Cauldron DEX, A Cornerstone of DeFi on Bitcoin Cash.

The Cauldron DEX is the first native decentralized exchange (DEX) built on the Bitcoin Cash (BCH) network using the post-2023 CashTokens standard. It represents a major step in bringing decentralized finance to BCH by enabling peer to peer token swaps and liquidity provision without custodial intermediaries.

Cauldron DEX does not have a traditional “owner” like a centralized company controlling user funds. However, the protocol and interface are developed and maintained by Riften Labs, a Norwegian company (often referred to in documentation as Riften Labs AS).

The smart contracts themselves are non custodial, meaning no party ever holds user assets , they remain fully controlled by the user’s wallet keys. This aligns with the decentralized ethos of blockchain finance. There are indications in some web interfaces that rights related to the interface (like the website and branding) may be managed by entities such as Whiterun LLC, but the core functionality remains open source or verifiable on chain.

Cauldron’s alpha version became publicly available in May,2023, with early community mentions pointing to a launch around July 1, 2023. Since then it’s evolved through beta phases and increasing TVL (total value locked) as BCH-native DeFi grew in activity and reaching $1.62M.

Cauldron DEX offers three main functions,

Token Swaps.

Users can swap BCH and any fungible CashTokens directly on chain through smart contracts.

Liquidity Provision (LP):

Users create micro pools by locking BCH and a CashToken pair. These micro-pools serve as automated market maker (AMM) liquidity sources for traders.

Automated Market Maker Model

Cauldron uses an AMM akin to Uniswap’s constant product formula (𝑥 × 𝑦 = 𝑘), but optimized for BCH’s UTXO model. Instead of one massive pool per trading pair, it uses many micro pools, making capital more distributed and scalable.

That design ensures that trades are immediate, censorship-resistant, and non custodial. There are no order books or centralized matching engines.

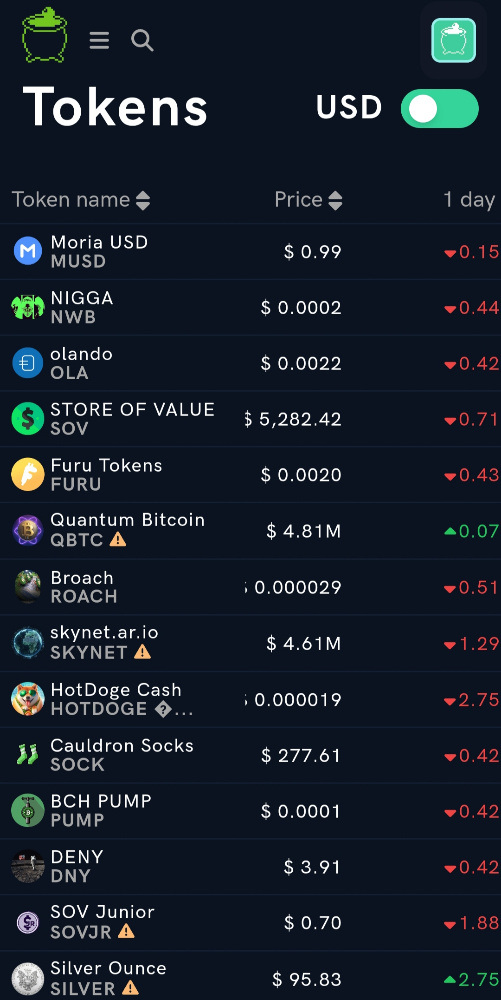

CashTokens & Tradable Assets

CashTokens are BCH’s native token standard, supporting fungible tokens, NFTs, and other programmable assets. These tokens can be minted and traded on Cauldron. Examples of tokens actively traded on Cauldron include,

MUSD , A decentralized stablecoin on BCH

FURU , A token tied to the BCH Guru ecosystem

Meme and community tokens with BCH pairs.

There is no specific “CASH token” native to Cauldron (e.g., a DEX-governance token) unless users or communities choose to issue one , Cauldron itself does not emit a native token for trading or governance as of today , early 2026.

Role in the BCH Ecosystem

Cauldron is widely regarded as a pivotal infrastructure piece for bringing DeFi and liquidity to BCH , an ecosystem that historically lagged DeFi adoption compared to Ethereum or BNB Chain.

Its integration with wallets like Paytaca and zapit signals broader BCH DeFi participation. Because of low blockchain fees on BCH, Cauldron enables cost effective trading , often less than a cent per transaction.

Cauldron Prospects & Growth.

Prospects are promising but speculative,

✅ Strengths

🫰True non custodial DEX, Ensures user control and censorship resistance.

🫰CashTokens liquidity growth, Expands BCH’s utility beyond simple payments.

🫰Low fees, Attracts cost sensitive traders and LPs.

🫰Yield opportunities, LPs earn full trading fees.

⚠️ Challenges

🚨Liquidity fragmentation , Micro pools mean liquidity can be shallow on individual pairs compared to major DEXes.

🚨Risk of impermanent loss , Similar to AMMs everywhere.

🚨Ecosystem maturity, BCH DeFi is small relative to Ethereum or Avalanche, which could slow adoption.

Is It Recommendable?

Yes it is Recommendable for,

🔥BCH holders wanting decentralized exposure to CashTokens.

🔥Yield seeking LPs willing to manage impermanent loss.

🔥Developers building BCH DeFi.

Not ideal for,

🪫Traders needing deep liquidity on popular assets.

🪫Users uncomfortable with non custodial DeFi risks.

Conclusion.

Cauldron DEX is a landmark project in the Bitcoin Cash ecosystem , a truly decentralized exchange enabling CashToken swaps and liquidity provision directly on the BCH chain. Built by Riften Labs and launched in 2023, it leverages the new CashTokens standard to bring DeFi to a network once limited to pure payments. With low fees, full LP fee ownership, and expanding integrations, it represents a genuine building block for BCH DeFi but like all DeFi platforms, success depends on usage, liquidity, and ecosystem growth.

Thank you so much for your valuable time till here. Like, upvote and leave comment for feedback. I am grateful always by reading your opinions in comments.

Note: The article also published on my read.cash wall .

Cheers,

Amjad

![[Honest Review] The 2026 Faucet Redlist: Why I'm Blacklisting Cointiply & Where I’m Moving My BCH](https://cdn.bulbapp.io/frontend/images/4b90c949-f023-424f-9331-42c28b565ab0/1)