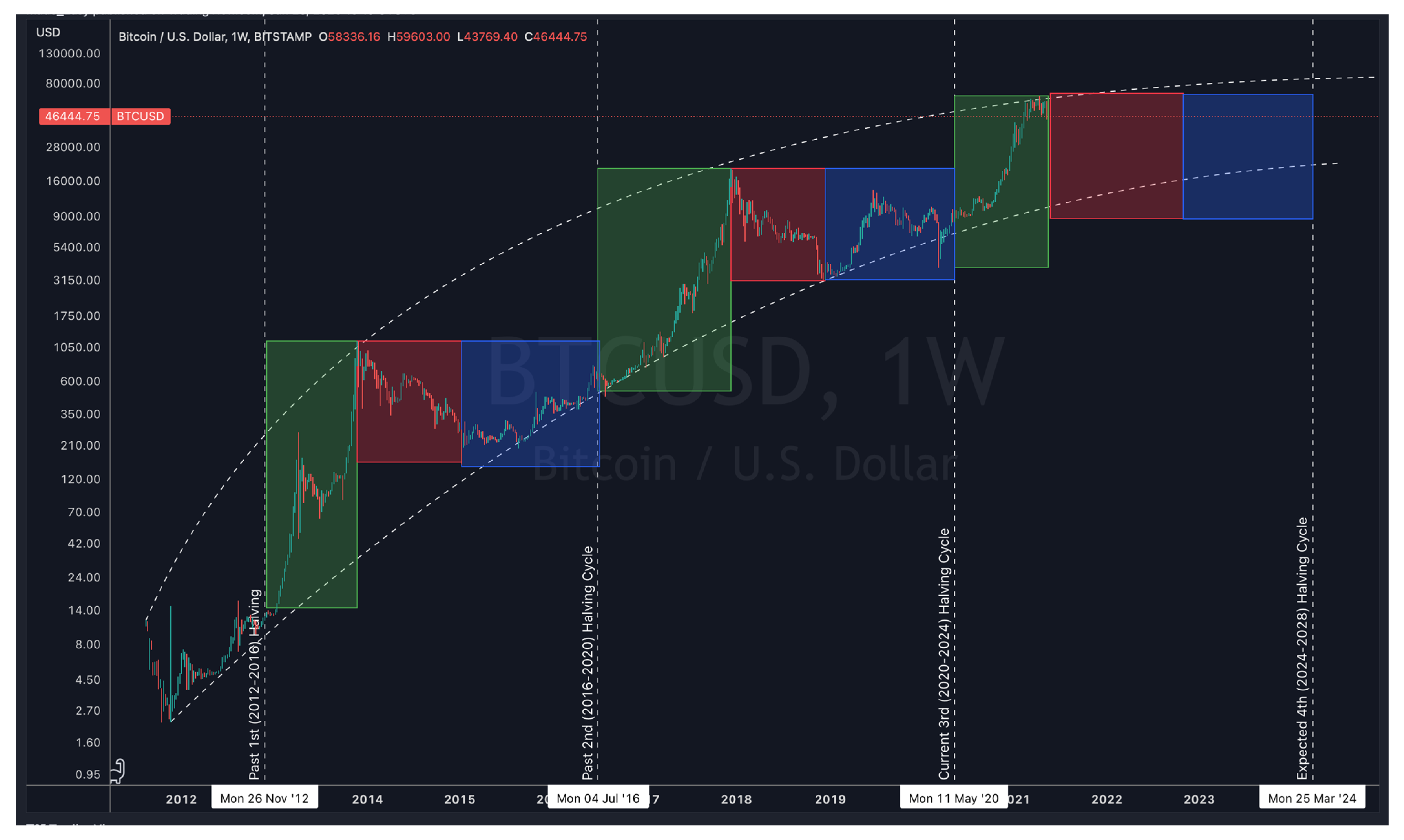

- Analyzing Market Trends: Staying informed about market trends and conducting technical and fundamental analysis to make informed investment decisions.

- Evaluating Risks: Assessing the risks associated with a particular cryptocurrency or project, such as regulatory issues, competition, or technological challenges.

3.Diversification and Risk Management:

- Portfolio Diversification: Spreading investments across multiple cryptocurrencies to minimize risk exposure.

- Risk Management Strategies: Implementing risk management techniques, such as setting stop-loss orders, to mitigate potential losses.

- Avoiding Overexposure: Avoiding investing more than one can afford to lose and maintaining a balanced portfolio.

4.Education and Knowledge Sharing:

- Learning Resources: Engaging in educational materials, online courses, and reputable sources to understand the fundamentals of blockchain technology and cryptocurrencies.

- Community Engagement: Participating in cryptocurrency communities, forums, and social media platforms to gain insights, share knowledge, and learn from experienced traders and investors.

II. Bad Practices of Cryptocurrency:

1.Lack of Security Awareness:

- Weak Passwords and Authentication: Using easily guessable passwords and failing to enable two-factor authentication, exposing accounts to potential hacks.

- Phishing and Scams: Falling victim to phishing attempts or fraudulent schemes that trick users into revealing their private keys or personal information.

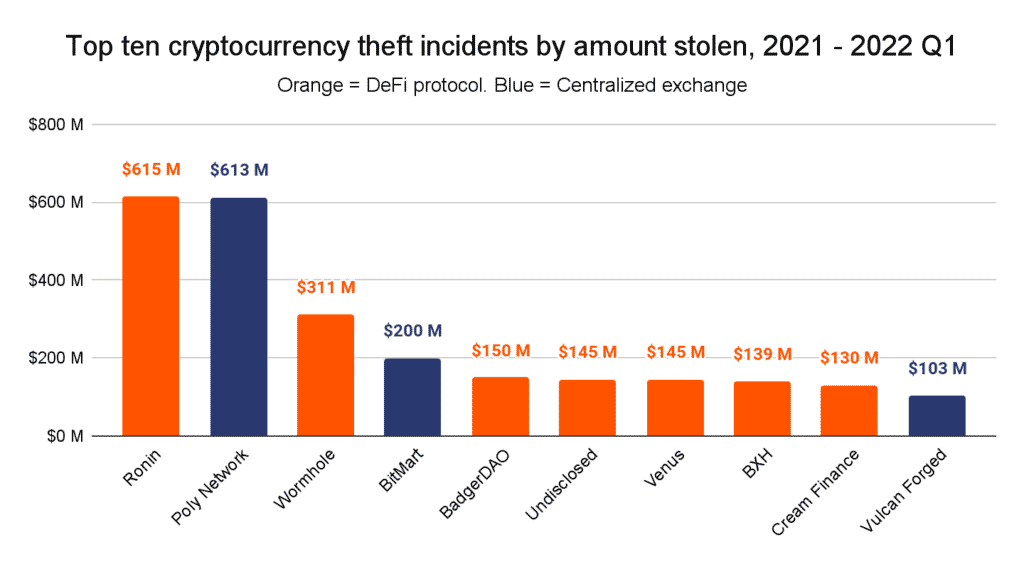

- Storing Funds on Exchanges: Keeping large amounts of cryptocurrencies on exchanges, which are susceptible to security breaches.

2.Impulsive Trading and Emotional Decision-making:

- FOMO and FUD: Succumbing to the Fear Of Missing Out (FOMO) or Fear, Uncertainty, and Doubt (FUD) narratives, leading to impulsive investment decisions.

- Lack of Trading Discipline: Engaging in excessive trading, day trading, or blindly following market trends without a well-defined strategy, resulting in losses.

3.Lack of Regulation and Compliance:

- Illegal Activities: Participating in money laundering, terrorist financing, or other illicit activities using cryptocurrencies, undermining the integrity of the ecosystem.

- Lack of KYC/AML Compliance: Neglecting Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, potentially exposing oneself to legal and regulatory risks.

4.Unrealistic Expectations and Speculative Behavior:

- Get-Rich-Quick Mentality: Entering the cryptocurrency market with unrealistic expectations of making quick profits, leading to poor investment decisions.

- Following Hype and Pump-and-Dump Schemes: Falling for hype-driven marketing campaigns or participating in pump-and-dump schemes, which manipulate prices and deceive investors.

Conclusion:

Cryptocurrencies present immense potential for innovation and financial inclusion. However, like any emerging technology, there are both good and bad practices associated with their use. By adopting good practices such as implementing strong security measures, conducting thorough research, practicing diversification, and continuously educating oneself, individuals can navigate the cryptocurrency landscape more effectively and reduce the risks associated with this evolving ecosystem. On the other hand, avoiding bad practices like neglecting security, engaging in impulsive trading, disregarding regulation, and falling for unrealistic expectations can help protect users from potential pitfalls and negative experiences. It is crucial to approach cryptocurrencies with caution, prudence, and a commitment to responsible practices for long-term success in today's dynamic cryptocurrency environment.

![[Honest Review] The 2026 Faucet Redlist: Why I'm Blacklisting Cointiply & Where I’m Moving My BCH](https://cdn.bulbapp.io/frontend/images/4b90c949-f023-424f-9331-42c28b565ab0/1)