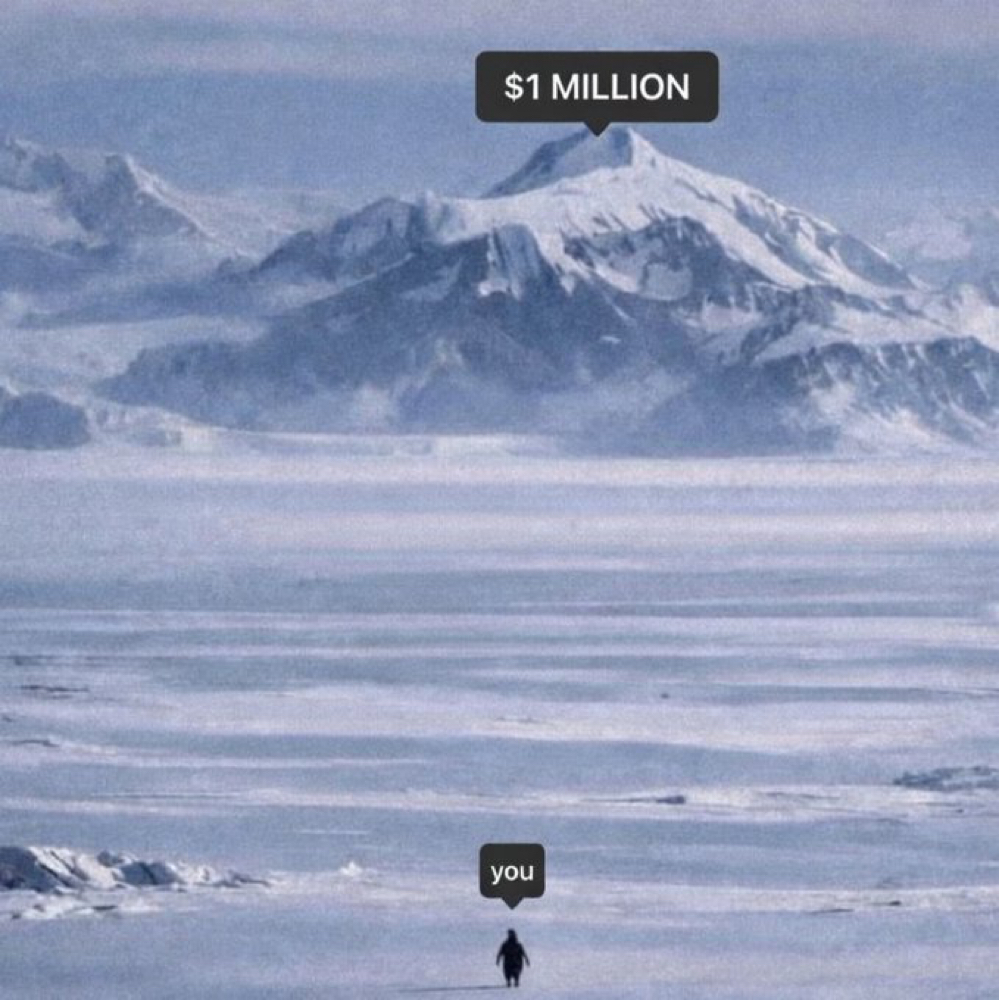

Beneath the Iceberg|Crypto Observation Notes | Week 3

Weekly Summary

- Market Structure: Bitcoin’s price range shifted upward this week, indicating capital flowing back into major assets.While sentiment has improved, overall positioning remains cautious rather than aggressive.

- Community Sentiment: Market mood leaned slightly positive, with discussions largely centered around BTC and ETH ETFs.Despite the improved tone, participants remain observant and restrained rather than decisively risk-on.

- Project Observation: DePIN-related projects continue to focus on governance, transparency, and narrative alignment.Development cadence remains medium- to long-term oriented, with little emphasis on short-term price movements.

Sentiment warmed, while actions remained measured and disciplined.

Layer ① | Market Structure

- Bitcoin Price Range: 90,120 – 97,909 Approximately an 8% weekly increase, marking a breakout from a prolonged consolidation phase. Market sentiment showed visible improvement.

- BTC Dominance: 59.14% → 59.94% (slight increase) Capital continued to concentrate in major assets, reflecting a conservative risk preference.

- Total Market Capitalization: Slight increase. Signs of capital returning, though not yet indicative of broad market expansion.

This week reflected improving sentiment with capital still selectively deployed.

Layer ② | Community Sentiment (CMC Observation)

- Voting Bias: Slightly bullish

- Primary Discussion Topics: BTC / ETH ETF developments

- Sentiment Interpretation: The community remains cautious, with no extreme optimism or fear observed.

Attention remains focused on established narratives and major assets, with no clear signs of decisive risk expansion.

Layer ③ | Projects Low-Frequency Observation

Grass (DePIN|Infrastructure)

- Weekly Update: Yes

Key Observations:

- Completion of another round of open-market GRASS buybacks, extending previous treasury allocation strategies.

- Public disclosure of treasury wallet addresses, enhancing transparency in fund management.

Interpretation:

- Current priorities center on financial governance and long-term operational stability

- Developments are internal and structural, rather than narrative-driven or price-reactive

Grass continues to strengthen its governance framework and financial discipline, maintaining a medium- to long-term development pace.

Hivello (DePIN|Node Aggregation)

- Weekly Update: No technical or product updates

Key Observations:

- Messaging focused on differentiating short-term speculation from long-term participation

- Reaffirmed DePIN as infrastructure that matures alongside usage, devices, and adoption over time

Interpretation:

- Emphasis on narrative clarification and participant education

- No signals of a new development phase at this stage

Hivello remains focused on reinforcing long-term positioning rather than near-term milestones.

--- Disclaimer ---

This journal is a personal observation and learning record. It reflects my own interpretations of market structure, sentiment, and project developments at a given point in time. It is not intended as investment advice, financial guidance, or a recommendation to buy or sell any asset. The purpose of these notes is to document my ongoing learning process and to observe how narratives, behavior, and structure evolve over time. Readers are encouraged to conduct their own research and form their own perspectives.